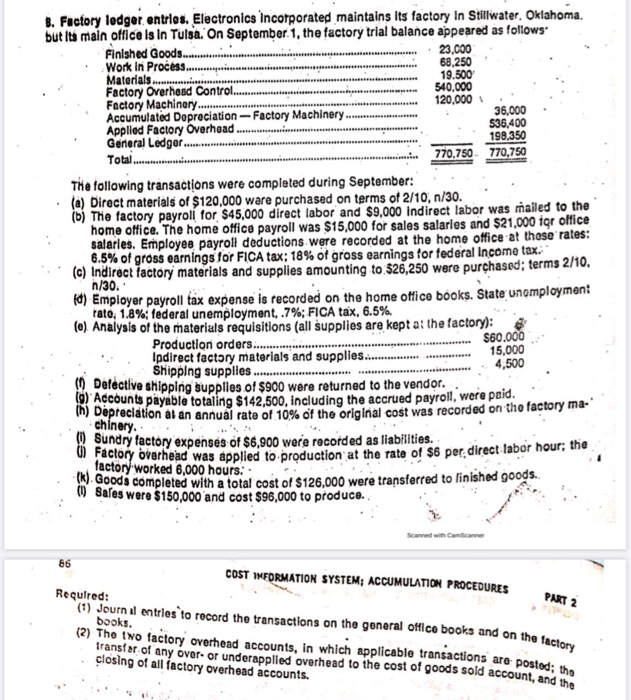

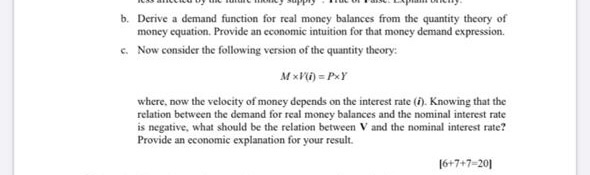

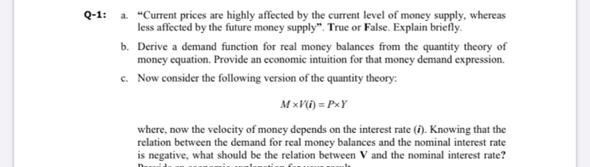

19.500 B. Factory ledger entries. Electronics Incorporated maintains its factory In Stillwater. Oklahoma. but its main office is in Tulsa. On September 1, the factory trial balance appeared as follows: Finished Goods 23.000 Work in Process....... 68.250 Materials. Factory Overhead Control.. 540,000 Factory Machinery.... 120,000 Accumulated Depreciation -- Factory Machinery. 36,000 Applied Factory Overhead ... 536,400 General Ledgor........ 198,350 Total.... 770.750 770,750 The following transactions were completed during September: (a) Direct materials of $120,000 ware purchased on terms of 2/10, n/30. (b) The factory payroll for $45,000 direct labor and $9,000 indirect labor was mailed to the home office. The home office payroll was $15,000 for sales salaries and S21,000 for office salaries. Employee payroll deductions were recorded at the home office at these rates: 6.5% of gross earnings for FICA tax: 18% of gross earnings for federal Income tax. (c) Indirect factory materials and supplies amounting to $26,250 were purchased; terms 2/10, ret) Employer payroll tax expense is recorded on the home office books. State unemploymen: rate 1.8% federal unemployment, 7%; FICA tax, 6.5%. (c) Analysis of the materials requisitions (all supplies are kept at the factory): Production orders........... $60.000 Ipdirect factory materials and supplies.... 15,000 Shipping supplies .... 4,500 Detective shipping supplies of $900 were returned to the vendor. (3) Accounts payable totaling S142,500, including the accrued payroll, were paid. th) Depreciation at an annual rate of 10% of the original cost was recorded on the factory ma." Sundry factory expenses of $6,900 were recorded as liabilities. 0) Factory overhead was applied to production at the rate of $6 per direct labor hour; the (k) Goods completed with a total cost of $126,000 were transferred to linished goods ( Baes were $150,000 and cost $96,000 to produce. Scared wine 66 PART 2 COST INFORMATION SYSTEM; ACCUMULATION PROCEDURES Required: (1) Journal entries to record the transactions on the general office books and on the factory (2) The two factory overhead accounts, in which applicable transactions are posted: the transfer of any over- or underapplied overhead to the cost of goods sold account, and the closing of all factory overhead accounts. b. Derive a demand function for real money balances from the quantity theory of money equation. Provide an economic intuition for that money demand expression. c. Now consider the following version of the quantity theory MxWD = PxY where, now the velocity of money depends on the interest rate (1). Knowing that the relation between the demand for real money balances and the nominal interest rate is negative, what should be the relation between V and the nominal interest rate? Provide an economic explanation for your result. [6+7+7-201 Q-1: a. "Current prices are highly affected by the current level of money supply, whereas less affected by the future money supply". True or False. Explain briefly b. Derive a demand function for real money balances from the quantity theory of money equation. Provide an economic intuition for that money demand expression c Now consider the following version of the quantity theory MxV)=PxY where, now the velocity of money depends on the interest rate (). Knowing that the relation between the demand for real money balances and the nominal interest rate is negative, what should be the relation between V and the nominal interest rate? 19.500 B. Factory ledger entries. Electronics Incorporated maintains its factory In Stillwater. Oklahoma. but its main office is in Tulsa. On September 1, the factory trial balance appeared as follows: Finished Goods 23.000 Work in Process....... 68.250 Materials. Factory Overhead Control.. 540,000 Factory Machinery.... 120,000 Accumulated Depreciation -- Factory Machinery. 36,000 Applied Factory Overhead ... 536,400 General Ledgor........ 198,350 Total.... 770.750 770,750 The following transactions were completed during September: (a) Direct materials of $120,000 ware purchased on terms of 2/10, n/30. (b) The factory payroll for $45,000 direct labor and $9,000 indirect labor was mailed to the home office. The home office payroll was $15,000 for sales salaries and S21,000 for office salaries. Employee payroll deductions were recorded at the home office at these rates: 6.5% of gross earnings for FICA tax: 18% of gross earnings for federal Income tax. (c) Indirect factory materials and supplies amounting to $26,250 were purchased; terms 2/10, ret) Employer payroll tax expense is recorded on the home office books. State unemploymen: rate 1.8% federal unemployment, 7%; FICA tax, 6.5%. (c) Analysis of the materials requisitions (all supplies are kept at the factory): Production orders........... $60.000 Ipdirect factory materials and supplies.... 15,000 Shipping supplies .... 4,500 Detective shipping supplies of $900 were returned to the vendor. (3) Accounts payable totaling S142,500, including the accrued payroll, were paid. th) Depreciation at an annual rate of 10% of the original cost was recorded on the factory ma." Sundry factory expenses of $6,900 were recorded as liabilities. 0) Factory overhead was applied to production at the rate of $6 per direct labor hour; the (k) Goods completed with a total cost of $126,000 were transferred to linished goods ( Baes were $150,000 and cost $96,000 to produce. Scared wine 66 PART 2 COST INFORMATION SYSTEM; ACCUMULATION PROCEDURES Required: (1) Journal entries to record the transactions on the general office books and on the factory (2) The two factory overhead accounts, in which applicable transactions are posted: the transfer of any over- or underapplied overhead to the cost of goods sold account, and the closing of all factory overhead accounts. b. Derive a demand function for real money balances from the quantity theory of money equation. Provide an economic intuition for that money demand expression. c. Now consider the following version of the quantity theory MxWD = PxY where, now the velocity of money depends on the interest rate (1). Knowing that the relation between the demand for real money balances and the nominal interest rate is negative, what should be the relation between V and the nominal interest rate? Provide an economic explanation for your result. [6+7+7-201 Q-1: a. "Current prices are highly affected by the current level of money supply, whereas less affected by the future money supply". True or False. Explain briefly b. Derive a demand function for real money balances from the quantity theory of money equation. Provide an economic intuition for that money demand expression c Now consider the following version of the quantity theory MxV)=PxY where, now the velocity of money depends on the interest rate (). Knowing that the relation between the demand for real money balances and the nominal interest rate is negative, what should be the relation between V and the nominal interest rate