Answered step by step

Verified Expert Solution

Question

1 Approved Answer

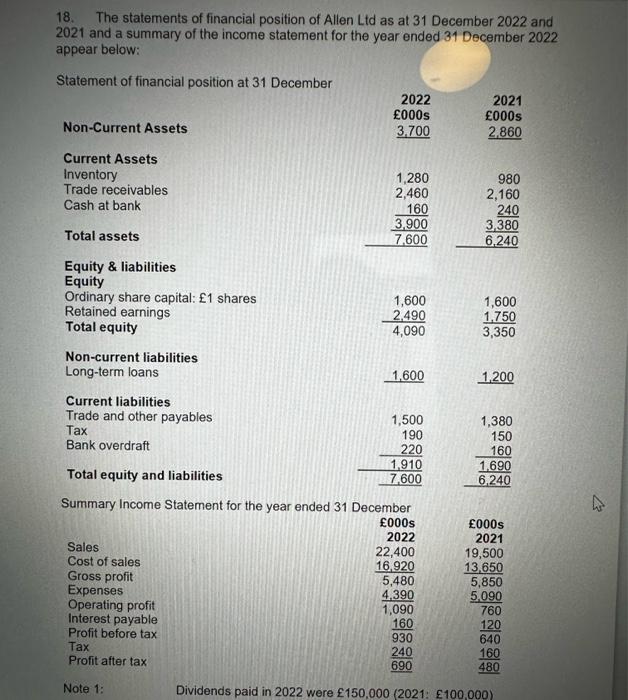

18. The statements of financial position of Allen Ltd as at 31 December 2022 and 2021 and a summary of the income statement for the

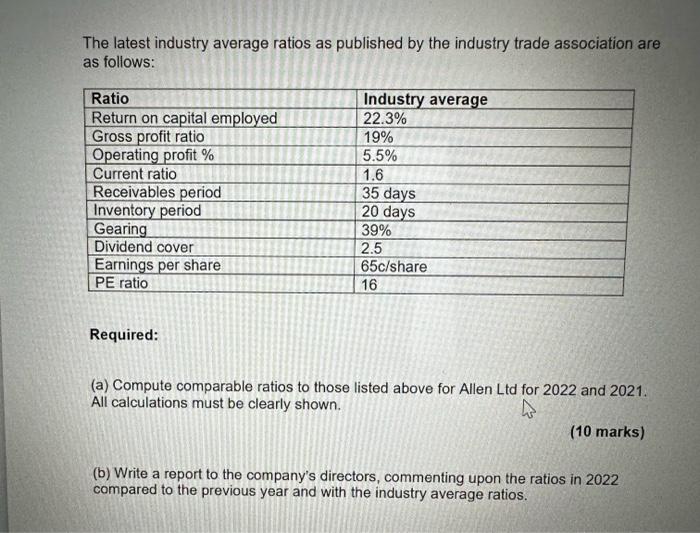

18. The statements of financial position of Allen Ltd as at 31 December 2022 and 2021 and a summary of the income statement for the year ended 31 December 2022 appear below: Statement of financial position at 31 December Non-Current Assets Current Assets Inventory Trade receivables Cash at bank Total assets Equity & liabilities Equity Ordinary share capital: 1 shares Retained earnings Total equity Non-current liabilities Long-term loans Current liabilities Trade and other payables Tax Bank overdraft Sales Cost of sales Gross profit Expenses Operating profit Interest payable Profit before tax Tax Profit after tax 2022 000s 3,700 Note 1: 1,280 2,460 160 3,900 7,600 1,600 2,490 4,090 1,600 1,500 190 220 Total equity and liabilities Summary Income Statement for the year ended 31 December 000s 2022 1,910 7,600 22,400 16,920 5,480 4,390 1,090 160 930 240 690 2021 000s 2,860 980 2,160 240 3,380 6,240 1,600 1,750 3,350 1,200 1,380 150 160 1,690 6,240 000s 2021 19,500 13,650 5,850 5,090 760 120 640 160 480 Dividends paid in 2022 were 150,000 (2021: 100,000) 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started