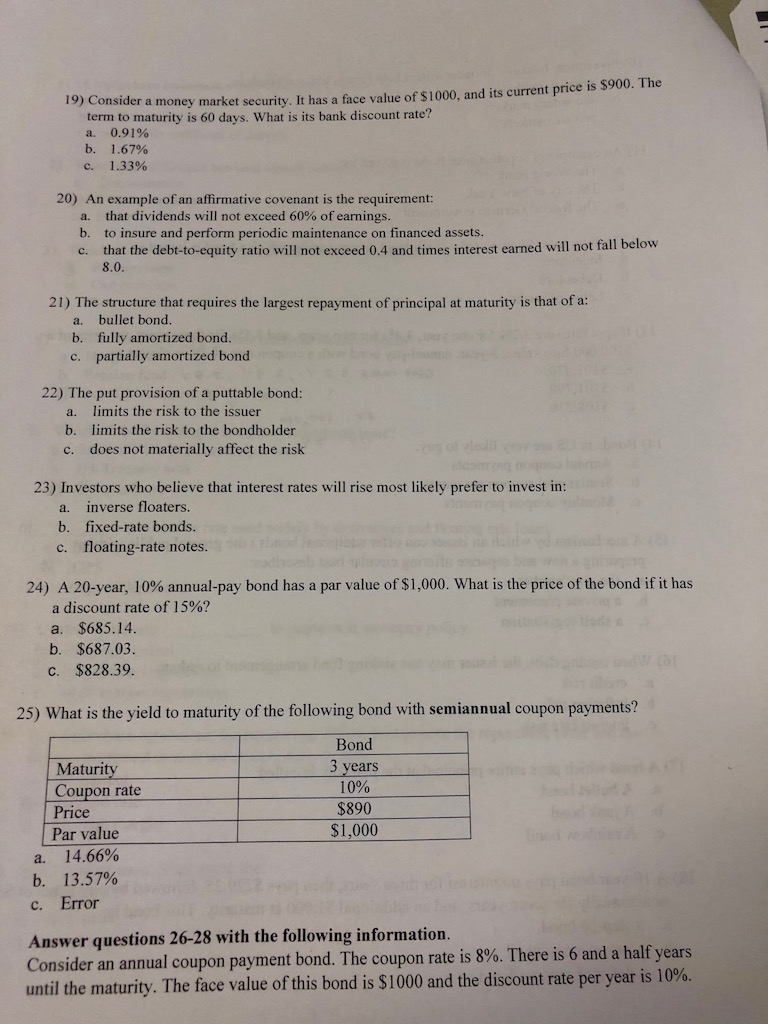

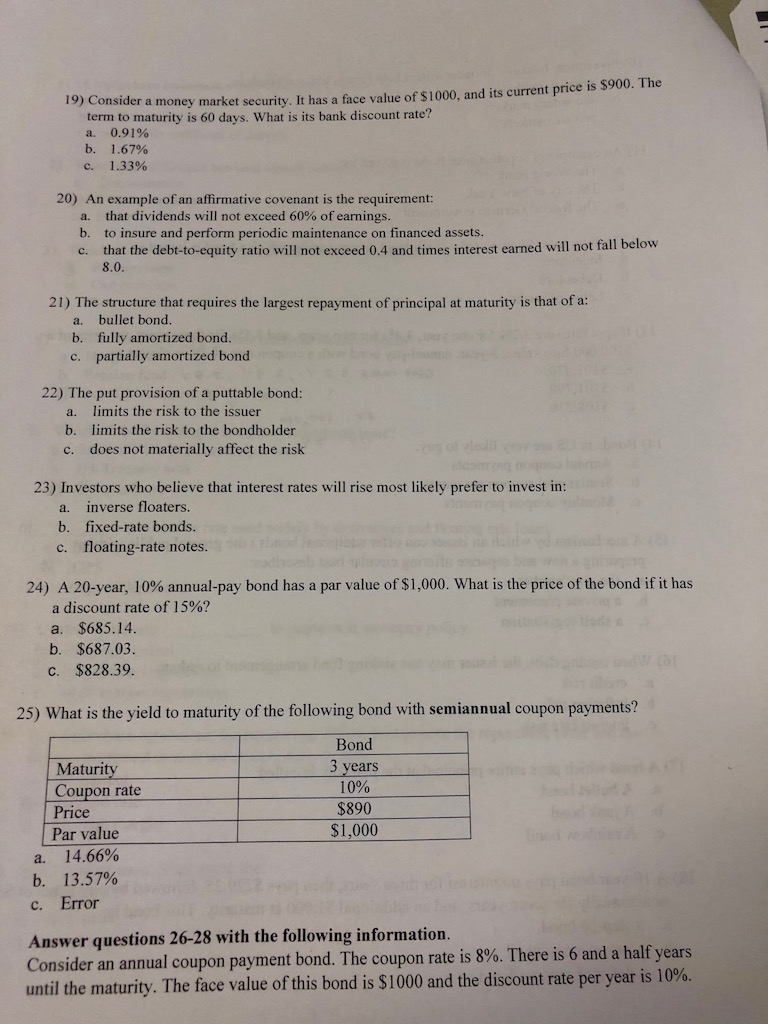

19) Consider a money market security. It has a face value of $1000, and its current price is term to maturity is 60 days. What is its bank discount rate? a. 0.91% b. 1.67% c. 1.33% 20) An example of an affirmative covenant is the requirement: a. that dividends will not exceed 60% of earnings. b. to insure and perform periodic maintenance on financed assets. c. that the debt-to-equity ratio will not exceed 0.4 and times interest earned will not fallbero 8.0. 21) The structure that requires the largest repayment of principal at maturity is that of a a. bullet bond. b. fully amortized bond. c. partially amortized bond 22) The put provision of a puttable bond: a. limits the risk to the issuer b. limits the risk to the bondholder c. does not materially affect the risk 23) Investors who believe that interest rates will rise most likely prefer to invest in: a. inverse floaters. b. fixed-rate bonds. c. floating-rate notes. 24) A 20-year, 10% annual-pay bond has a par value of $1,000. What is the price of the bond if it has a discount rate of 15%? a. $685.14. b. $687.03. C. $828.39. 25) What is the yield to maturity of the following bond with semiannual coupon payments? Maturity Coupon rate Price Par value a. 14.66% b. 13.57% c. Error Bond 3 years 10% $890 $1,000 Answer questions 26-28 with the following information. Consider an annual coupon payment bond. The coupon rate is 8%. There is 6 and a half years until the maturity. The face value of this bond is $1000 and the discount rate per year is 10%. 19) Consider a money market security. It has a face value of $1000, and its current price is term to maturity is 60 days. What is its bank discount rate? a. 0.91% b. 1.67% c. 1.33% 20) An example of an affirmative covenant is the requirement: a. that dividends will not exceed 60% of earnings. b. to insure and perform periodic maintenance on financed assets. c. that the debt-to-equity ratio will not exceed 0.4 and times interest earned will not fallbero 8.0. 21) The structure that requires the largest repayment of principal at maturity is that of a a. bullet bond. b. fully amortized bond. c. partially amortized bond 22) The put provision of a puttable bond: a. limits the risk to the issuer b. limits the risk to the bondholder c. does not materially affect the risk 23) Investors who believe that interest rates will rise most likely prefer to invest in: a. inverse floaters. b. fixed-rate bonds. c. floating-rate notes. 24) A 20-year, 10% annual-pay bond has a par value of $1,000. What is the price of the bond if it has a discount rate of 15%? a. $685.14. b. $687.03. C. $828.39. 25) What is the yield to maturity of the following bond with semiannual coupon payments? Maturity Coupon rate Price Par value a. 14.66% b. 13.57% c. Error Bond 3 years 10% $890 $1,000 Answer questions 26-28 with the following information. Consider an annual coupon payment bond. The coupon rate is 8%. There is 6 and a half years until the maturity. The face value of this bond is $1000 and the discount rate per year is 10%