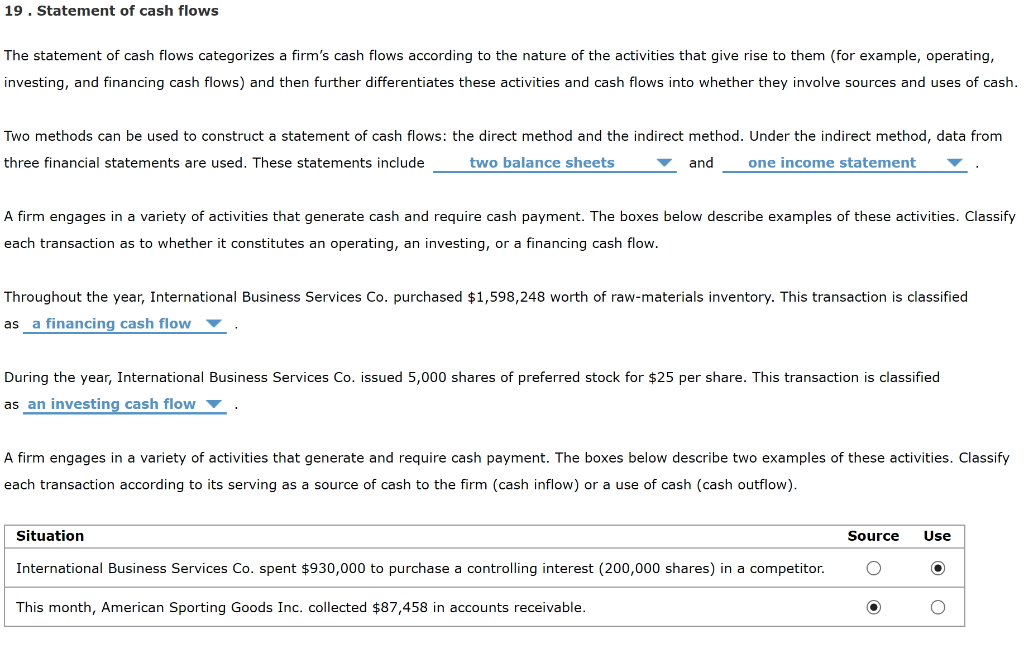

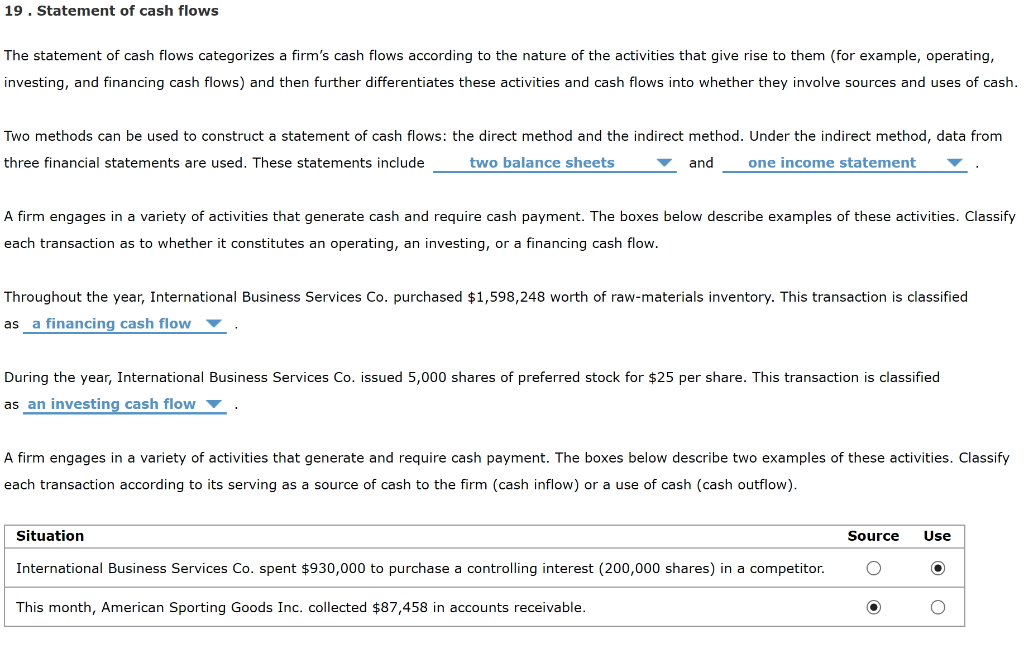

19. Statement of cash flows The statement of cash flows categorizes a firm's cash flows according to the nature of the activities that give rise to them (for example, operating, investing, and financing cash flows) and then further differentiates these activities and cash flows into whether they involve sources and uses of cash. Two methods can be used to construct a statement of cash flows: the direct method and the indirect method. Under the indirect method, data from three financial statements are used. These statements include two balance sheets and one income statement A firm engages in a variety of activities that generate cash and require cash payment. The boxes below describe examples of these activities. Classify each transaction as to whether it constitutes an operating, an investing, or a financing cash flow. Throughout the year, International Business Services Co. purchased $1,598,248 worth of raw-materials inventory. This transaction is classified as a financing cash flow During the year, International Business Services Co. issued 5,000 shares of preferred stock for $25 per share. This transaction is classified as an investing cash flow A firm engages in a variety of activities that generate and require cash payment. The boxes below describe two examples of these activities. Classify each transaction according to its serving as a source of cash to the firm (cash inflow) or a use of cash (cash outflow). Situation Source Use International Business Services Co. spent $930,000 to purchase a controlling interest (200,000 shares) in a competitor. This month, American Sporting Goods Inc. collected $87,458 in accounts receivable. 19. Statement of cash flows The statement of cash flows categorizes a firm's cash flows according to the nature of the activities that give rise to them (for example, operating, investing, and financing cash flows) and then further differentiates these activities and cash flows into whether they involve sources and uses of cash. Two methods can be used to construct a statement of cash flows: the direct method and the indirect method. Under the indirect method, data from three financial statements are used. These statements include two balance sheets and one income statement A firm engages in a variety of activities that generate cash and require cash payment. The boxes below describe examples of these activities. Classify each transaction as to whether it constitutes an operating, an investing, or a financing cash flow. Throughout the year, International Business Services Co. purchased $1,598,248 worth of raw-materials inventory. This transaction is classified as a financing cash flow During the year, International Business Services Co. issued 5,000 shares of preferred stock for $25 per share. This transaction is classified as an investing cash flow A firm engages in a variety of activities that generate and require cash payment. The boxes below describe two examples of these activities. Classify each transaction according to its serving as a source of cash to the firm (cash inflow) or a use of cash (cash outflow). Situation Source Use International Business Services Co. spent $930,000 to purchase a controlling interest (200,000 shares) in a competitor. This month, American Sporting Goods Inc. collected $87,458 in accounts receivable