Answered step by step

Verified Expert Solution

Question

1 Approved Answer

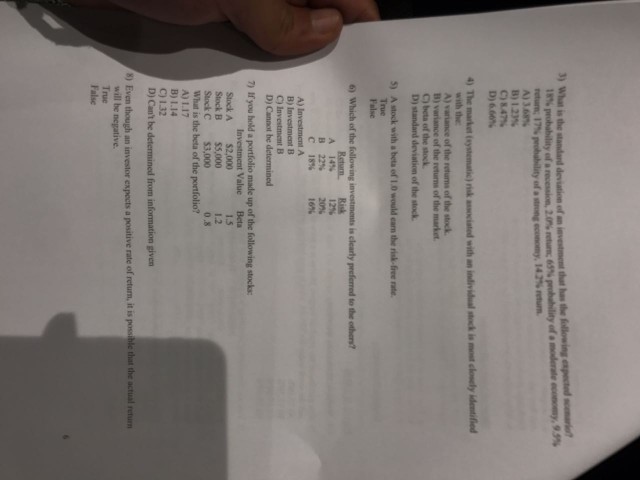

18% retum, 17% probabilityofastiing economy, 142% return. A)368% B)123% C)8.47% D) 6,00% 4) The market (ystematic) risk associated with an individual sock is most closly

18% retum, 17% probabilityofastiing economy, 142% return. A)368% B)123% C)8.47% D) 6,00% 4) The market (ystematic) risk associated with an individual sock is most closly identified with the A) variance of the retums of the stock B) variance of the returns of the market C) beta of the stock A stock with a beta of 1.0 would earn the risk-free rate True 5) Retum 14% 22% 18% Risk 12% 20% 16% A C A) Investment A B) Investment B C) Investment B D) Cannot be determined 7) If you hold a portfolio made up of the following stocks Investment ValueBeta 1.5 1.2 0.8 Stock A $2,000 Stock B $5,000 Stock C$3,000 What is the beta of the poetfolio? A) 1.17 B) 1.14 C) 1.32 D) Can't be determined from information given 8) Even though an investor expects a positive rate of return, it is possible that the actual return will be negative. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started