Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19. The Fama-French-Carhart model is a Four Factor Model that, in addition to the Usual Three Factors present in the Fama-French Model, it has

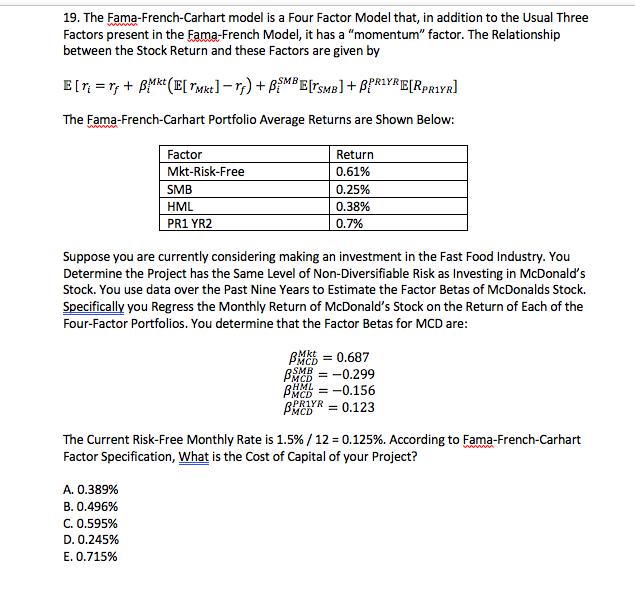

19. The Fama-French-Carhart model is a Four Factor Model that, in addition to the Usual Three Factors present in the Fama-French Model, it has a "momentum" factor. The Relationship between the Stock Return and these Factors are given by E [T=T + BMkt (E[Mke]-T) + BMBE[TSMB] + BPRYRE[RPRIYR] The Fama-French-Carhart Portfolio Average Returns are Shown Below: Factor Mkt-Risk-Free SMB HML PR1 YR2 A. 0.389% B. 0.496% C. 0.595% D. 0.245% E. 0.715% Return 0.61% Suppose you are currently considering making an investment in the Fast Food Industry. You Determine the Project has the Same Level of Non-Diversifiable Risk as Investing in McDonald's Stock. You use data over the Past Nine Years to Estimate the Factor Betas of McDonalds Stock. Specifically you Regress the Monthly Return of McDonald's Stock on the Return of Each of the Four-Factor Portfolios. You determine that the Factor Betas for MCD are: 0.25% 0.38% 0.7% BSMB BM = 0.687 = -0.299 PMCK = -0.156 BRYR = 0.123 The Current Risk-Free Monthly Rate is 1.5% / 12 = 0.125 %. According to Fama-French-Carhart Factor Specification, What is the Cost of Capital of your Project?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

File Paste 1 2 3 4 5 6 C Home HH QJ Cut E Copy Format Painter Clipboard QN10 Insert Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started