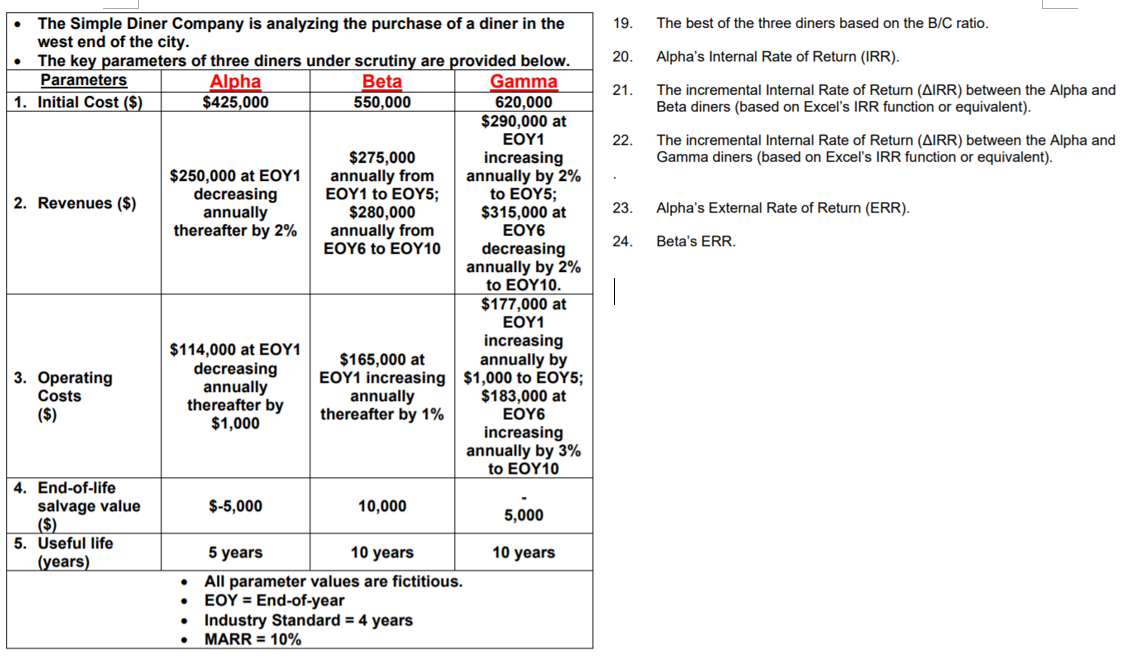

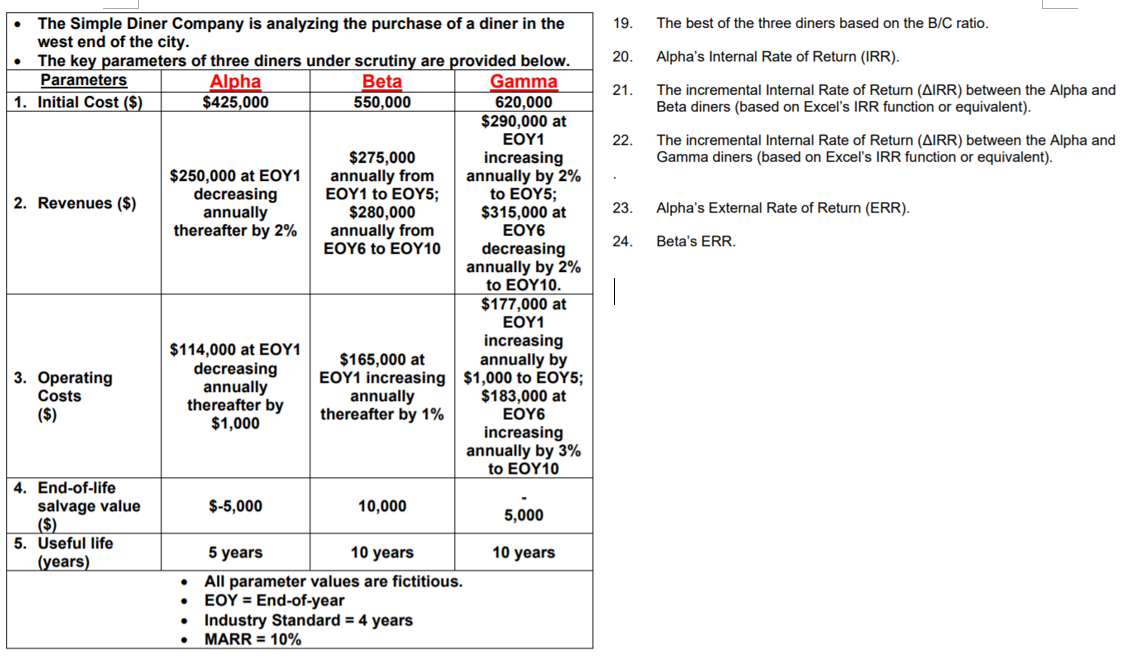

19. The best of the three diners based on the B/C ratio. 20. 21. Alpha's Internal Rate of Return (IRR). The incremental Internal Rate of Return (AIRR) between the Alpha and Beta diners (based on Excel's IRR function or equivalent). 22. The incremental Internal Rate of Return (AIRR) between the Alpha and Gamma diners (based on Excel's IRR function or equivalent). 23. Alpha's External Rate of Return (ERR). 24. Beta's ERR | The Simple Diner Company is analyzing the purchase of a diner in the west end of the city. The key parameters of three diners under scrutiny are provided below. Parameters Alpha Beta Gamma 1. Initial Cost ($) $425,000 550,000 620,000 $290,000 at EOY1 $275,000 increasing $250,000 at EOY1 annually from annually by 2% decreasing EOY1 to EOY5; to EOY5; 2. Revenues ($) annually $280,000 $315,000 at thereafter by 2% annually from EOY6 EOY6 to EOY10 decreasing annually by 2% to EOY10. $177,000 at EOY1 increasing $114,000 at EOY1 $165,000 at decreasing 3. Operating annually by annually EOY1 increasing $1,000 to EOY5; Costs annually $183,000 at thereafter by ($) $1,000 thereafter by 1% EOY6 increasing annually by 3% to EOY10 4. End-of-life salvage value $-5,000 10,000 5,000 ($) 5. Useful life 5 years 10 years (years) All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% 10 years 19. The best of the three diners based on the B/C ratio. 20. 21. Alpha's Internal Rate of Return (IRR). The incremental Internal Rate of Return (AIRR) between the Alpha and Beta diners (based on Excel's IRR function or equivalent). 22. The incremental Internal Rate of Return (AIRR) between the Alpha and Gamma diners (based on Excel's IRR function or equivalent). 23. Alpha's External Rate of Return (ERR). 24. Beta's ERR | The Simple Diner Company is analyzing the purchase of a diner in the west end of the city. The key parameters of three diners under scrutiny are provided below. Parameters Alpha Beta Gamma 1. Initial Cost ($) $425,000 550,000 620,000 $290,000 at EOY1 $275,000 increasing $250,000 at EOY1 annually from annually by 2% decreasing EOY1 to EOY5; to EOY5; 2. Revenues ($) annually $280,000 $315,000 at thereafter by 2% annually from EOY6 EOY6 to EOY10 decreasing annually by 2% to EOY10. $177,000 at EOY1 increasing $114,000 at EOY1 $165,000 at decreasing 3. Operating annually by annually EOY1 increasing $1,000 to EOY5; Costs annually $183,000 at thereafter by ($) $1,000 thereafter by 1% EOY6 increasing annually by 3% to EOY10 4. End-of-life salvage value $-5,000 10,000 5,000 ($) 5. Useful life 5 years 10 years (years) All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% 10 years