Answered step by step

Verified Expert Solution

Question

1 Approved Answer

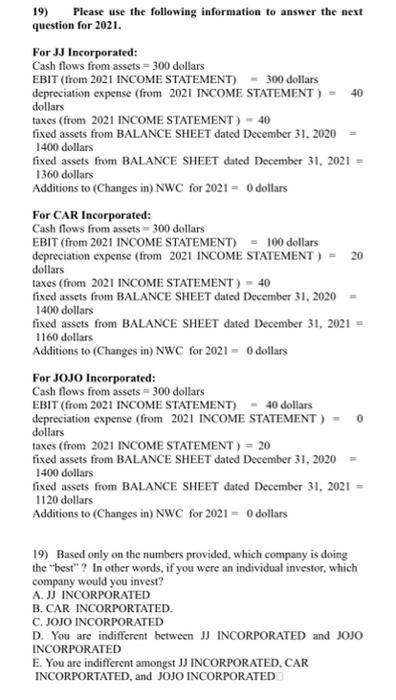

19) Please use the following information to answer the next question for 2021. For JJ Incorporated: Cash flows from assets = 300 dollars EBIT

19) Please use the following information to answer the next question for 2021. For JJ Incorporated: Cash flows from assets = 300 dollars EBIT (from 2021 INCOME STATEMENT) - 300 dollars depreciation expense (from 2021 INCOME STATEMENT ) = 40 dollars taxes (from 2021 INCOME STATEMENT) - 40 fixed assets from BALANCE SHEET dated December 31, 2020 1400 dollars fixed assets from BALANCE SHEET dated December 31, 2021 1360 dollars Additions to (Changes in) NWC for 2021= 0 dollars For CAR Incorporated: Cash flows from assets- 300 dollars EBIT (from 2021 INCOME STATEMENT) = 100 dollars depreciation expense (from 2021 INCOME STATEMENT) = dollars 20 taxes (from 2021 INCOME STATEMENT) = 40 fixed assets from BALANCE SHEET dated December 31, 2020 1400 dollars fixed assets from BALANCE SHEET dated December 31, 2021 = 1160 dollars Additions to (Changes in) NWC for 2021- 0 dollars For JOJO Incorporated: Cash flows from assets = 300 dollars EBIT (from 2021 INCOME STATEMENT) 40 dollars depreciation expense (from 2021 INCOME STATEMENT) dollars taxes (from 2021 INCOME STATEMENT ) = 20 fixed assets from BALANCE SHEET dated December 31, 2020 1400 dollars fixed assets from BALANCE SHEET dated December 31, 2021 1120 dollars Additions to (Changes in) NWC for 2021= 0 dollars 0 19) Based only on the numbers provided, which company is doing the "best"? In other words, if you were an individual investor, which company would you invest? A. JJ INCORPORATED B. CAR INCORPORTATED. C. JOJO INCORPORATED D. You are indifferent between JJ INCORPORATED and JOJO INCORPORATED E. You are indifferent amongst JJ INCORPORATED, CAR INCORPORTATED, and JOJO INCORPORATED

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below E You are indifferent amongs...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started