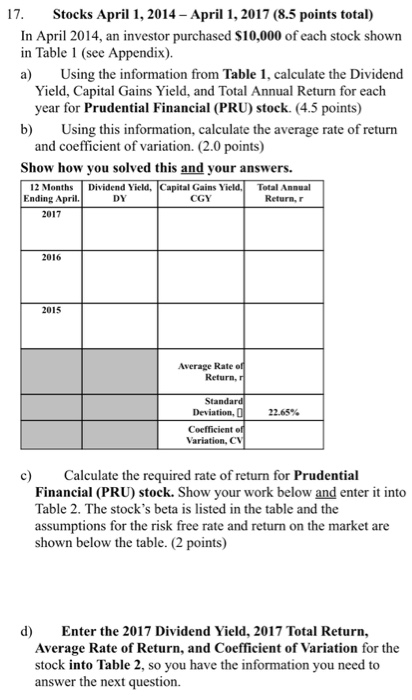

17.Stocks April 1, 2014-April 1,2017 (8.5 points total) In April 2014, an investor purchased $10,000 of each stock shown in Table 1 (see Appendix). a) Usng the information from Table 1, calculate the Dividend Yield, Capital Gains Yield, and Total Annual Return for each year for Prudential Financial (PRU) stock. (4.5 points) b) Using this information, calculate the average rate of return Show how you solved this and your answers. Ending April. and coefficient of variation. (2.0 points) Total Annual Return, r 12 Months Dividend Yield, Capital Gains Y DY CGY 2017 2016 2015 Average Rate 22.65% Coefficient Variation, C c) Calculate the required rate of return for Prudential Financial (PRU) stock. Show your work below and enter it into Table 2. The stock's beta is listed in the table and the assumptions for the risk free rate and return on the market are shown below the table. (2 points) d) Enter the 2017 Dividend Yield, 2017 Total Return, Average Rate of Return, and Coefficient of Variation for the stock into Table 2, so you have the information you need to answer the next question. 17.Stocks April 1, 2014-April 1,2017 (8.5 points total) In April 2014, an investor purchased $10,000 of each stock shown in Table 1 (see Appendix). a) Usng the information from Table 1, calculate the Dividend Yield, Capital Gains Yield, and Total Annual Return for each year for Prudential Financial (PRU) stock. (4.5 points) b) Using this information, calculate the average rate of return Show how you solved this and your answers. Ending April. and coefficient of variation. (2.0 points) Total Annual Return, r 12 Months Dividend Yield, Capital Gains Y DY CGY 2017 2016 2015 Average Rate 22.65% Coefficient Variation, C c) Calculate the required rate of return for Prudential Financial (PRU) stock. Show your work below and enter it into Table 2. The stock's beta is listed in the table and the assumptions for the risk free rate and return on the market are shown below the table. (2 points) d) Enter the 2017 Dividend Yield, 2017 Total Return, Average Rate of Return, and Coefficient of Variation for the stock into Table 2, so you have the information you need to answer the next