Question

19. Firm A buys CDS from AIG. The notional amount is 1 million USD. The reference entity is firm B. The swap premium is

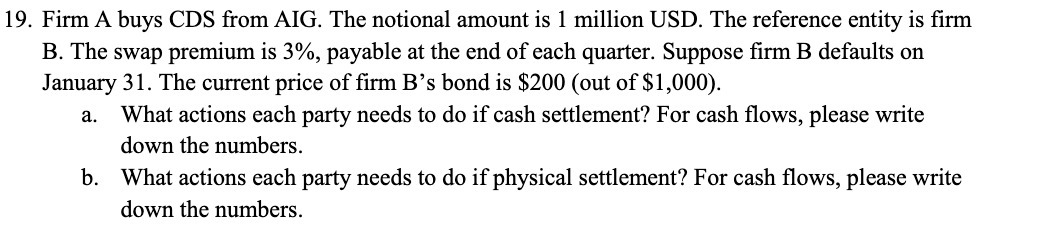

19. Firm A buys CDS from AIG. The notional amount is 1 million USD. The reference entity is firm B. The swap premium is 3%, payable at the end of each quarter. Suppose firm B defaults on January 31. The current price of firm B's bond is $200 (out of $1,000). a. What actions each party needs to do if cash settlement? For cash flows, please write down the numbers. b. What actions each party needs to do if physical settlement? For cash flows, please write down the numbers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Settlement of Credit Default Swap CDS Scenario Firm A bought a CDS on Firm B from AIG Firm B default...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Bond Markets Analysis and Strategies

Authors: Frank J.Fabozzi

9th edition

133796779, 978-0133796773

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App