Question

18 years and 9 months ago the company which you work for signed an Interest Rate Swap with a bank. The maturity is 20 years,

18 years and 9 months ago the company which you work for signed an Interest Rate Swap with a bank. The maturity is 20 years, so there are 1.25 years left. The conditions of the swap are as follows: Company receives Libor at 6 months plus a spread of 100 b.p. Bank receives 8% every 6 months 30/360. Notional: 100 million.

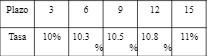

100 million The continuous zero curve is:

Finally consider that the floating reference rate (6 month Libor) on the last settlement date of the swap was 10.2%. Determine the value of this swap for the financial institution. For purposes of simplifying calculations, consider a 30/360 day count for the fixed and variable part of this swap.

Plazo 3 6 9 12 15 Tasa 10% 10.3 10.8 11% 10.5 90 9 Plazo 3 6 9 12 15 Tasa 10% 10.3 10.8 11% 10.5 90 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started