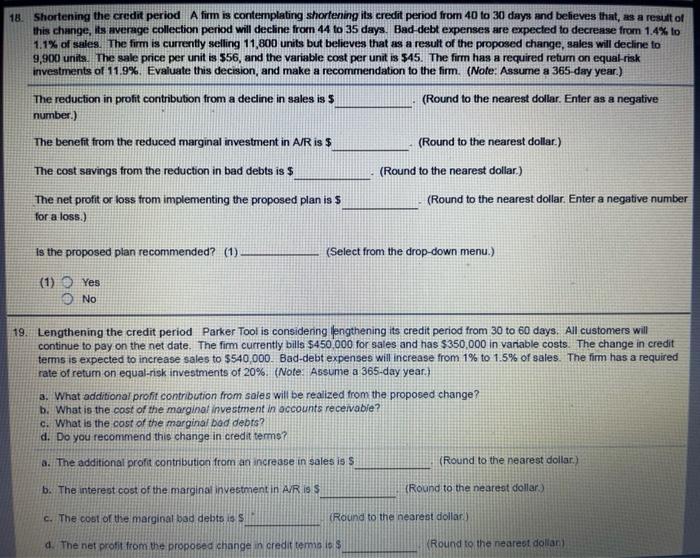

18. Shortening the credit period A firm is contemplating shortening its credit period from 40 to 30 days and believes that, as a result of this change, its average collection period will decline from 44 to 35 days. Bad debt expenses are expected to decrease from 1.4% to 1.1% of sales. The firm is currently selling 11,800 units but believes that as a result of the proposed change, sales will decline to 9,900 units. The sale price per unit is 556, and the variable cost per unit is $45. The firm has a required return on equal risk investments of 11.9%. Evaluate this decision, and make a recommendation to the firm. (Note: Assume a 365 day year.) The reduction in profit contribution from a decline in sales is $ (Round to the nearest dollar. Enter as a negative number.) The benefit from the reduced marginal investment in A/R is $ (Round to the nearest dollar) The cost savings from the reduction in bad debts is $ The net profit or loss from implementing the proposed plan is $ for a loss.) (Round to the nearest dollar.) (Round to the nearest dollar. Enter a negative number Is the proposed plan recommended? (1) (Select from the drop-down menu.) (1) Yes No 19. Lengthening the credit period Parker Tool is considering lengthening its credit period from 30 to 60 days. All customers will continue to pay on the net date. The firm currently bills $450 000 for sales and has $350,000 in variable costs. The change in credit terms is expected to increase sales to $540,000. Bad-debt expenses will increase from 1% to 1.5% of sales. The firm has a required rate of return on equal-risk investments of 20% (Note: Assume a 365-day year.) a. What additional profit contribution from sales will be realized from the proposed change? b. What is the cost of the marginal investment in accounts receivable? c. What is the cost of the marginal bod debts? d. Do you recommend this change in credit terms? a. The additional profit contribution from an increase in sales is S (Round to the nearest dollar.) b. The interest cost of the marginal investment in A/R IS S {Round to the nearest dollar) c. The cost of the marginal bad debts is S (Round to the nearest dollar) d. The net profit from the proposed change in credit terma los Round to the nearest dollan