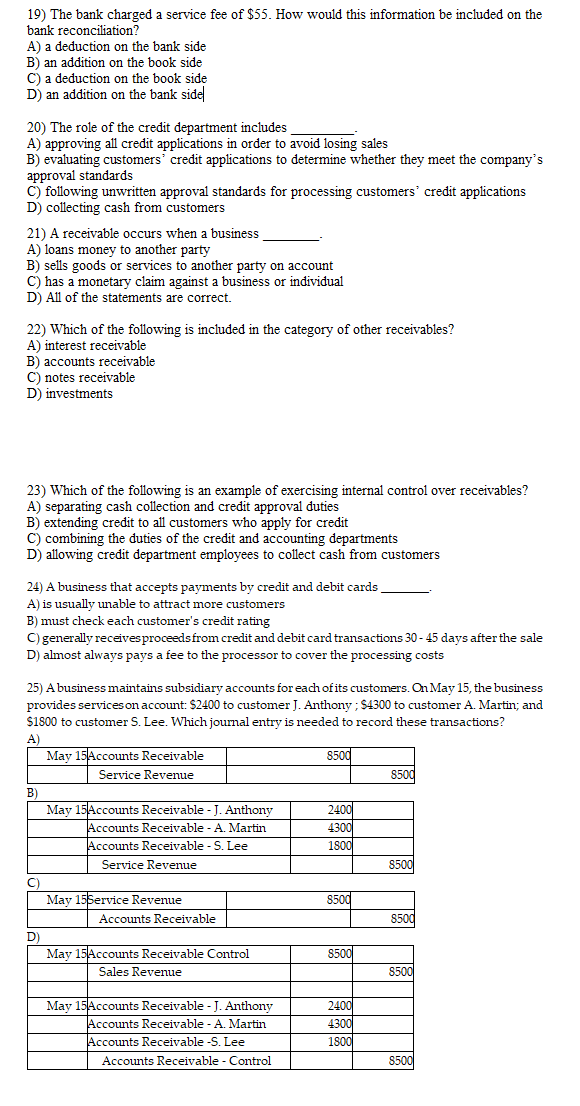

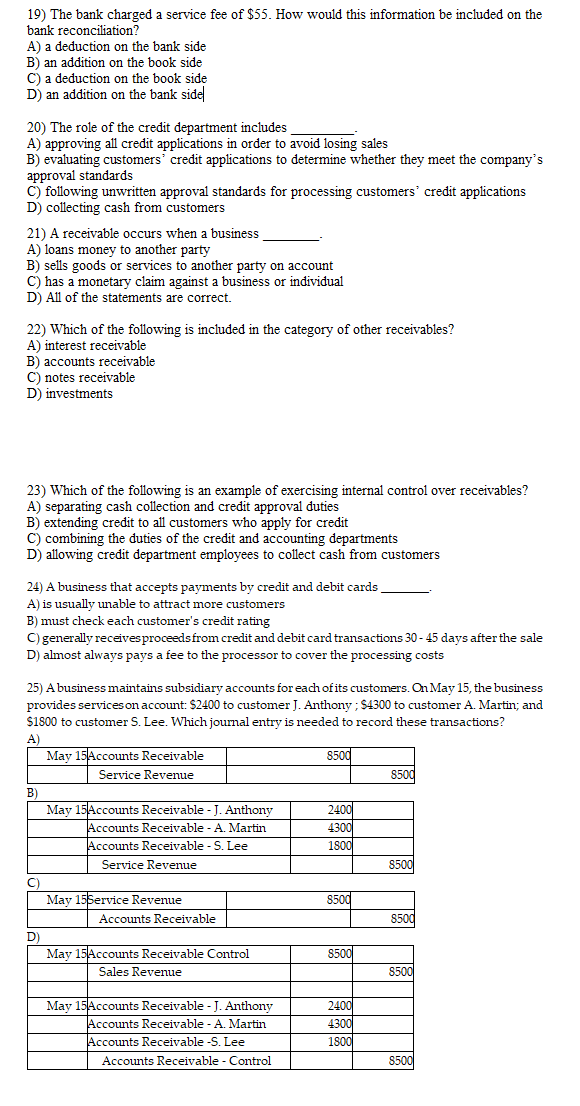

19) The bank charged a service fee of $55. How would this information be included on the bank reconciliation? A) a deduction on the bank side B) an addition on the book side C) a deduction on the book side D) an addition on the bank side 20) The role of the credit department includes A) approving all credit applications in order to avoid losing sales B) evaluating customers' credit applications to determine whether they meet the company's approval standards C) following unwritten approval standards for processing customers' credit applications D) collecting cash from customers 21) A receivable occurs when a business A) loans money to another party B) sells goods or services to another party on account C) has a monetary claim against a business or individual D) All of the statements are correct. 22) Which of the following is included in the category of other receivables? A) interest receivable B) accounts receivable C) notes receivable D) investments 23) Which of the following is an example of exercising internal control over receivables? A) separating cash collection and credit approval duties B) extending credit to all customers who apply for credit C) combining the duties of the credit and accounting departments D) allowing credit department employees to collect cash from customers 24) A business that accepts payments by credit and debit cards A) is usually unable to attract more customers B) must check each customer's credit rating C) generally receives proceeds from credit and debit card transactions 30 - 45 days after the sale D) almost always pays a fee to the processor to cover the processing costs 25) A business maintains subsidiary accounts for each of its customers. On May 15, the business provides services on account: $2400 to customer J. Anthony; S4300 to customer A. Martin; and $1800 to customer S. Lee. Which journal entry is needed to record these transactions? A) May 15Accounts Receivable 8500 Service Revenue 8500 B May 15 Accounts Receivable - J. Anthony 2400 Accounts Receivable - A. Martin 4300 Accounts Receivable - S. Lee 1500 Service Revenue 8500 C) May 155ervice Revenue 8500 Accounts Receivable 8500 D) May 15 Accounts Receivable Control 8500 Sales Revenue 8500 May 15 Accounts Receivable - J. Anthony Accounts Receivable - A. Martin Accounts Receivable -S. Lee Accounts Receivable - Control 2400 4300 1800 8500