Answered step by step

Verified Expert Solution

Question

1 Approved Answer

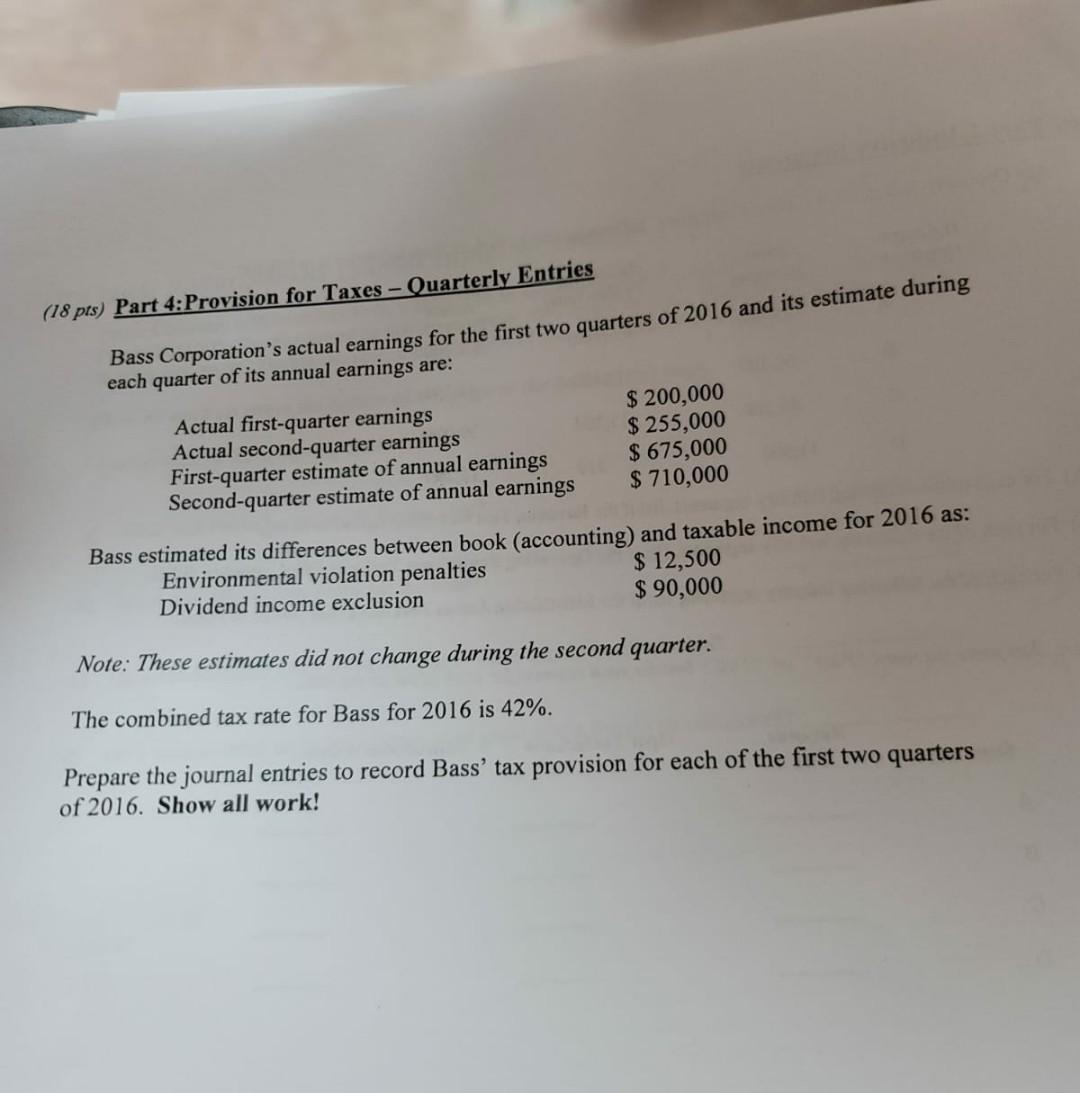

(18 pts) Part 4:Provision for Taxes - Quarterly Entries Bass Corporation's actual earnings for the first two quarters of 2016 and its estimate during each

(18 pts) Part 4:Provision for Taxes - Quarterly Entries Bass Corporation's actual earnings for the first two quarters of 2016 and its estimate during each quarter of its annual earnings are: Actual first-quarter earnings $ 200,000 Actual second-quarter earnings $ 255,000 First-quarter estimate of annual earnings $ 675,000 Second-quarter estimate of annual earnings $ 710,000 Bass estimated its differences between book accounting) and taxable income for 2016 as: Environmental violation penalties $ 12,500 Dividend income exclusion $ 90,000 Note: These estimates did not change during the second quarter. The combined tax rate for Bass for 2016 is 42%. Prepare the journal entries to record Bass' tax provision for each of the first two quarters of 2016. Show all work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started