Answered step by step

Verified Expert Solution

Question

1 Approved Answer

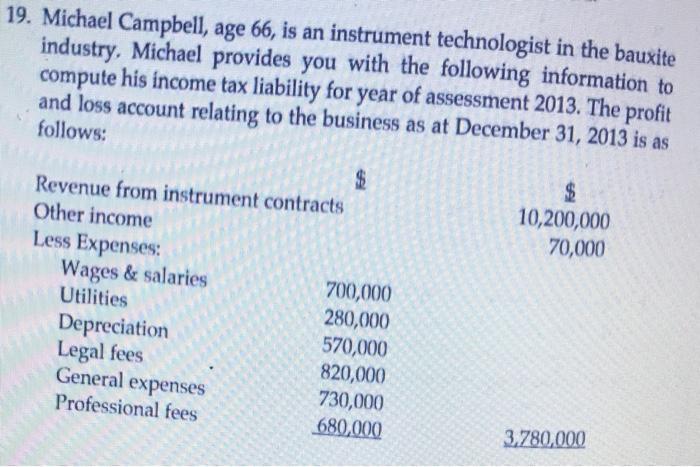

19. Michael Campbell, age 66, is an instrument technologist in the bauxite industry, Michael provides you with the following information to compute his income

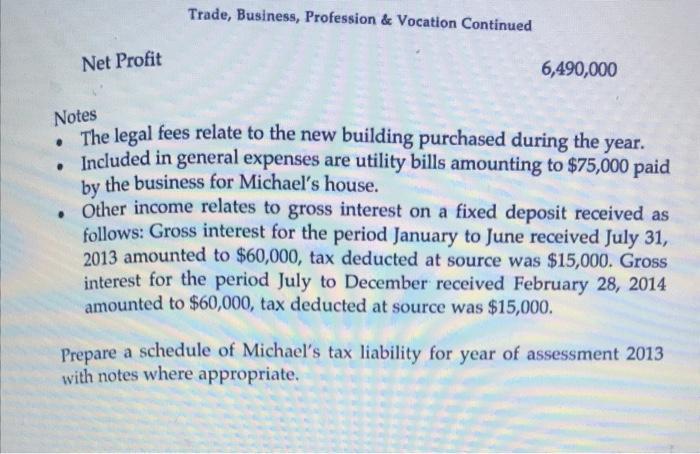

19. Michael Campbell, age 66, is an instrument technologist in the bauxite industry, Michael provides you with the following information to compute his income tax liability for year of assessment 2013. The profit and loss account relating to the business as at December 31, 2013 is as follows: Revenue from instrument contracts Other income Less Expenses: Wages & salaries Utilities Depreciation Legal fees General expenses Professional fees 700,000 280,000 570,000 820,000 730,000 680,000 $ 10,200,000 70,000 3,780,000 Net Profit Trade, Business, Profession & Vocation Continued 6,490,000 Notes The legal fees relate to the new building purchased during the year. Included in general expenses are utility bills amounting to $75,000 paid by the business for Michael's house. Other income relates to gross interest on a fixed deposit received as follows: Gross interest for the period January to June received July 31, 2013 amounted to $60,000, tax deducted at source was $15,000. Gross interest for the period July to December received February 28, 2014 amounted to $60,000, tax deducted at source was $15,000. Prepare a schedule of Michael's tax liability for year of assessment 2013 with notes where appropriate.

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution Income tax legal responsibility for the 12 months of evaluation 2013 Revenue from tool cont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started