18. In credit terms of 3/15, n/45, the 3 represents the a number of days in the discount period b. full amount of the

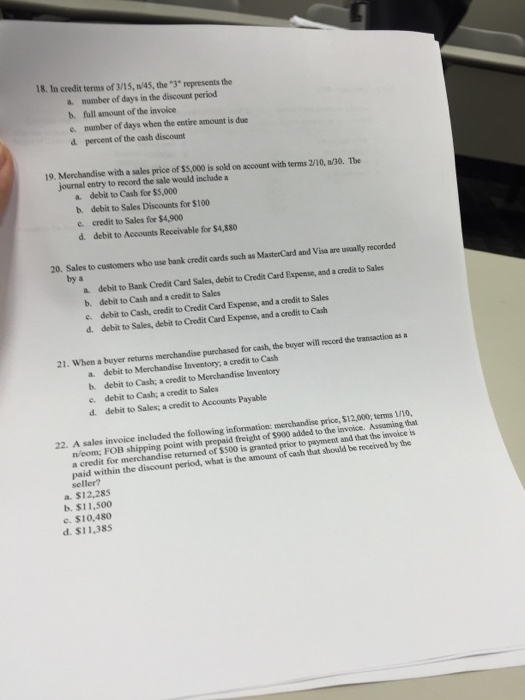

18. In credit terms of 3/15, n/45, the "3" represents the a number of days in the discount period b. full amount of the invoice c. number of days when the entire amount is due d. percent of the cash discount 19. Merchandise with a sales price of $5,000 is sold on account with terms 2/10, n/30. The journal entry to record the sale would include a a. debit to Cash for $5,000 b. debit to Sales Discounts for $100 c. credit to Sales for $4,900 d. 20. Sales to customers who use bank credit cards such as MasterCard and Visa are usually recorded by a a b. debit to Accounts Receivable for $4,880 e. d. debit to Bank Credit Card Sales, debit to Credit Card Expense, and a credit to Sales debit to Cash and a credit to Sales debit to Cash, credit to Credit Card Expense, and a credit to Sales debit to Sales, debit to Credit Card Expense, and a credit to Cash 21. When a buyer returns merchandise purchased for cash, the buyer will record the transaction as a a debit to Merchandise Inventory, a credit to Cash b. debit to Cash; a credit to Merchandise Inventory e. debit to Cash; a credit to Sales d. debit to Sales; a credit to Accounts Payable 22. A sales invoice included the following information: merchandise price, $12,000; terms 1/10, n'eom; FOB shipping point with prepaid freight of $900 added to the invoice. Assuming that a credit for merchandise returned of $500 is granted prior to payment and that the invoice is paid within the discount period, what is the amount of cash that should be received by the seller? a. $12,285 b. $11,500 e. $10,480 d. $11,385

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

18 Answerd percentage of the cash discount Explanation Credit terms is the time period in w...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started