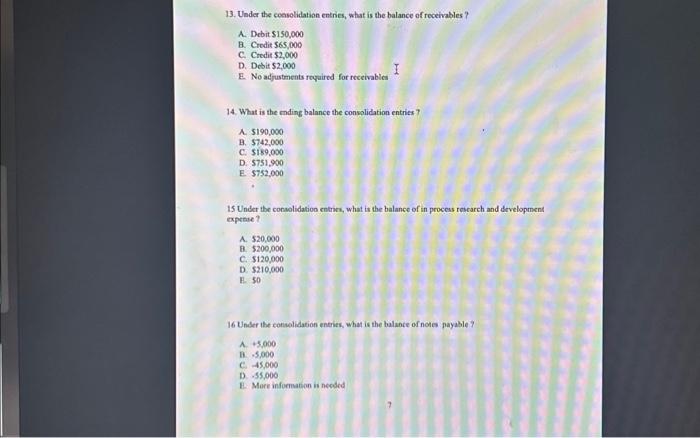

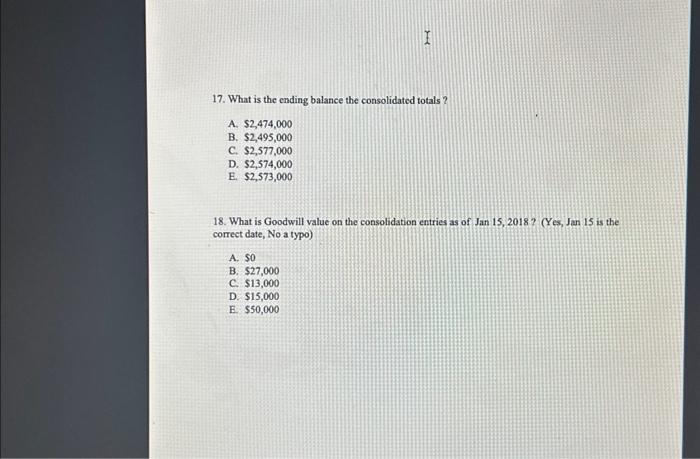

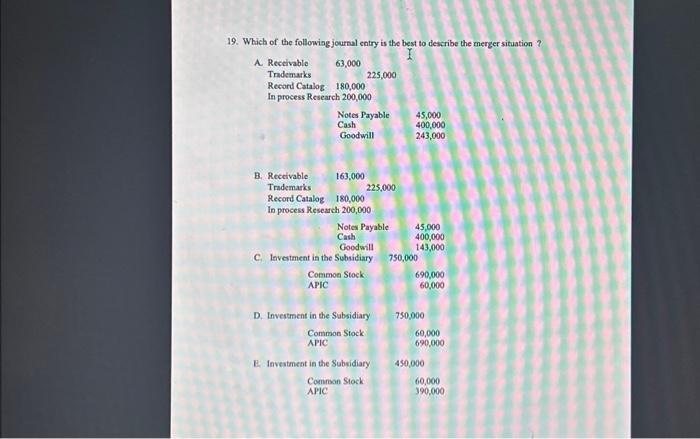

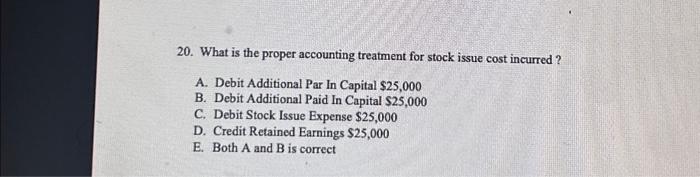

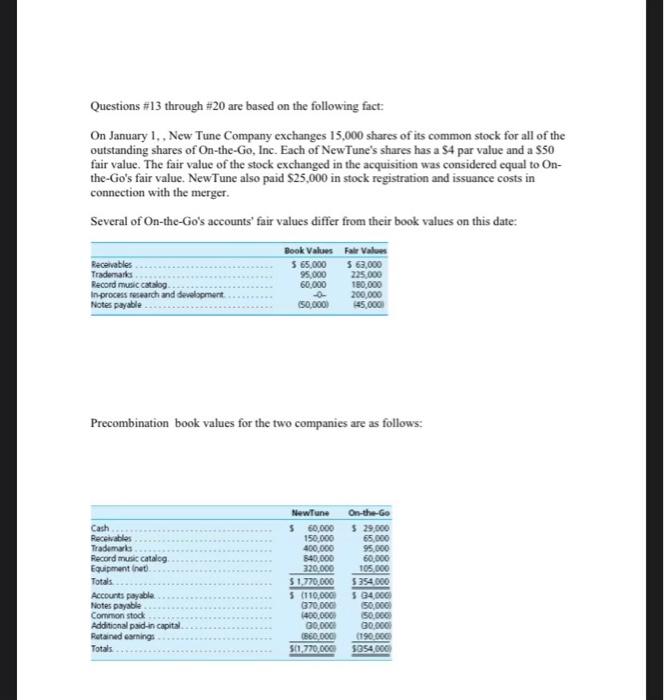

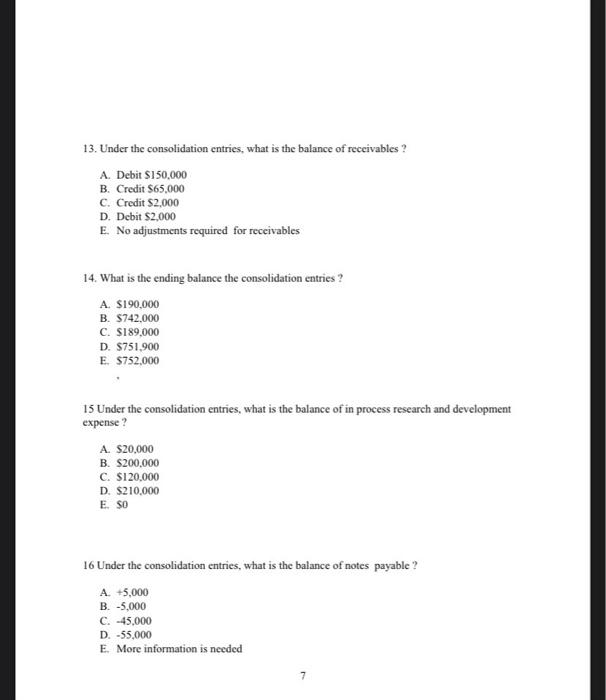

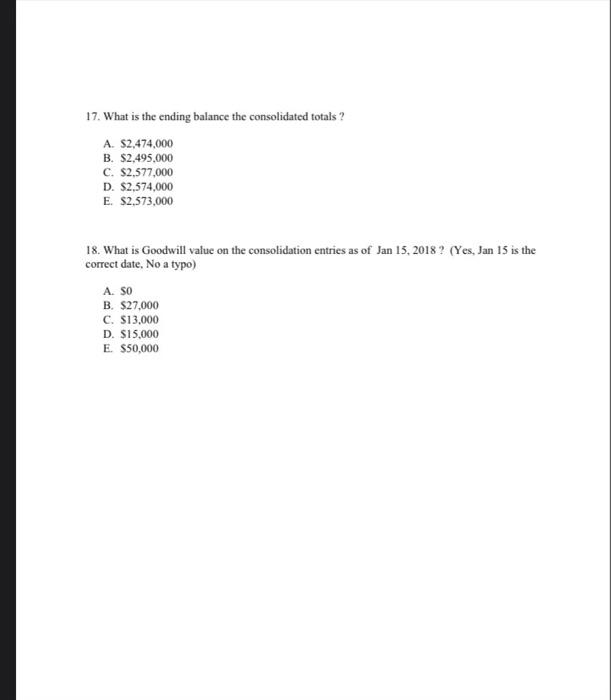

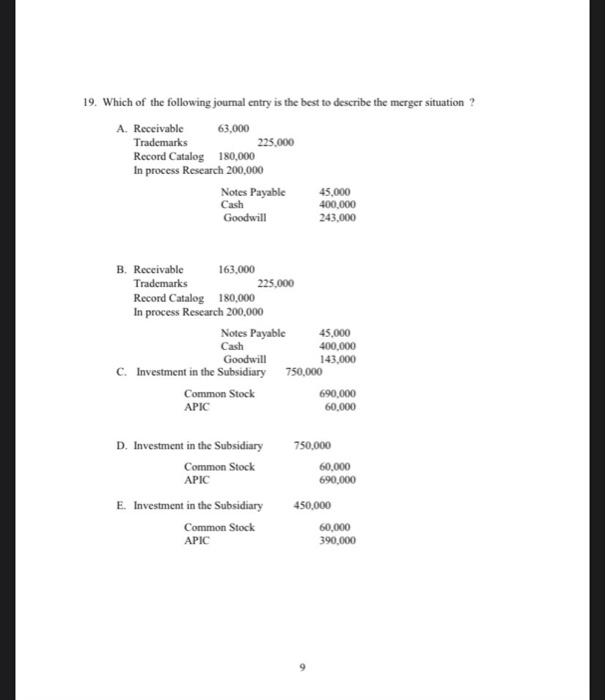

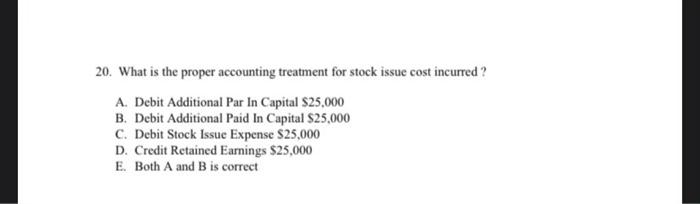

19. Which of the following journal entry is the best to describe the merger situation ? 20. What is the proper accounting treatment for stock issue cost incurred ? A. Debit Additional Par In Capital $25,000 B. Debit Additional Paid In Capital $2$,000 C. Debit Stock Issue Expense $25,000 D. Credit Retained Earnings $25,000 E. Both A and B is correct 13. Under the consolidation entries, what is the balance of receivables ? A. Debit $150.000 B. Credit $65,000 C. Credit $2,000 D. Debit $2,000 E. No adjustments required for receivables 14. What is the ending balance the consolidation entries ? A. $190,000 B. $742,000 C. $189,000 D. $751,900 E. $752,000 15 Under the consolidation entries, what is the balance of in process research and development expense ? A. $20,000 B. $200,000 C. $120,000 D. $210.000 E. $0 16 Under the consolidation entries, what is the balance of notes payable ? A. +5,000 B. 5,000 C. 45,000 D. 55,000 E. More information is needed 17. What is the ending balance the consolidated totals ? A. $2,474,000 B. $2,495,000 C. $2,577,000 D. $2,574,000 E. $2,573,000 18. What is Goodwill value on the consolidation entries as of Jan 15, 2018? (Yes, Jan 15 is the correct date, No a typo) A. 50 B. $27,000 C. $13,000 D. $15,000 E. $50,000 13. Under the consolidation entries, what is the balance of receivables? A. Debit $150,000 B. Credit 565,000 C. Crodit $2,000 D. Desit $2,000 E. No adfustments reyaired for receivable 14. What is the ending balance the convolidation entries ? A. 5190,000 B. $742,000 C. $189,000 D. $751,900 E. 5752,000 15 Under the consalidation entries, what is the balance of in process research and developenent expense ? A. $20,000 f. $200,000 C. $120,000 D. $210,000 F. 50 16 Under the consalidation eneries, what is the balance of note payable? A. $5000 D. 5,000 c. 45,000 D. ,55,000 E. More information is necoled 20. What is the proper accounting treatment for stock issue cost incurred ? A. Debit Additional Par In Capital $25,000 B. Debit Additional Paid In Capital $25,000 C. Debit Stock Issue Expense $25,000 D. Credit Retained Earnings $25,000 E. Both A and B is correct Questions #13 through $20 are based on the following fact: On January 1, New Tune Company exchanges 15,000 shares of its common stock for all of the outstanding shares of On-the-Go, Inc. Each of NewTune's shares has a \$4 par value and a $50 fair value. The fair value of the stock exchanged in the acquisition was considered equal to Onthe-Go's fair value. NewTune also paid $25,000 in stock registration and issuance costs in connection with the merger. Several of On-the-Go's accounts' fair values differ from their book values on this date: Precombination book values for the two companies are as follows: 17. What is the ending balance the consolidated totals ? A. $2,474,000 B. $2,495,000 C. $2,577,000 D. $2,574,000 E. $2,573,000 18. What is Goodwill value on the consolidation entries as of Jan 15, 2018? (Yes, Jan 15 is the correct date, No a typo) A. 50 B. $27,000 C. $13,000 D. $15,000 E. $50,000 On Janusry 1,. New Tune Cormpany exchanges 15,000 shares of its comenon stock for all of the outstanding shares of On-the-Go, lnc. Fach of Now Tune's shares has a $4 par value and a $50 fair value. The fair value of the stock exchanged if the acquisition was considered equal to Cb the-Go's fair value. New Tuae also paid $25,000 in stock rogistration and issuance corts in connection with the merger. Sevenl of On-the-Go's accounty' fair values differ from their book values on this date: Preceenbination book values for the two companies ate as follows: 19. Which of the followiag journal entry is the best to describe the merger situation