18.4 please written neatly

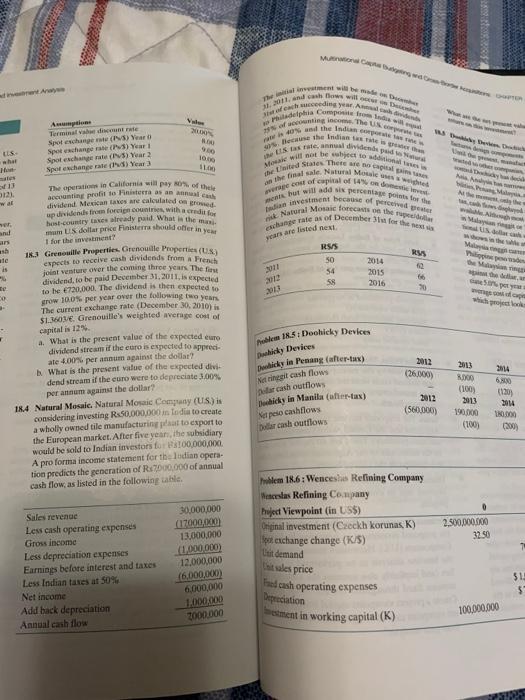

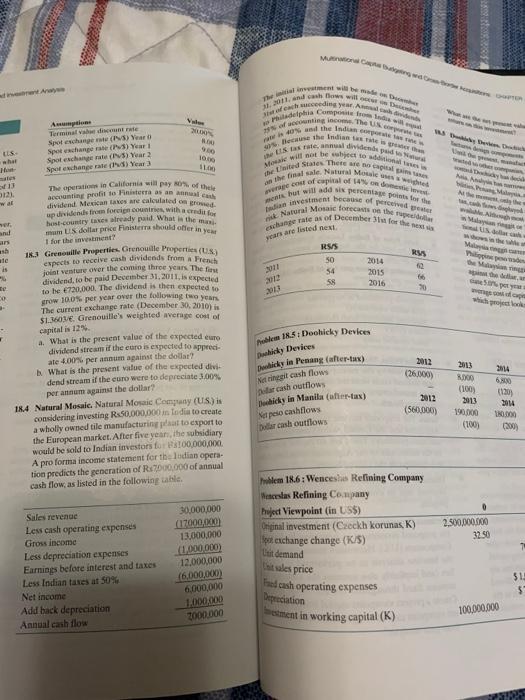

NUN Ampum Terminal de por exchange rate () Year Spot change rate (P3) Year Spotte (I) Year 2 Spal exchange rates) Year 3 LE what H V. 13 12 wa The me te madh Werfenwedig yr Arna and cash will be of The UN delphia Compete free al the Indian ce The Indiana Movie will not be set to IN E teleb tid Seat The the final del Mow coloco de but will add sin percent of the investment because of perce enerate as of December of the ni Natural Mosaic forecasts on the years are steder RSS 50 2014 54 2015 58 2016 90 .. A Man US RS poty 2013 w which The poems will pay of the a proto raam dividend Mexican la are calculated on up didendis from forven countries, with a cred for host country are already What is the mm US dollar price Fisher in y 1 for the investment ash 1x. Grenouille Properties Grenouille Properties (0) le expects to receive cash dividends from Fresh is joint venture over the coming three yearsThe dividend to be paid December 31, 2011, is expected te to be 720,000. The dividend is then expected grow 100% per year over the following two years The current exchange rate (December 30, 2010), $1.ove. Grenouille's weighted average cost of capital is 12% a. What is the present value of the expected euro dividend stream if the car is expected to apprec- ale 400% per annum against the dollar What is the present value of the expected divi dend stream if the curo were to depreciate 3.00% per annum against the dollar? 18.4 Natural Mosaic Natural Mosaic Company (US) considering investing Rs50,000,000 in todil to create a wholly owned tile manufacturing plaat to export to the European market. After five years, the subsidiary would be sold to Indian investors for 100,000,000 A pro forma income statement for the Indian opera- tion predicts the generation of R7000.000 of annual cash flow, as listed in the following table po 18.5: Doohicky Devices Dubidy Devices 2012 (36.000) Dowkids in Penang (ertux) Net ringgit cash flows Dalah outflows Dicky in Manila (her-tax) Netpeso cashflows Dar cash outflows 2013 8000 (100) 2013 190.000 (100) 2014 600 (120) 2014 2012 (560.000) Plem 18.6: Wencesls Refining Company Wenceslas Refining Company hjed Viewpoint (in US$) Original investment (Cxockh korunas, K) per exchange change (5/5) 2.500.000.000 32.50 Clit demand Sales revenue Les cash operating expenses Gross income Less depreciation expenses Earnings before interest and taxes Less Indian taxes at 50% Net income Add back depreciation Annual cash flow 30,000,000 (17000,000 13.000.000 (1.000.000) 12,000,000 6.000.000 6,000,000 1.000.000 3000.000 Chitales price 51 $ Fred cash operating expenses Depreciation Sestment in working capital (K) 100.000.000