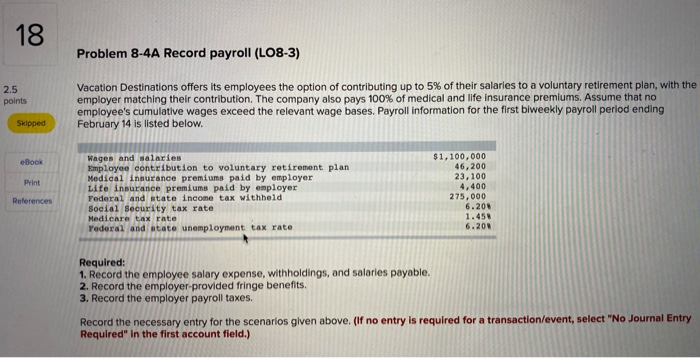

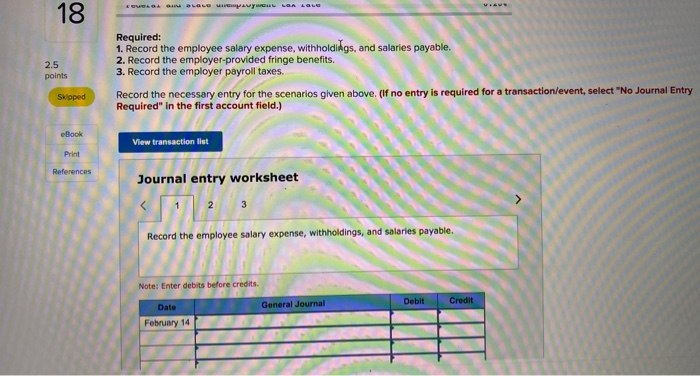

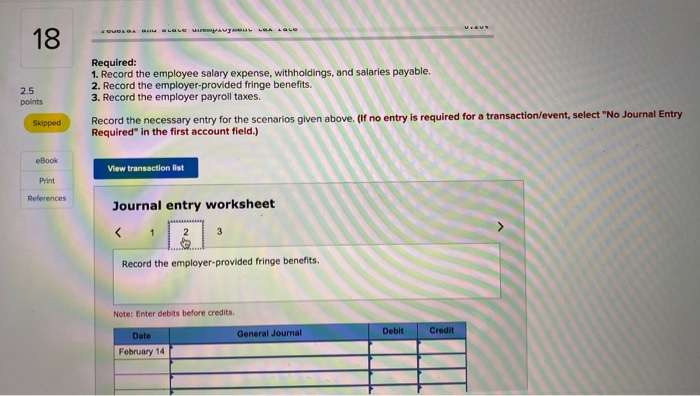

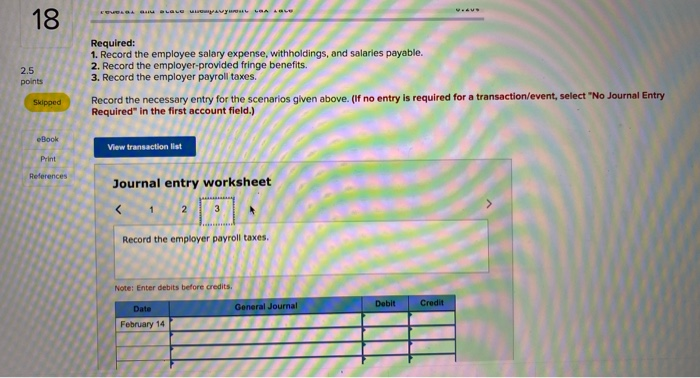

18 Problem 8-4A Record payroll (LO8-3) 2.5 points Vacation Destinations offers its employees the option of contributing up to 5% of their salaries to a voluntary retirement plan, with the employer matching their contribution. The company also pays 100% of medical and life insurance premiums. Assume that no employee's cumulative wages exceed the relevant wage bases, Payroll information for the first biweekly payroll period ending February 14 is listed below. Skipped eBook Print Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums paid by employer Life insurance premiums paid by employer Federal and state income tax withheld Social Security tax rate Medicare tax rate Yederal and state unemployment tax rate $1,100,000 46,200 23,100 4,400 275,000 6.200 1.450 6.200 References Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) LOVE U LOLO pavL LOA LOLE . 18 2.5 points Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Skloped eBook View transaction list Print References Journal entry worksheet 2 3 Record the employee salary expense, withholdings, and salaries payable. Note: Enter debits before credits. Debit Credit Date General Journal February 14 SOVELA LLOTAULA AL 18 2.5 points Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Skipped eBook View transaction list Print References Journal entry worksheet 1 2 3 Record the employer-provided fringe benefits. Note: Enter debits before credits General Journal Debit Credit Date February 14 . 8 2.5 points Required: 1. Record the employee salary expense, withholdings, and salaries payable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Skipped eBook View transaction list Print References Journal entry worksheet 1 2 3 Record the employer payroll taxes. Note: Enter debits before credits. Debit General Journal Date Credit February 14