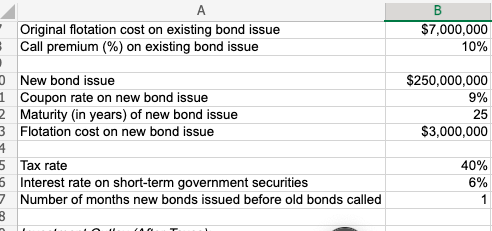

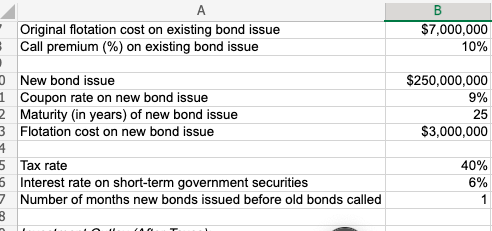

18 Video Excel Online Structured Activity: Refunding Analysis Mullet Technologies is considering whether or not to refund $250 million, 14% coupon, 30-year bond issue that was sold 5 years ago. It is amortizing $7 million of flotation costs on the 14% bonds over the issue's 30-year life. Mullet's investment banks have indicated that the company could sell a new 25- year issue at an interest rate of 9% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 9% any time soon, but there is a chance that rates will increase. A call premium of 10% would be required to retire the old bonds, and flotation costs on the new issue would amount to $3 million. Mullet's marginal federal-plus-state tax rate is 40%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being invested in short-term government securities returning 6% annually during the interim period. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Conduct a complete bond refunding analysis. What is the bond refunding's NPV? Do not round intermediate calculations. Round your answer to the nearest dollar. $ 14.9 X . I A Original flotation cost on existing bond issue Call premium (%) on existing bond issue 0 New bond issue 1 Coupon rate on new bond issue 2 Maturity (in years) of new bond issue 3 Flotation cost on new bond issue 4 5 Tax rate 6 Interest rate on short-term government securities Number of months new bonds issued before old bonds called 7 B B $7,000,000 10% $250,000,000 9% 25 $3,000,000 40% 6% 18 Video Excel Online Structured Activity: Refunding Analysis Mullet Technologies is considering whether or not to refund $250 million, 14% coupon, 30-year bond issue that was sold 5 years ago. It is amortizing $7 million of flotation costs on the 14% bonds over the issue's 30-year life. Mullet's investment banks have indicated that the company could sell a new 25- year issue at an interest rate of 9% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 9% any time soon, but there is a chance that rates will increase. A call premium of 10% would be required to retire the old bonds, and flotation costs on the new issue would amount to $3 million. Mullet's marginal federal-plus-state tax rate is 40%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being invested in short-term government securities returning 6% annually during the interim period. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Conduct a complete bond refunding analysis. What is the bond refunding's NPV? Do not round intermediate calculations. Round your answer to the nearest dollar. $ 14.9 X . I A Original flotation cost on existing bond issue Call premium (%) on existing bond issue 0 New bond issue 1 Coupon rate on new bond issue 2 Maturity (in years) of new bond issue 3 Flotation cost on new bond issue 4 5 Tax rate 6 Interest rate on short-term government securities Number of months new bonds issued before old bonds called 7 B B $7,000,000 10% $250,000,000 9% 25 $3,000,000 40% 6%