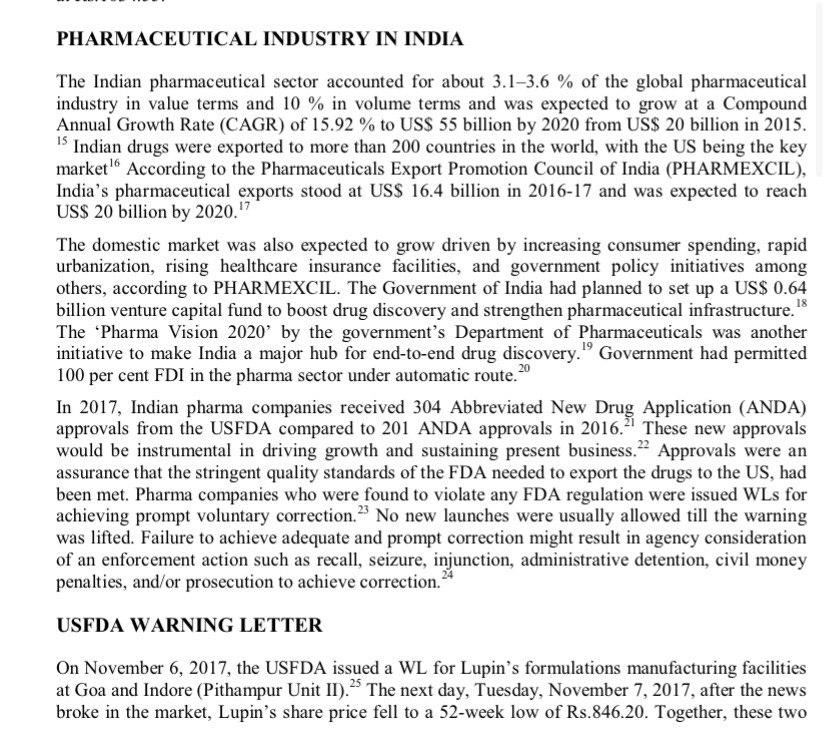

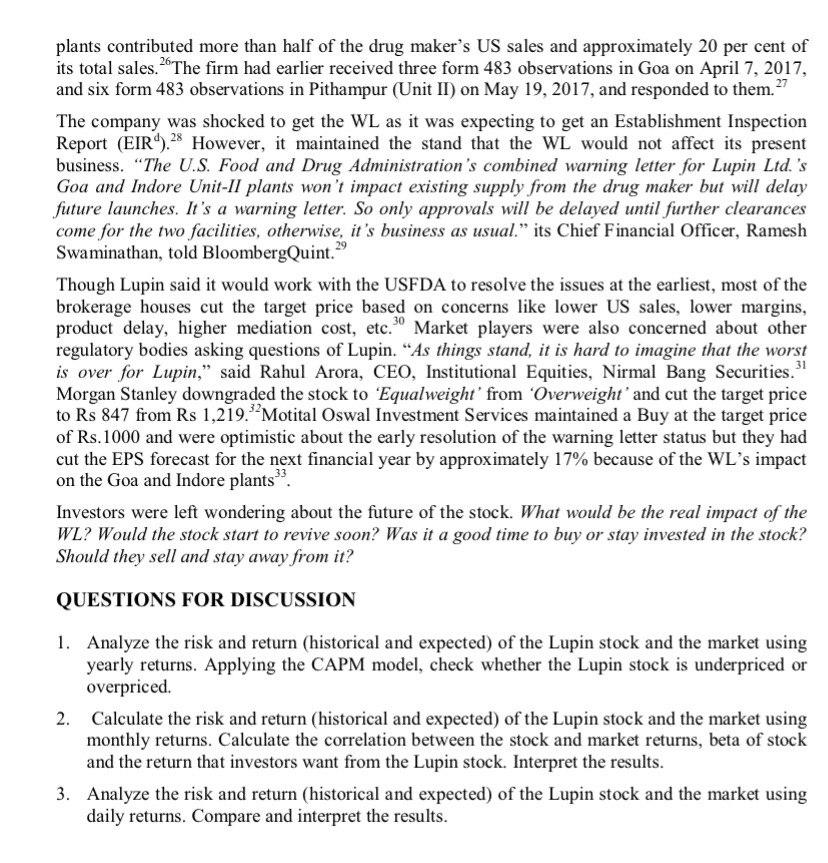

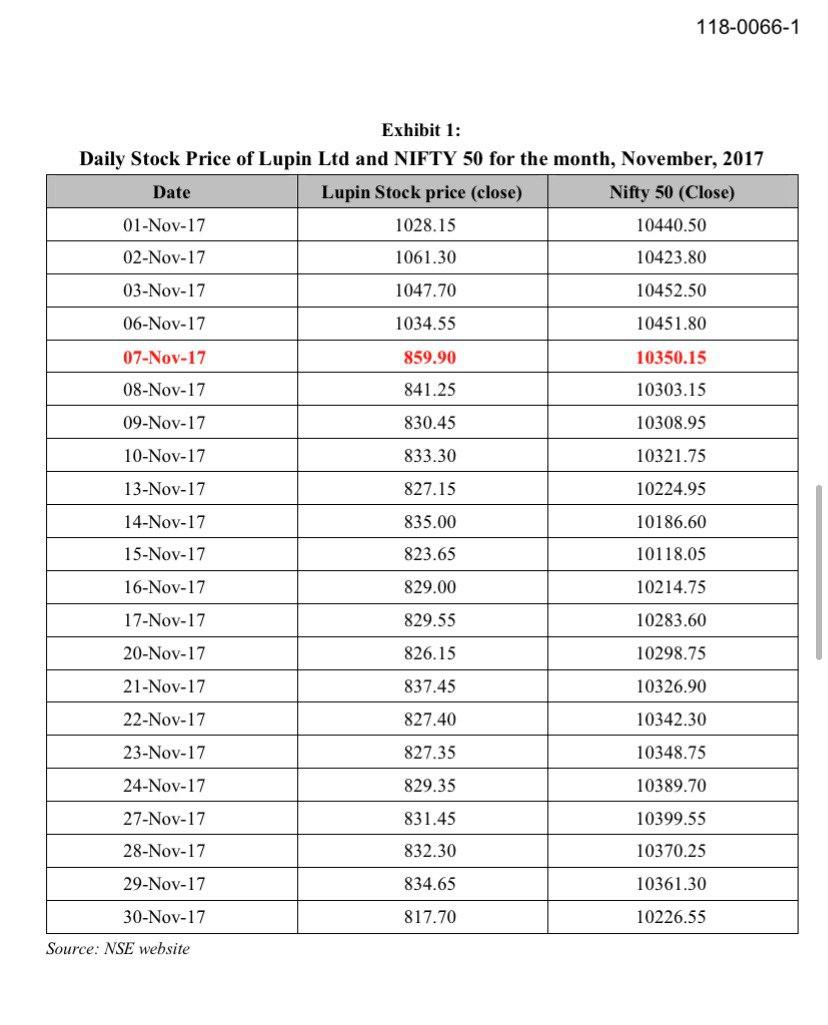

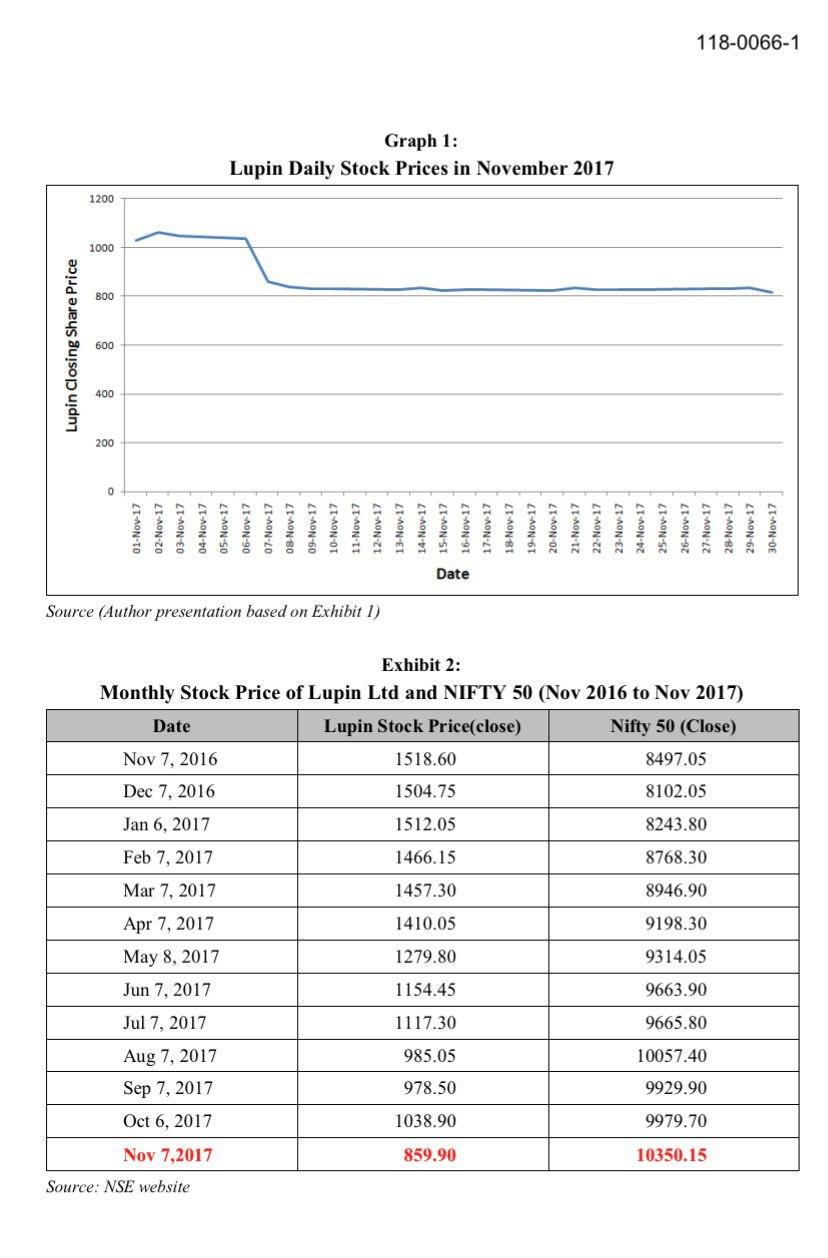

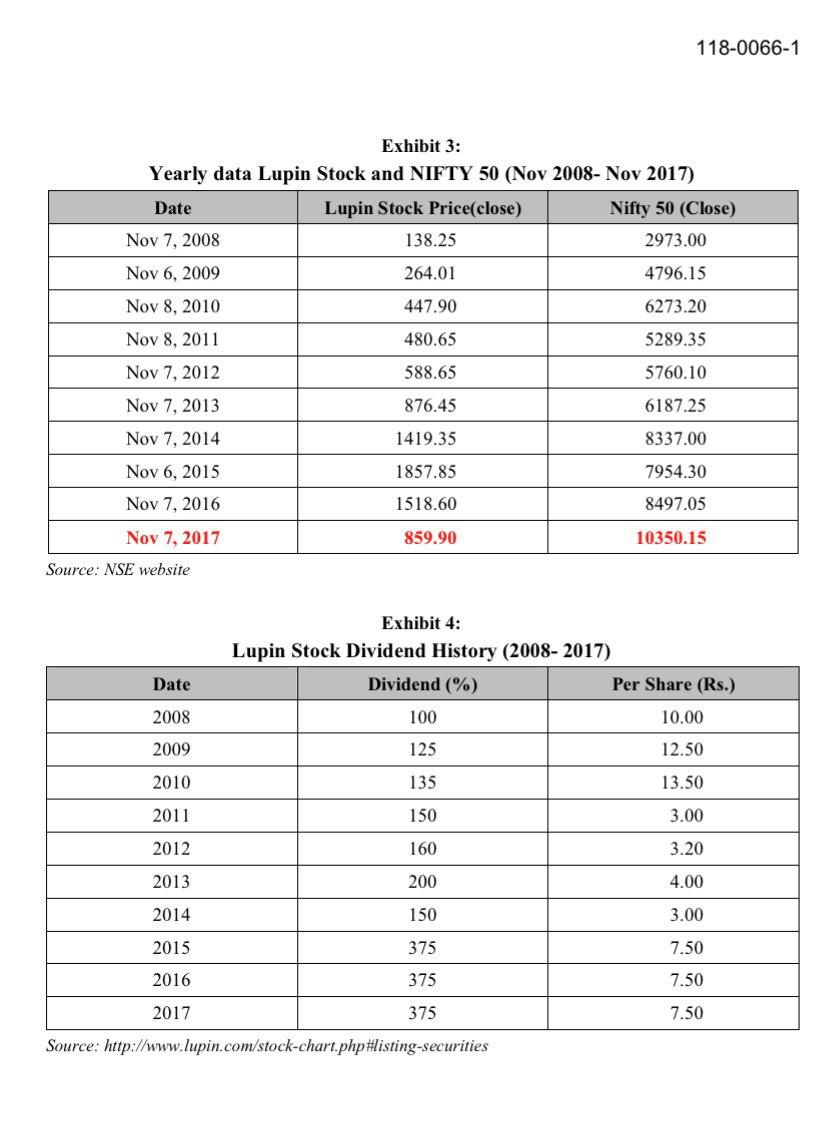

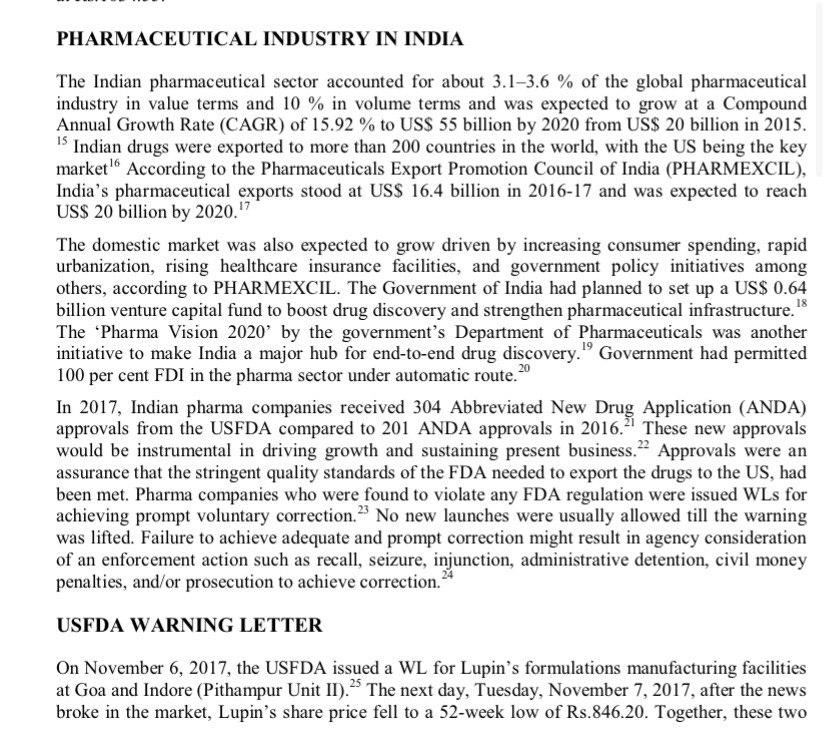

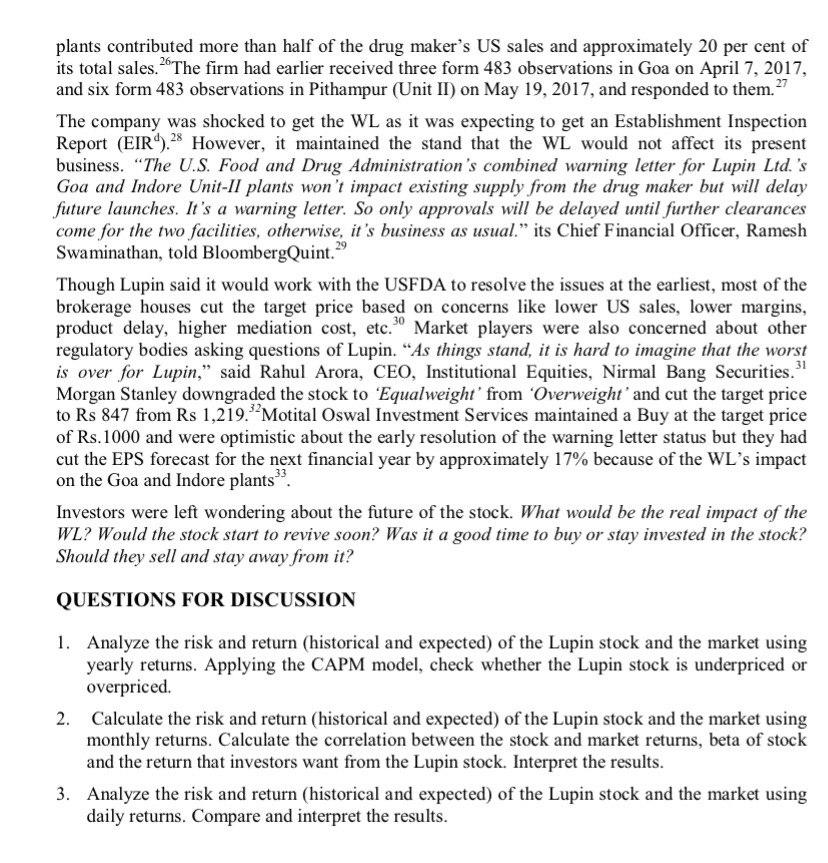

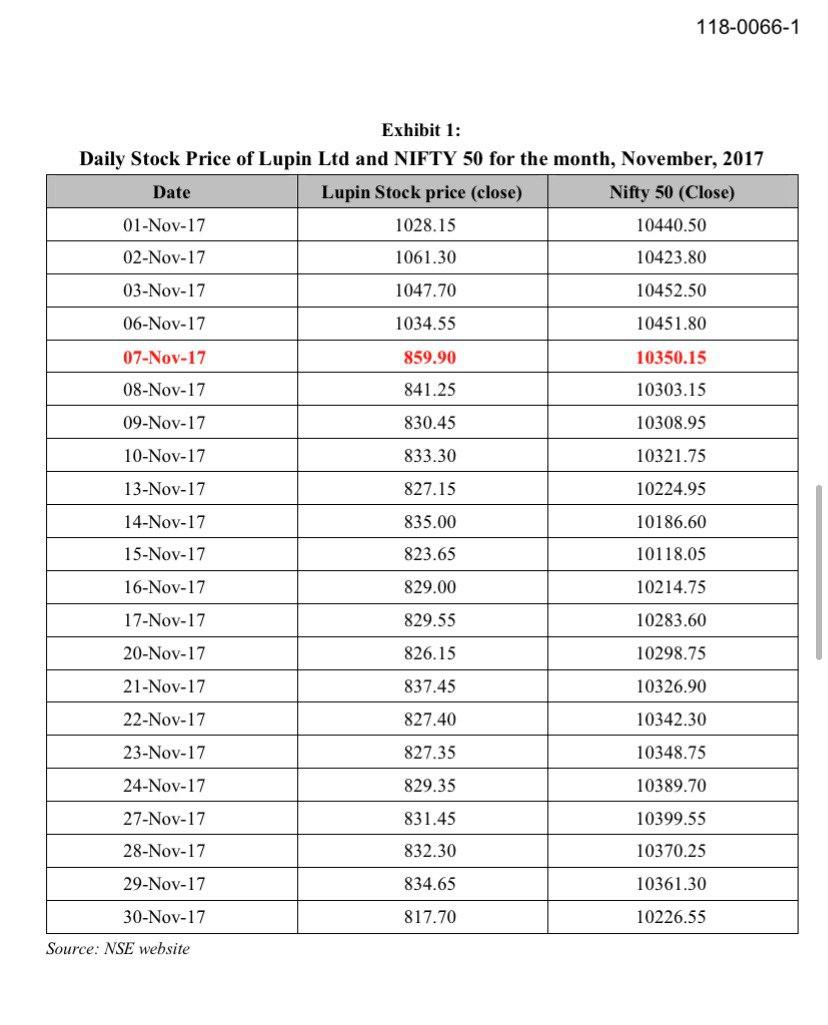

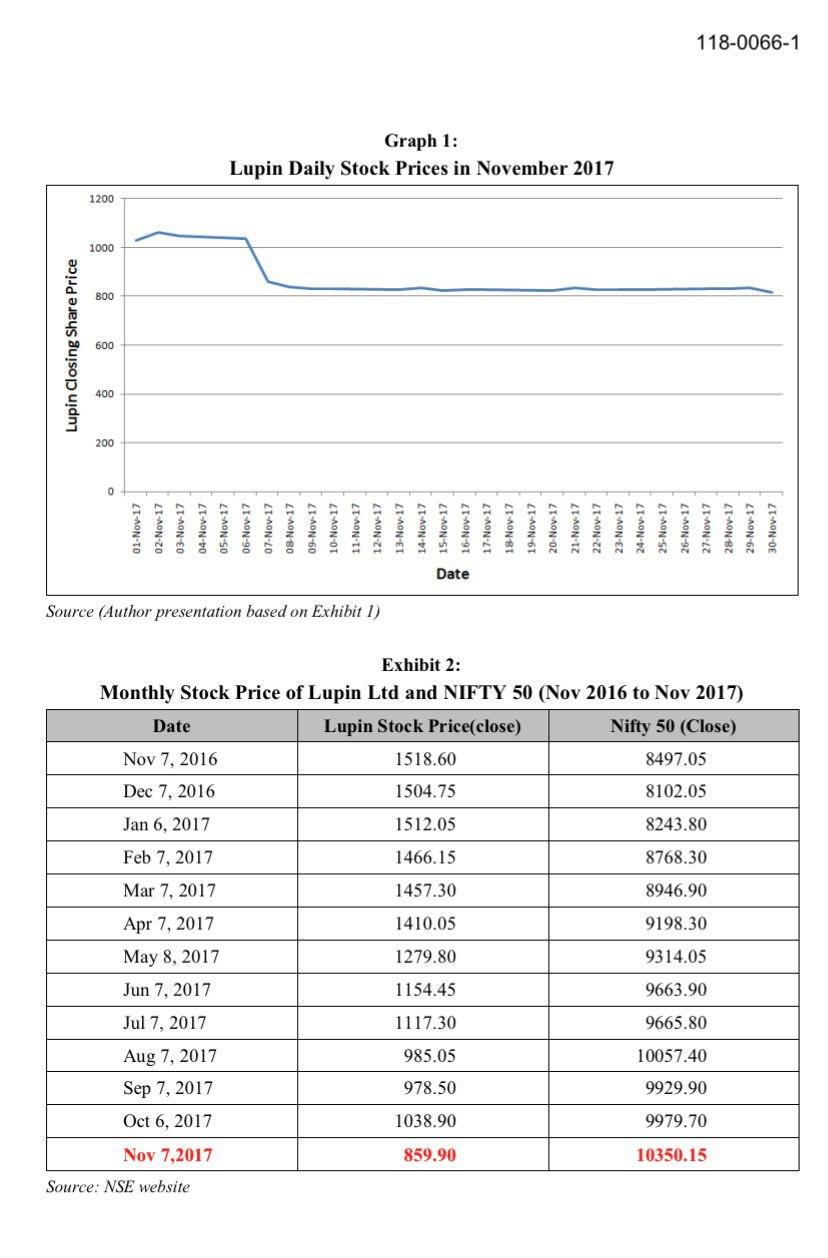

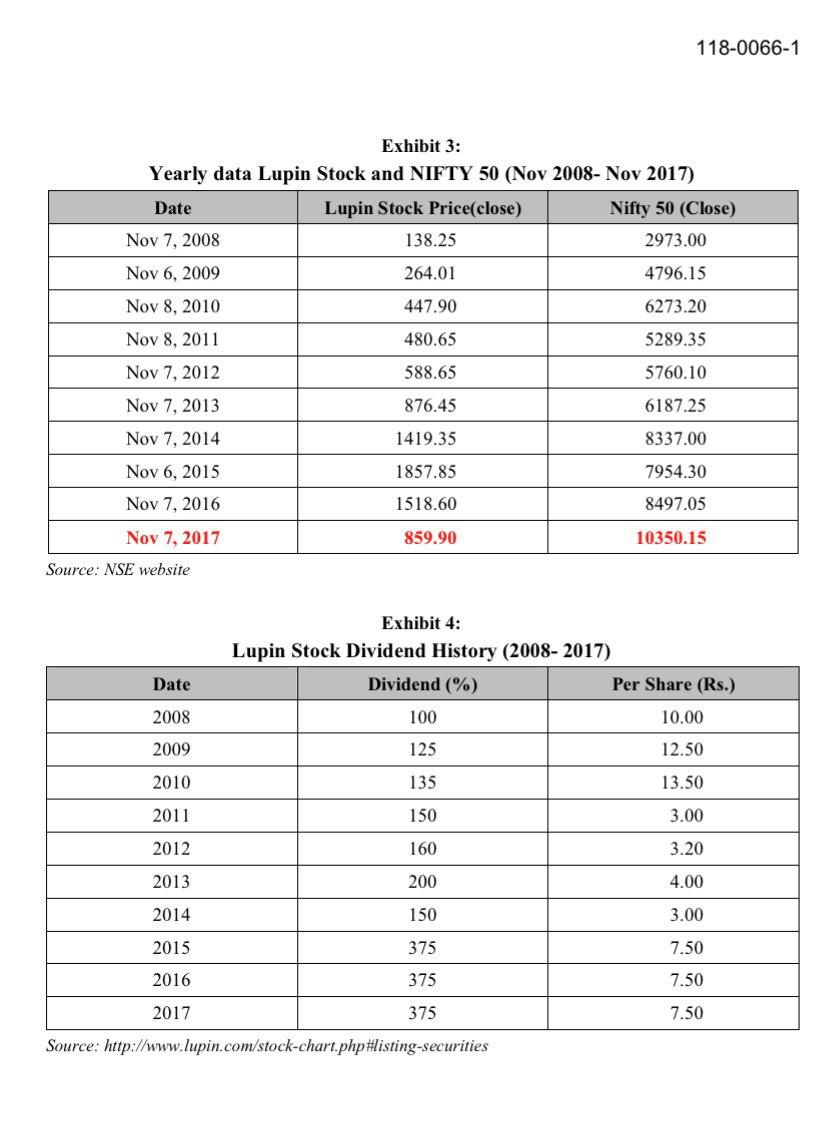

18 PHARMACEUTICAL INDUSTRY IN INDIA The Indian pharmaceutical sector accounted for about 3.1-3.6 % of the global pharmaceutical industry in value terms and 10 % in volume terms and was expected to grow at a Compound Annual Growth Rate (CAGR) of 15.92% to US$ 55 billion by 2020 from US$ 20 billion in 2015. 15 Indian drugs were exported to more than 200 countries in the world, with the US being the key market 16 According to the Pharmaceuticals Export Promotion Council of India (PHARMEXCIL), India's pharmaceutical exports stood at US$ 16.4 billion in 2016-17 and was expected to reach US$ 20 billion by 2020." The domestic market was also expected to grow driven by increasing consumer spending, rapid urbanization, rising healthcare insurance facilities, and government policy initiatives among others, according to PHARMEXCIL. The Government of India had planned to set up a US$ 0.64 billion venture capital fund to boost drug discovery and strengthen pharmaceutical infrastructure. The Pharma Vision 2020' by the government's Department of Pharmaceuticals was another initiative to make India a major hub for end-to-end drug discovery." Government had permitted 100 per cent FDI in the pharma sector under automatic route. In 2017, Indian pharma companies received 304 Abbreviated New Drug Application (ANDA) approvals from the USFDA compared to 201 ANDA approvals in 2016. These new approvals would be instrumental in driving growth and sustaining present business. Approvals were an assurance that the stringent quality standards of the FDA needed to export the drugs to the US, had been met. Pharma companies who were found to violate any FDA regulation were issued WLs for achieving prompt voluntary correction.2 No new launches were usually allowed till the warning was lifted. Failure to achieve adequate and prompt correction might result in agency consideration of an enforcement action such as recall, seizure, injunction, administrative detention, civil money penalties, and/or prosecution to achieve correction. 20 22 USFDA WARNING LETTER On November 6, 2017, the USFDA issued a WL for Lupin's formulations manufacturing facilities at Goa and Indore (Pithampur Unit II).25 The next day, Tuesday, November 7, 2017, after the news broke in the market, Lupin's share price fell to a 52-week low of Rs.846.20. Together, these two plants contributed more than half of the drug maker's US sales and approximately 20 per cent of its total sales. The firm had earlier received three form 483 observations in Goa on April 7, 2017, and six form 483 observations in Pithampur (Unit II) on May 19, 2017, and responded to them. 27 The company was shocked to get the WL as it was expecting to get an Establishment Inspection Report (EIR4).28 However, it maintained the stand that the WL would not affect its present business. The U.S. Food and Drug Administration's combined warning letter for Lupin Ltd.'s Goa and Indore Unit-Il plants won't impact existing supply from the drug maker but will delay future launches. It's a warning letter. So only approvals will be delayed until further clearances come for the two facilities, otherwise, it's business as usual." its Chief Financial Officer, Ramesh Swaminathan, told BloombergQuint.29 Though Lupin said it would work with the USFDA to resolve the issues at the earliest, most of the brokerage houses cut the target price based on concerns like lower US sales, lower margins, product delay, higher mediation cost, etc." Market players were also concerned about other regulatory bodies asking questions of Lupin. As things stand, it is hard to imagine that the worst is over for Lupin, said Rahul Arora, CEO, Institutional Equities, Nirmal Bang Securities." Morgan Stanley downgraded the stock to 'Equalweight' from 'Overweight and cut the target price to Rs 847 from Rs 1,219. Motital Oswal Investment Services maintained a Buy at the target price of Rs.1000 and were optimistic about the early resolution of the warning letter status but they had cut the EPS forecast for the next financial year by approximately 17% because of the WL's impact on the Goa and Indore plants." Investors were left wondering about the future of the stock. What would be the real impact of the WL? Would the stock start to revive soon? Was it a good time to buy or stay invested in the stock? Should they sell and stay away from it? 30 QUESTIONS FOR DISCUSSION 1. Analyze the risk and return (historical and expected) of the Lupin stock and the market using yearly returns. Applying the CAPM model, check whether the Lupin stock is underpriced or overpriced. 2. Calculate the risk and return (historical and expected) of the Lupin stock and the market using monthly returns. Calculate the correlation between the stock and market returns, beta of stock and the return that investors want from the Lupin stock. Interpret the results. 3. Analyze the risk and return (historical and expected) of the Lupin stock and the market using daily returns. Compare and interpret the results. 118-0066-1 Exhibit 1: Daily Stock Price of Lupin Ltd and NIFTY 50 for the month, November, 2017 Date Lupin Stock price (close) Nifty 50 (Close) 01-Nov-17 1028.15 10440.50 02-Nov-17 1061.30 10423.80 03-Nov-17 1047.70 10452.50 06-Nov-17 1034.55 10451.80 07-Nov-17 859.90 10350.15 08-Nov-17 841.25 10303.15 09-Nov-17 830.45 10308.95 10-Nov-17 833.30 10321.75 13-Nov-17 827.15 10224.95 14-Nov-17 835.00 10186.60 15-Nov-17 823.65 10118.05 16-Nov-17 829.00 10214.75 829.55 10283.60 17-Nov-17 20-Nov-17 826.15 10298.75 21-Nov-17 837.45 10326.90 22-Nov-17 827.40 10342.30 23-Nov-17 827.35 10348.75 24-Nov-17 829.35 10389.70 27-Nov-17 831.45 10399.55 28-Nov-17 832.30 10370.25 29-Nov-17 834.65 10361.30 30-Nov-17 817.70 10226.55 Source: NSE website Lupin Closing Share Price 200 400 600 800 1000 1200 0 Source: NSE website Nov 7, 2017 Oct 6, 2017 Sep 7, 2017 Aug 7, 2017 Jul 7, 2017 Jun 7, 2017 May 8, 2017 Apr 7, 2017 Mar 7, 2017 Feb 7, 2017 Jan 6, 2017 Source (Author presentation based on Exhibit 1) 01-Nov-17 02-Nov-17 03-Nov-17 04-Nov-17 05-Nov-17 06-Nov-17 07-Nov-17 859.90 1038.90 978.50 985.05 1117.30 1154.45 1279.80 1410.05 1457.30 1466.15 1512.05 Dec 7, 2016 Nov 7, 2016 Date 1504.75 1518.60 Lupin Stock Price(close) Monthly Stock Price of Lupin Ltd and NIFTY 50 (Nov 2016 to Nov 2017) Exhibit 2: 8102.05 8497.05 Nifty 50 (Close) 08-Nov-17 09-Nov-17 10-Nov-17 11-Nov-17 12-Nov-17 13-Nov-17 14-Nov-17 15-Nov-17 16-Nov-17 17-Nov-17 18-Nov-17 19-Nov-17 20-Nov-17 21-Nov-17 22-Nov-17 23-Nov-17 24-Nov-17 25-Nov-17 26-Nov 17 27. Nov 17 28-Nov-17 29-Nov-17 30-Nov-17 Lupin Daily Stock Prices in November 2017 Graph 1: Date 10350.15 9979.70 9929.90 10057.40 9665.80 9663.90 9314.05 9198.30 8946.90 8768.30 8243.80 118-0066-1 118-0066-1 Exhibit 3: Yearly data Lupin Stock and NIFTY 50 (Nov 2008- Nov 2017) Lupin Stock Price(close) Nifty 50 (Close) Nov 7, 2008 138.25 2973.00 Nov 6, 2009 264.01 4796.15 Date Nov 8, 2010 447.90 6273.20 Nov 8, 2011 480.65 5289.35 Nov 7, 2012 588.65 5760.10 Nov 7, 2013 876.45 6187.25 Nov 7, 2014 1419.35 8337.00 Nov 6, 2015 1857.85 7954.30 Nov 7, 2016 1518.60 8497.05 Nov 7, 2017 859.90 10350.15 Source: NSE website Exhibit 4: Lupin Stock Dividend History (2008-2017) Dividend (%) Per Share (Rs.) Date 100 10.00 2008 2009 125 12.50 2010 135 13.50 2011 150 3.00 2012 160 3.20 2013 200 4.00 2014 150 3.00 2015 375 7.50 2016 375 7.50 2017 375 7.50 Source: http://www.lupin.com/stock-chart.php#listing-securities 18 PHARMACEUTICAL INDUSTRY IN INDIA The Indian pharmaceutical sector accounted for about 3.1-3.6 % of the global pharmaceutical industry in value terms and 10 % in volume terms and was expected to grow at a Compound Annual Growth Rate (CAGR) of 15.92% to US$ 55 billion by 2020 from US$ 20 billion in 2015. 15 Indian drugs were exported to more than 200 countries in the world, with the US being the key market 16 According to the Pharmaceuticals Export Promotion Council of India (PHARMEXCIL), India's pharmaceutical exports stood at US$ 16.4 billion in 2016-17 and was expected to reach US$ 20 billion by 2020." The domestic market was also expected to grow driven by increasing consumer spending, rapid urbanization, rising healthcare insurance facilities, and government policy initiatives among others, according to PHARMEXCIL. The Government of India had planned to set up a US$ 0.64 billion venture capital fund to boost drug discovery and strengthen pharmaceutical infrastructure. The Pharma Vision 2020' by the government's Department of Pharmaceuticals was another initiative to make India a major hub for end-to-end drug discovery." Government had permitted 100 per cent FDI in the pharma sector under automatic route. In 2017, Indian pharma companies received 304 Abbreviated New Drug Application (ANDA) approvals from the USFDA compared to 201 ANDA approvals in 2016. These new approvals would be instrumental in driving growth and sustaining present business. Approvals were an assurance that the stringent quality standards of the FDA needed to export the drugs to the US, had been met. Pharma companies who were found to violate any FDA regulation were issued WLs for achieving prompt voluntary correction.2 No new launches were usually allowed till the warning was lifted. Failure to achieve adequate and prompt correction might result in agency consideration of an enforcement action such as recall, seizure, injunction, administrative detention, civil money penalties, and/or prosecution to achieve correction. 20 22 USFDA WARNING LETTER On November 6, 2017, the USFDA issued a WL for Lupin's formulations manufacturing facilities at Goa and Indore (Pithampur Unit II).25 The next day, Tuesday, November 7, 2017, after the news broke in the market, Lupin's share price fell to a 52-week low of Rs.846.20. Together, these two plants contributed more than half of the drug maker's US sales and approximately 20 per cent of its total sales. The firm had earlier received three form 483 observations in Goa on April 7, 2017, and six form 483 observations in Pithampur (Unit II) on May 19, 2017, and responded to them. 27 The company was shocked to get the WL as it was expecting to get an Establishment Inspection Report (EIR4).28 However, it maintained the stand that the WL would not affect its present business. The U.S. Food and Drug Administration's combined warning letter for Lupin Ltd.'s Goa and Indore Unit-Il plants won't impact existing supply from the drug maker but will delay future launches. It's a warning letter. So only approvals will be delayed until further clearances come for the two facilities, otherwise, it's business as usual." its Chief Financial Officer, Ramesh Swaminathan, told BloombergQuint.29 Though Lupin said it would work with the USFDA to resolve the issues at the earliest, most of the brokerage houses cut the target price based on concerns like lower US sales, lower margins, product delay, higher mediation cost, etc." Market players were also concerned about other regulatory bodies asking questions of Lupin. As things stand, it is hard to imagine that the worst is over for Lupin, said Rahul Arora, CEO, Institutional Equities, Nirmal Bang Securities." Morgan Stanley downgraded the stock to 'Equalweight' from 'Overweight and cut the target price to Rs 847 from Rs 1,219. Motital Oswal Investment Services maintained a Buy at the target price of Rs.1000 and were optimistic about the early resolution of the warning letter status but they had cut the EPS forecast for the next financial year by approximately 17% because of the WL's impact on the Goa and Indore plants." Investors were left wondering about the future of the stock. What would be the real impact of the WL? Would the stock start to revive soon? Was it a good time to buy or stay invested in the stock? Should they sell and stay away from it? 30 QUESTIONS FOR DISCUSSION 1. Analyze the risk and return (historical and expected) of the Lupin stock and the market using yearly returns. Applying the CAPM model, check whether the Lupin stock is underpriced or overpriced. 2. Calculate the risk and return (historical and expected) of the Lupin stock and the market using monthly returns. Calculate the correlation between the stock and market returns, beta of stock and the return that investors want from the Lupin stock. Interpret the results. 3. Analyze the risk and return (historical and expected) of the Lupin stock and the market using daily returns. Compare and interpret the results. 118-0066-1 Exhibit 1: Daily Stock Price of Lupin Ltd and NIFTY 50 for the month, November, 2017 Date Lupin Stock price (close) Nifty 50 (Close) 01-Nov-17 1028.15 10440.50 02-Nov-17 1061.30 10423.80 03-Nov-17 1047.70 10452.50 06-Nov-17 1034.55 10451.80 07-Nov-17 859.90 10350.15 08-Nov-17 841.25 10303.15 09-Nov-17 830.45 10308.95 10-Nov-17 833.30 10321.75 13-Nov-17 827.15 10224.95 14-Nov-17 835.00 10186.60 15-Nov-17 823.65 10118.05 16-Nov-17 829.00 10214.75 829.55 10283.60 17-Nov-17 20-Nov-17 826.15 10298.75 21-Nov-17 837.45 10326.90 22-Nov-17 827.40 10342.30 23-Nov-17 827.35 10348.75 24-Nov-17 829.35 10389.70 27-Nov-17 831.45 10399.55 28-Nov-17 832.30 10370.25 29-Nov-17 834.65 10361.30 30-Nov-17 817.70 10226.55 Source: NSE website Lupin Closing Share Price 200 400 600 800 1000 1200 0 Source: NSE website Nov 7, 2017 Oct 6, 2017 Sep 7, 2017 Aug 7, 2017 Jul 7, 2017 Jun 7, 2017 May 8, 2017 Apr 7, 2017 Mar 7, 2017 Feb 7, 2017 Jan 6, 2017 Source (Author presentation based on Exhibit 1) 01-Nov-17 02-Nov-17 03-Nov-17 04-Nov-17 05-Nov-17 06-Nov-17 07-Nov-17 859.90 1038.90 978.50 985.05 1117.30 1154.45 1279.80 1410.05 1457.30 1466.15 1512.05 Dec 7, 2016 Nov 7, 2016 Date 1504.75 1518.60 Lupin Stock Price(close) Monthly Stock Price of Lupin Ltd and NIFTY 50 (Nov 2016 to Nov 2017) Exhibit 2: 8102.05 8497.05 Nifty 50 (Close) 08-Nov-17 09-Nov-17 10-Nov-17 11-Nov-17 12-Nov-17 13-Nov-17 14-Nov-17 15-Nov-17 16-Nov-17 17-Nov-17 18-Nov-17 19-Nov-17 20-Nov-17 21-Nov-17 22-Nov-17 23-Nov-17 24-Nov-17 25-Nov-17 26-Nov 17 27. Nov 17 28-Nov-17 29-Nov-17 30-Nov-17 Lupin Daily Stock Prices in November 2017 Graph 1: Date 10350.15 9979.70 9929.90 10057.40 9665.80 9663.90 9314.05 9198.30 8946.90 8768.30 8243.80 118-0066-1 118-0066-1 Exhibit 3: Yearly data Lupin Stock and NIFTY 50 (Nov 2008- Nov 2017) Lupin Stock Price(close) Nifty 50 (Close) Nov 7, 2008 138.25 2973.00 Nov 6, 2009 264.01 4796.15 Date Nov 8, 2010 447.90 6273.20 Nov 8, 2011 480.65 5289.35 Nov 7, 2012 588.65 5760.10 Nov 7, 2013 876.45 6187.25 Nov 7, 2014 1419.35 8337.00 Nov 6, 2015 1857.85 7954.30 Nov 7, 2016 1518.60 8497.05 Nov 7, 2017 859.90 10350.15 Source: NSE website Exhibit 4: Lupin Stock Dividend History (2008-2017) Dividend (%) Per Share (Rs.) Date 100 10.00 2008 2009 125 12.50 2010 135 13.50 2011 150 3.00 2012 160 3.20 2013 200 4.00 2014 150 3.00 2015 375 7.50 2016 375 7.50 2017 375 7.50 Source: http://www.lupin.com/stock-chart.php#listing-securities