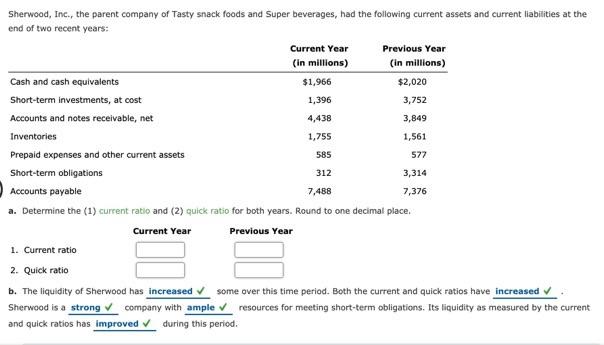

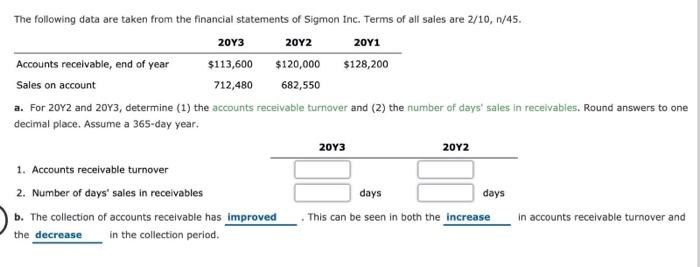

1,755 Sherwood, Inc., the parent company of Tasty snack foods and Super beverages, had the following current assets and current liabilities at the end of two recent years: Current Year Previous Year (in millions) (in millions) Cash and cash equivalents $1,966 $2,020 Short-term investments, at cost 1,396 3,752 Accounts and notes receivable, net 4,438 3,849 Inventories 1,561 Prepaid expenses and other current assets 585 577 Short-term obligations 3,314 Accounts payable 7.488 7,376 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Current Year Previous Year 1. Current ratio 2. Quick ratio b. The liquidity of Sherwood has increased some over this time period. Both the current and quick ratios have increased Sherwood is a strong company with ample resources for meeting short-term obligations. Its liquidity as measured by the current and quick ratios has improved during this period. 312 The following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, 1/45. 20Y3 2012 20Y1 Accounts receivable, end of year $113,600 $120,000 $128,200 Sales on account 712,480 682,550 a. For 2072 and 2013, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 2012 1. Accounts receivable turnover 2. Number of days' sales in receivables days days b. The collection of accounts receivable has improved This can be seen in both the increase in accounts receivable turnover and in the collection period. 2013 the decrease 1,755 Sherwood, Inc., the parent company of Tasty snack foods and Super beverages, had the following current assets and current liabilities at the end of two recent years: Current Year Previous Year (in millions) (in millions) Cash and cash equivalents $1,966 $2,020 Short-term investments, at cost 1,396 3,752 Accounts and notes receivable, net 4,438 3,849 Inventories 1,561 Prepaid expenses and other current assets 585 577 Short-term obligations 3,314 Accounts payable 7.488 7,376 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Current Year Previous Year 1. Current ratio 2. Quick ratio b. The liquidity of Sherwood has increased some over this time period. Both the current and quick ratios have increased Sherwood is a strong company with ample resources for meeting short-term obligations. Its liquidity as measured by the current and quick ratios has improved during this period. 312 The following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, 1/45. 20Y3 2012 20Y1 Accounts receivable, end of year $113,600 $120,000 $128,200 Sales on account 712,480 682,550 a. For 2072 and 2013, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 2012 1. Accounts receivable turnover 2. Number of days' sales in receivables days days b. The collection of accounts receivable has improved This can be seen in both the increase in accounts receivable turnover and in the collection period. 2013 the decrease