Answered step by step

Verified Expert Solution

Question

1 Approved Answer

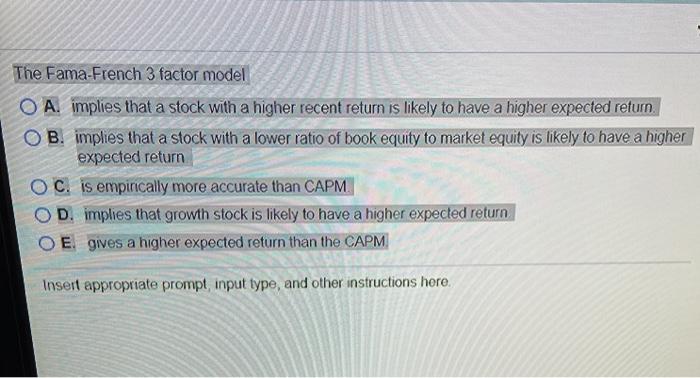

18 12 The Fama French 3 factor model O A. implies that a stock with a higher recent return is likely to have a higher

18 12

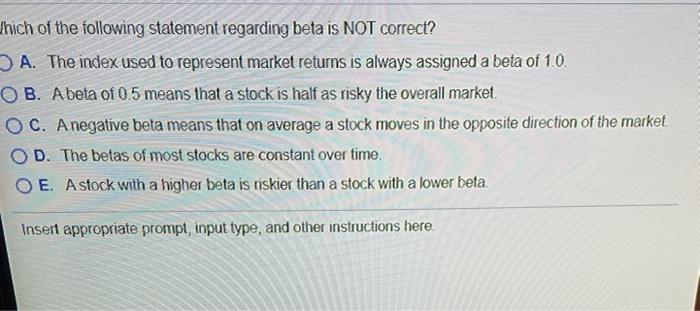

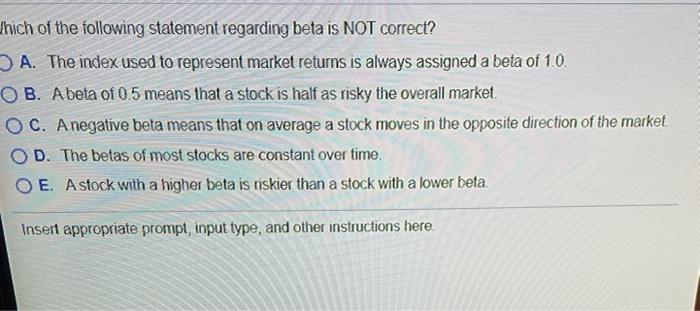

The Fama French 3 factor model O A. implies that a stock with a higher recent return is likely to have a higher expected return OB. implies that a stock with a lower ratio of book equity to market equity is likely to have a higher expected return O C. is empirically more accurate than CAPM. D. implies that growth stock is likely to have a higher expected return O E gives a higher expected return than the CAPM Insert appropriate prompt input type, and other instructions here. hich of the following statement regarding beta is NOT correct? A. The index used to represent market returns is always assigned a beta of 10. OB. Abeta of 0.5 means that a stock is half as risky the overall market OC. A negative beta means that on average a stock moves in the opposite direction of the market OD. The betas of most stocks are constant over time. O E. A stock with a higher beta is riskier than a stock with a lower beta Insert appropriate prompt, input type, and other instructions here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started