Question

18.19.20.21.22Assume that the economy is enjoying a strong boom, and as a result interest rates and money costs generally are relatively high. The WACC for

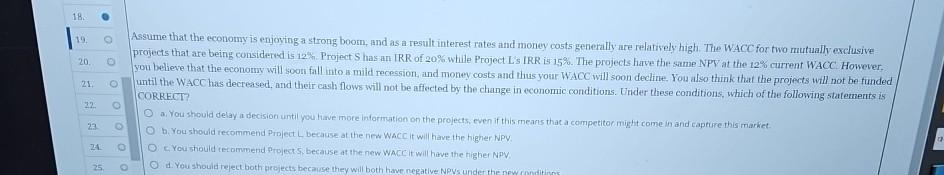

18.19.20.21.22Assume that the economy is enjoying a strong boom, and as a result interest rates and money costs generally are relatively high. The WACC for two mutually exclusiveprojects that are being considered is 12%. Project S has an IRRof 20% while Project L's IRRis 15%. The projects have the same NPV at the 129%cyou believe that the economy will soon fall into a mild recession, and money costs and thus your WACC will soon decline. You also think t24.kthat the noOcYou should recommend Project S, because at the new WACC it will have the higher NPV.25 o d You should reject both projects because they will bothountil the WACC has decreased, and their cash flows will not be affected by the change in economic conditions. Under these conditions, which of the following staternents iORRECT?Oa.You should delay a decision until you have more information on the projects, even if this rmeans that a competitor might come in and capture this marketOb.You should recommend Project L because at the new WACcCit will have the higher NPVHowever,1ded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started