Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19.3 On 1 March 2020, YY Ltd acquired 85% of the ordinary share capital of ZZ Ltd. There are no preference shares. Both companies

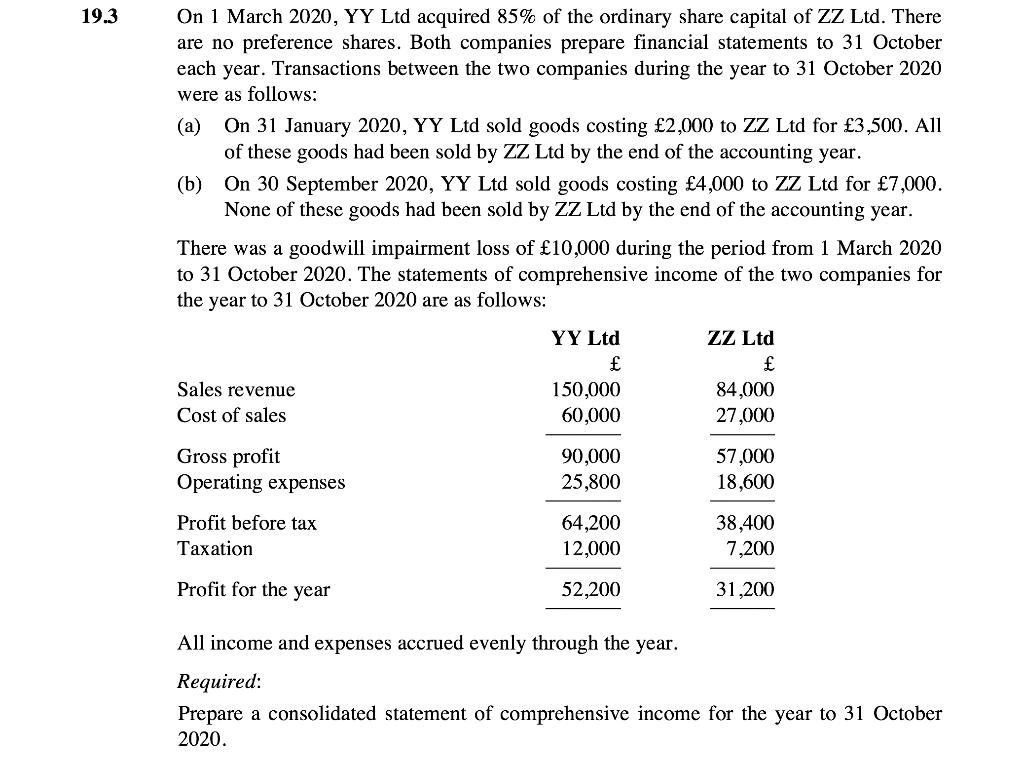

19.3 On 1 March 2020, YY Ltd acquired 85% of the ordinary share capital of ZZ Ltd. There are no preference shares. Both companies prepare financial statements to 31 October each year. Transactions between the two companies during the year to 31 October 2020 were as follows: (a) On 31 January 2020, YY Ltd sold goods costing 2,000 to ZZ Ltd for 3,500. All of these goods had been sold by ZZ Ltd by the end of the accounting year. (b) On 30 September 2020, YY Ltd sold goods costing 4,000 to ZZ Ltd for 7,000. None of these goods had been sold by ZZ Ltd by the end of the accounting year. There was a goodwill impairment loss of 10,000 during the period from 1 March 2020 to 31 October 2020. The statements of comprehensive income of the two companies for the year to 31 October 2020 are as follows: YY Ltd ZZ Ltd Sales revenue 150,000 84,000 Cost of sales 60,000 27,000 Gross profit 90,000 57,000 Operating expenses 25,800 18,600 Profit before tax 64,200 38,400 Taxation 12,000 7,200 Profit for the year 52,200 31,200 All income and expenses accrued evenly through the year. Required: Prepare a consolidated statement of comprehensive income for the year to 31 October 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started