Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19. Calculating Effective Rates of Return Lenders, like banks, often advertise a stated (or nominal rate) but multiple compounding periods during the year cause the

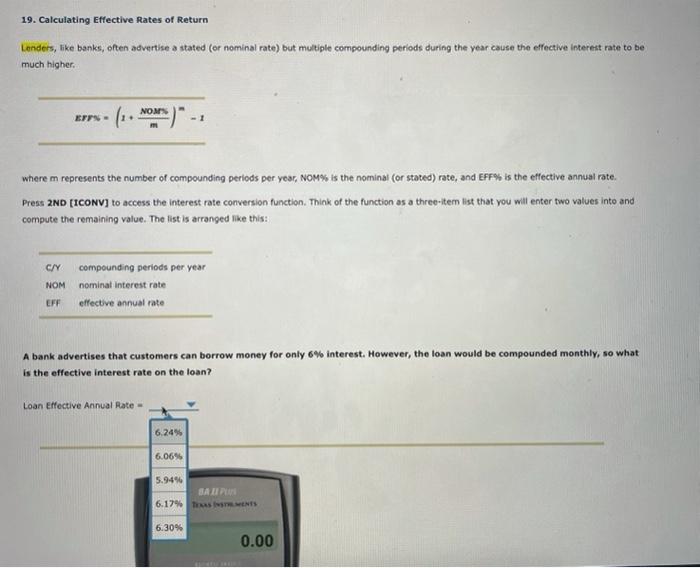

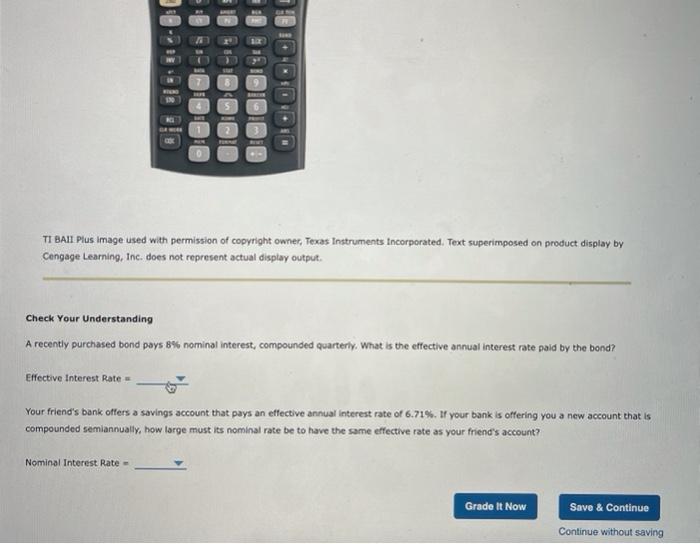

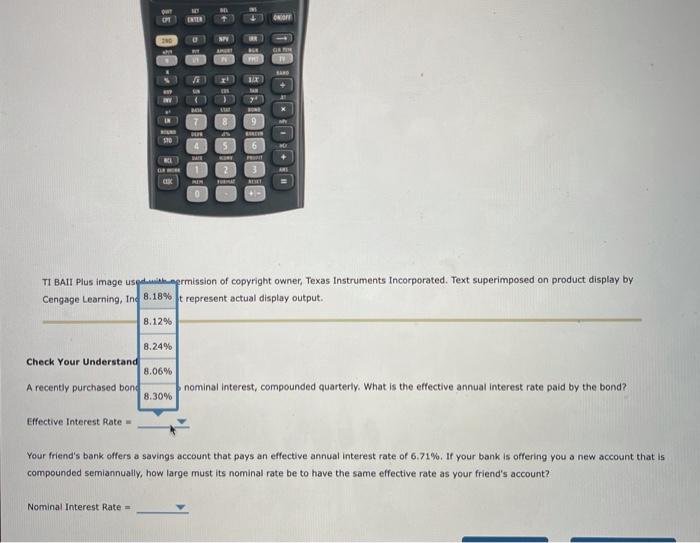

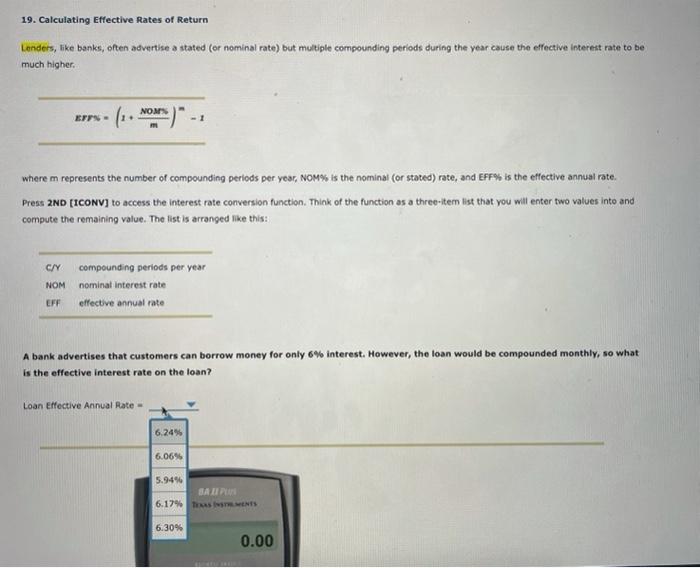

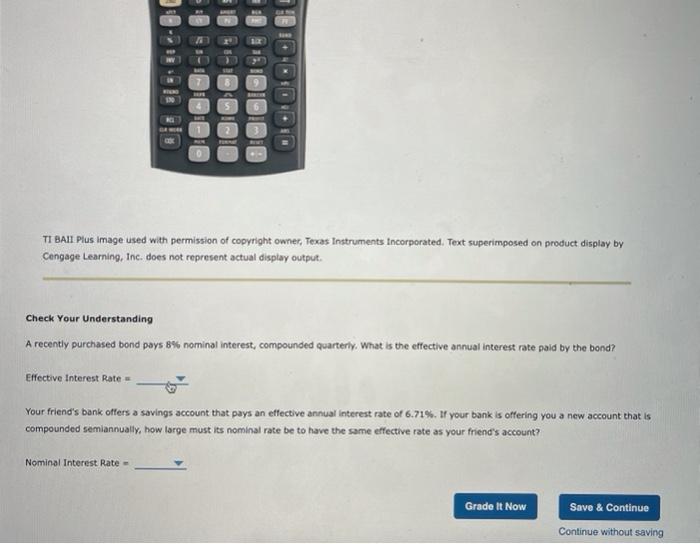

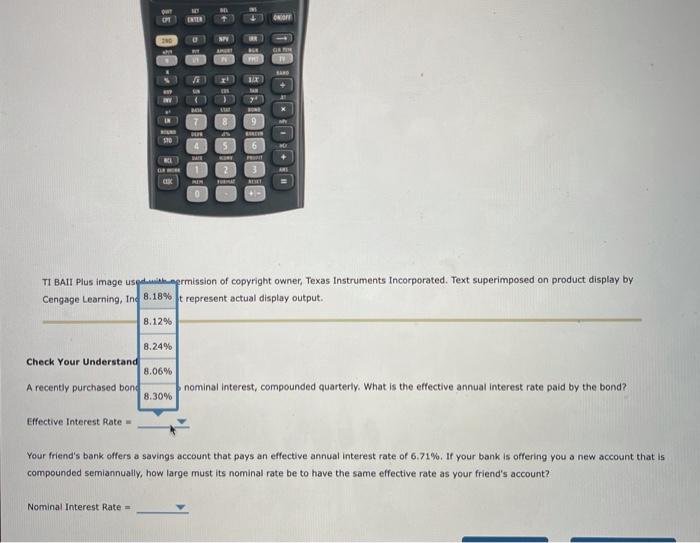

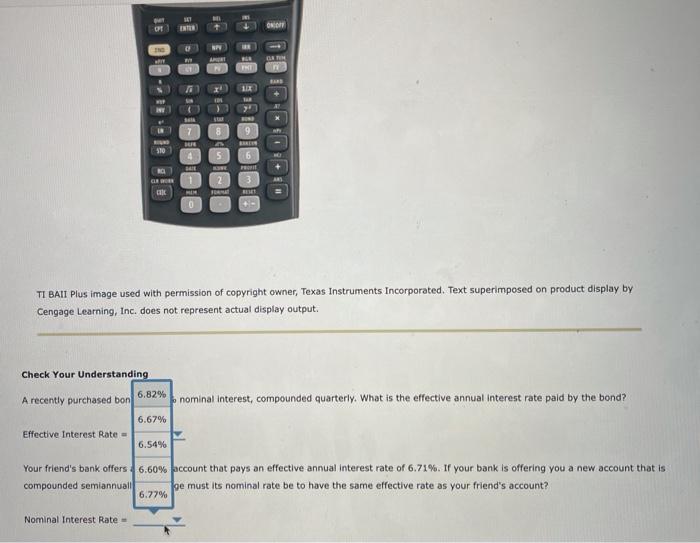

19. Calculating Effective Rates of Return Lenders, like banks, often advertise a stated (or nominal rate) but multiple compounding periods during the year cause the effective interest rate to be much higher. NOM% EFF%- 1. -1 where m represents the number of compounding periods per year, NOM% is the nominal (or stated) rate, and EFF% is the effective annual rate. Press 2ND [ICONV] to access the interest rate conversion function. Think of the function as a three-item list that you will enter two values into and compute the remaining value. The list is arranged like this: C/Y compounding periods per year NOM nominal interest rate EFF effective annual rate A bank advertises that customers can borrow money for only 6% interest. However, the loan would be compounded monthly, so what is the effective interest rate on the loan? Loan Effective Annual Rate - 6.24% 6.06% 5.94% BAZI PU 6.17% TEXAS INSTMENTS 6.30% 0.00 RIEND stat 8 WORK 5 HI 4 1 PIK 0 TI BAII Plus image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does not represent actual display output. Check Your Understanding A recently purchased bond pays 8% nominal interest, compounded quarterly. What is the effective annual interest rate paid by the bond? Effective Interest Rate = Your friend's bank offers a savings account that pays an effective annual interest rate of 6.71%. If your bank is offering you a new account that is compounded semiannually, how large must its nominal rate be to have the same effective rate as your friend's account? Nominal Interest Rate = Grade It Now Save & Continue Continue without saving 1040 6 EIER Out OPT IN BOUND 170 ENTER CL ax PHI 1/X y BOND 7 9 201 BARCIN 6 4 BATE PROFIT MIM NEXXT 0 4- TI BAII Plus image usedermission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Ind 8.18% t represent actual display output. 8.12% 8.24% Check Your Understand 8.06% A recently purchased bond nominal interest, compounded quarterly. What is the effective annual interest rate paid by the bond?? 8.30% Effective Interest Rate = Your friend's bank offers a savings account that pays an effective annual interest rate of 6.71%. If your bank is offering you a new account that is compounded semiannually, how large must its nominal rate be to have the same effective rate as your friend's account? Nominal Interest Rate A S M 1 On 8 AN 5 KONT 2 ONCOFE GRI BARD F 1 OPT WAY OM INTR INT CL 147 ENTEN 7 S+ S A PHI 1IX star BUND 8 9 4 BALI 5 6 SN 3614 7 SEFE 4 SAE 1 3 CIK MIM BESET 0 TI BAII Plus image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does not represent actual display output. Check Your Understanding 6.82% A recently purchased bon nominal interest, compounded quarterly. What is the effective annual interest rate paid by the bond? 6.67% Effective Interest Rate = 6.54% Your friend's bank offers 6.60% account that pays an effective annual interest rate of 6.71%. If your bank is offering you a new account that is ge must its nominal rate be to have the same effective rate as your friend's account? compounded semiannuall 6.77% Nominal Interest Rate -I 2 ON/OFF CATH BARD PR

19. Calculating Effective Rates of Return Lenders, like banks, often advertise a stated (or nominal rate) but multiple compounding periods during the year cause the effective interest rate to be much higher. NOM% EFF%- 1. -1 where m represents the number of compounding periods per year, NOM% is the nominal (or stated) rate, and EFF% is the effective annual rate. Press 2ND [ICONV] to access the interest rate conversion function. Think of the function as a three-item list that you will enter two values into and compute the remaining value. The list is arranged like this: C/Y compounding periods per year NOM nominal interest rate EFF effective annual rate A bank advertises that customers can borrow money for only 6% interest. However, the loan would be compounded monthly, so what is the effective interest rate on the loan? Loan Effective Annual Rate - 6.24% 6.06% 5.94% BAZI PU 6.17% TEXAS INSTMENTS 6.30% 0.00 RIEND stat 8 WORK 5 HI 4 1 PIK 0 TI BAII Plus image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does not represent actual display output. Check Your Understanding A recently purchased bond pays 8% nominal interest, compounded quarterly. What is the effective annual interest rate paid by the bond? Effective Interest Rate = Your friend's bank offers a savings account that pays an effective annual interest rate of 6.71%. If your bank is offering you a new account that is compounded semiannually, how large must its nominal rate be to have the same effective rate as your friend's account? Nominal Interest Rate = Grade It Now Save & Continue Continue without saving 1040 6 EIER Out OPT IN BOUND 170 ENTER CL ax PHI 1/X y BOND 7 9 201 BARCIN 6 4 BATE PROFIT MIM NEXXT 0 4- TI BAII Plus image usedermission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Ind 8.18% t represent actual display output. 8.12% 8.24% Check Your Understand 8.06% A recently purchased bond nominal interest, compounded quarterly. What is the effective annual interest rate paid by the bond?? 8.30% Effective Interest Rate = Your friend's bank offers a savings account that pays an effective annual interest rate of 6.71%. If your bank is offering you a new account that is compounded semiannually, how large must its nominal rate be to have the same effective rate as your friend's account? Nominal Interest Rate A S M 1 On 8 AN 5 KONT 2 ONCOFE GRI BARD F 1 OPT WAY OM INTR INT CL 147 ENTEN 7 S+ S A PHI 1IX star BUND 8 9 4 BALI 5 6 SN 3614 7 SEFE 4 SAE 1 3 CIK MIM BESET 0 TI BAII Plus image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does not represent actual display output. Check Your Understanding 6.82% A recently purchased bon nominal interest, compounded quarterly. What is the effective annual interest rate paid by the bond? 6.67% Effective Interest Rate = 6.54% Your friend's bank offers 6.60% account that pays an effective annual interest rate of 6.71%. If your bank is offering you a new account that is ge must its nominal rate be to have the same effective rate as your friend's account? compounded semiannuall 6.77% Nominal Interest Rate -I 2 ON/OFF CATH BARD PR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started