Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#18-1 A Knight Construction Co. has consistently used the percentage-of-completion method of recognizing revenue. During 2021, Knight entered into a fixed-price contract to construct

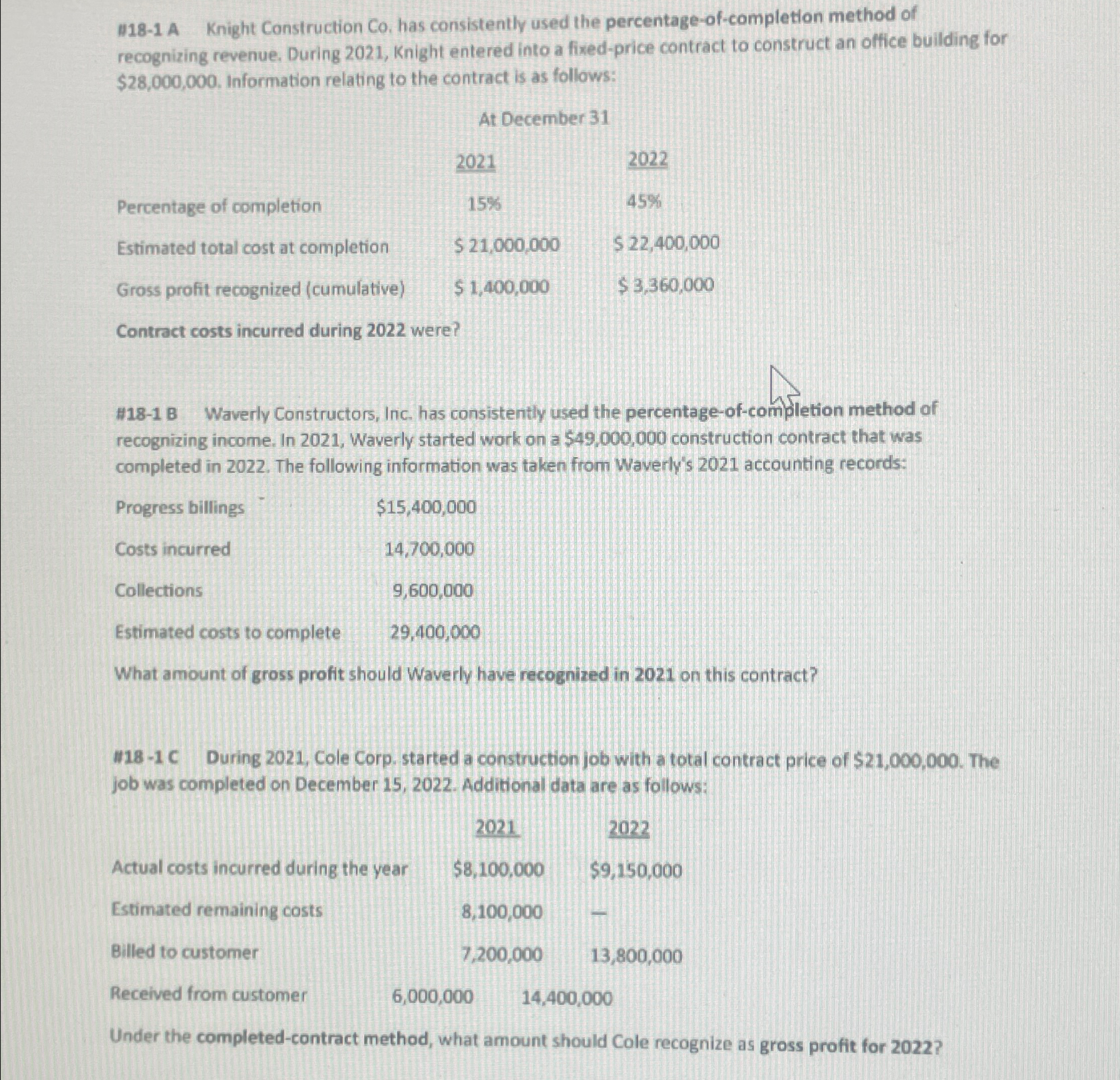

#18-1 A Knight Construction Co. has consistently used the percentage-of-completion method of recognizing revenue. During 2021, Knight entered into a fixed-price contract to construct an office building for $28,000,000. Information relating to the contract is as follows: At December 31 2021 2022 Percentage of completion 15% 45% Estimated total cost at completion $ 21,000,000 $ 22,400,000 Gross profit recognized (cumulative) Contract costs incurred during 2022 were? $1,400,000 $3,360,000 #18-1 B Waverly Constructors, Inc. has consistently used the percentage-of-completion method of recognizing income. In 2021, Waverly started work on a $49,000,000 construction contract that was completed in 2022. The following information was taken from Waverly's 2021 accounting records: Progress billings Costs incurred Collections Estimated costs to complete $15,400,000 14,700,000 9,600,000 29,400,000 What amount of gross profit should Waverly have recognized in 2021 on this contract? #18-1 C During 2021, Cole Corp. started a construction job with a total contract price of $21,000,000. The job was completed on December 15, 2022. Additional data are as follows: 2021 2022 Actual costs incurred during the year $8,100,000 $9,150,000 Estimated remaining costs 8,100,000 Billed to customer 7,200,000 13,800,000 Received from customer 6,000,000 14,400,000 Under the completed-contract method, what amount should Cole recognize as gross profit for 2022?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Knight Construction Co 1 Contract costs incurred during 2022 Percentage of completion in 2022 45 Est...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started