Answered step by step

Verified Expert Solution

Question

1 Approved Answer

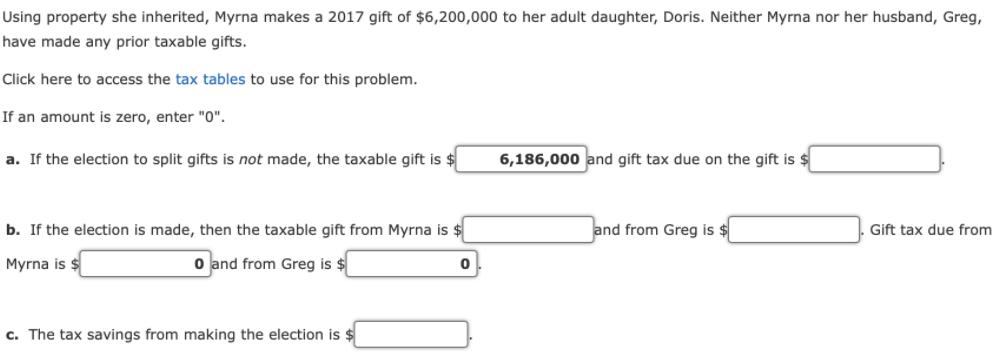

Using property she inherited, Myrna makes a 2017 gift of $6,200,000 to her adult daughter, Doris. Neither Myrna nor her husband, Greg, have made

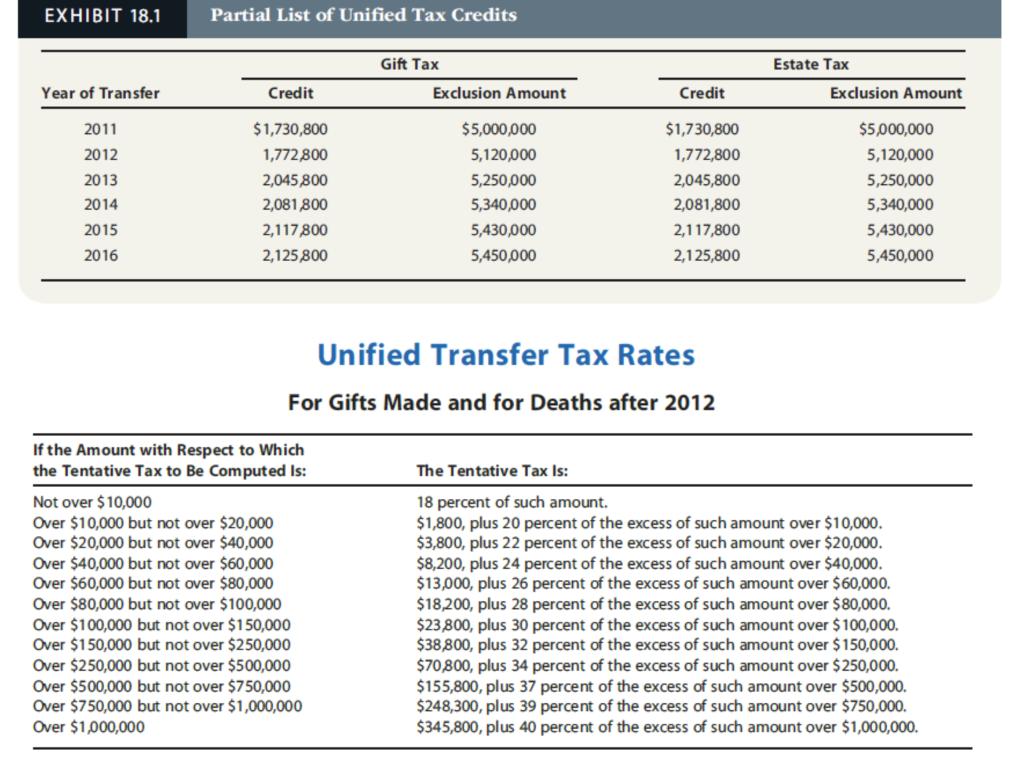

Using property she inherited, Myrna makes a 2017 gift of $6,200,000 to her adult daughter, Doris. Neither Myrna nor her husband, Greg, have made any prior taxable gifts. Click here to access the tax tables to use for this problem. If an amount is zero, enter "0". a. If the election to split gifts is not made, the taxable gift is $ 6,186,000 and gift tax due on the gift is $ b. If the election is made, then the taxable gift from Myrna is $ and from Greg is $ Gift tax due from Myrna is o and from Greg is $ c. The tax savings from making the election is $ EXHIBIT 18.1 Partial List of Unified Tax Credits Gift Tax Estate Tax Year of Transfer Credit Exclusion Amount Credit Exclusion Amount 2011 $1,730,800 $5,000,000 $1,730,800 $5,000,000 2012 1,772,800 5,120,000 1,772,800 5,120,000 2013 2,045800 5,250,000 2,045,800 5,250,000 2014 2,081,800 5,340,000 2,081,800 5,340,000 2015 2,117,800 5,430,000 2,117,800 5,430,000 2016 2,125,800 5,450,000 2,125,800 5,450,000 Unified Transfer Tax Rates For Gifts Made and for Deaths after 2012 If the Amount with Respect to Which the Tentative Tax to Be Computed Is: The Tentative Tax Is: Not over $10,000 Over $10,000 but not over $20,000 Over $20,000 but not over $40,000 Over $40,000 but not over $60,000 Over $60,000 but not over $80,000 Over $80,000 but not over $100,000 Over $100,000 but not over $150,000 Over $150,000 but not over $250,000 Over $250,000 but not over $500,000 Over $500,000 but not over $750,000 Over $750,000 but not over $1,000,000 Over $1,000,000 18 percent of such amount. $1,800, plus 20 percent of the excess of such amount over $10,000. $3,800, plus 22 percent of the excess of such amount over $20,000. $8,200, plus 24 percent of the excess of such amount over $40,000. $13,000, plus 26 percent of the excess of such amount over $60,000. $18,200, plus 28 percent of the excess of such amount over $80,000. $23,800, plus 30 percent of the excess of such amount over $100,000. $38,800, plus 32 percent of the excess of such amount over $150,000. $70,800, plus 34 percent of the excess of such amount over $250,000. $155,800, plus 37 percent of the excess of such amount over $500,000. $248,300, plus 39 percent of the excess of such amount over $750,000. $345,800, plus 40 percent of the excess of such amount over $1,000,000.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

step 1 of 6 Split gifts A rule underlying taxation that entitles married ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started