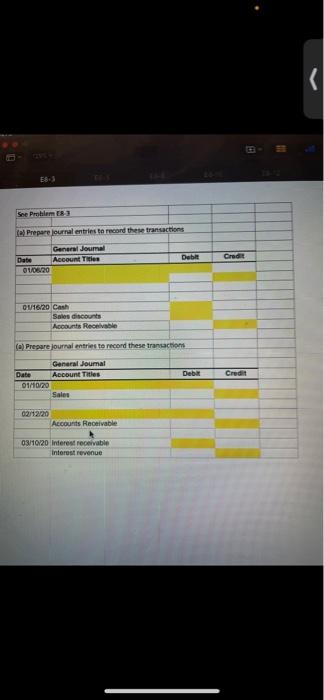

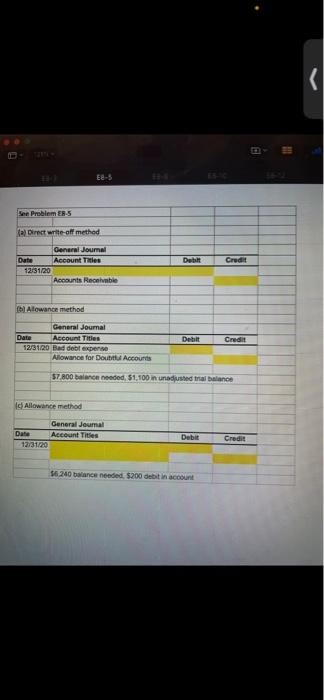

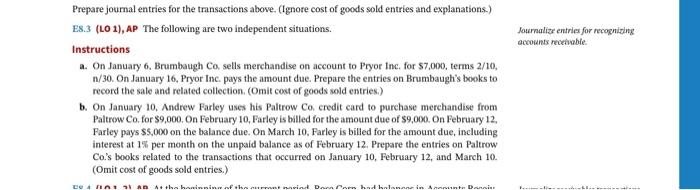

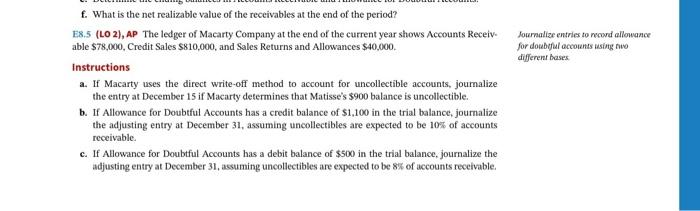

18.3 See Problems tal Prepare journal entries to record these transactions General Journal Date Account The 10620 Debe Cred Q116/20 Cash Sales discounts Account Ronable (a) Prepare journal entries to record these transactions Deba Cred General Joumal Date Account Titles 01/10/20 Sales 02/12/20 Accounts Receivable 03/10/20 Interest receivable interest revenue E-s See Problem ERS (a) Direct write-off method Dett Credit General Journal Date Account Toties 1213120 Accounts Recambie Alowance method Detit General Journal Date Account Tities 12/3120 Bad debt expense Allowance for Dout Accounts Credit 57.800 banon nooded, 51, 100 in unadjusted trial balance Id Allowance method General Joumal Account Titles Date Debit Credit 56 240 balance needed $200 debit in account Journalize entries for recognising accounts reale Prepare journal entries for the transactions above. (Ignore cost of goods sold entries and explanations.) E8.3 (LO 1), AP The following are two independent situations. Instructions a. On January 6, Brumbaugh Co sells merchandise on account to Pryor Inc. for $7,000, terms 2/10, n/30. On January 16, Pryor Inc. pays the amount due. Prepare the entries on Brumbaugh's books to record the sale and related collection (Omit cost of goods sold entries.) b. On January 10, Andrew Farley uses his Paltrow Co. credit card to purchase merchandise from Paltrow Co. for $9.000. On February 10, Farley is billed for the amount due of $9,000. On February 12, Farley pays $5,000 on the balance due. On March 10. Farley is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12. Prepare the entries on Paltrow Co.'s books related to the transactions that occurred on January 10, February 12, and March 10. (Omit cost of goods sold entries.) DAINAB Atha hinni fahariot De hadhain Ano Dani Journalize entries to record allowance for doubtful accounts using na different bases . What is the net realizable value of the receivables at the end of the period? E8.5 (LO2), AP The ledger of Macarty Company at the end of the current year shows Accounts Receiv able $78,000, Credit Sales $810,000, and Sales Returns and Allowances $40,000 Instructions a. If Macarty uses the direct write-off method to account for uncollectible accounts, journalize the entry at December 15 if Macarty determines that Matisse's $900 balance is uncollectible. b. If Allowance for Doubtful Accounts has a credit balance of $1,100 in the trial balance, journalize the adjusting entry at December 31, assuming uncollectibles are expected to be 10% of accounts receivable. c. If Allowance for Doubtful Accounts has a debit balance of $500 in the trial balance, journalize the adjusting entry at December 31, assuming uncollectibles are expected to be 8% of accounts receivable