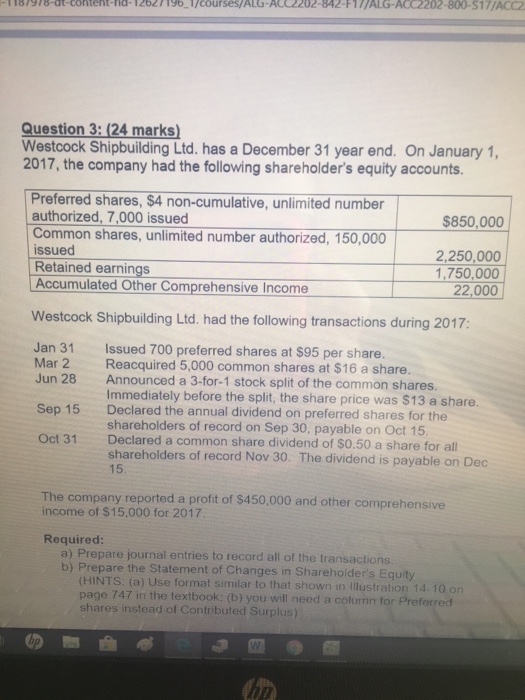

196-1/courses ALG-ACC2202-842 17/ALG.ACC2202-800-S 1 7/ACC2 '876.dt-content, na-1262 Question 3: (24 marks) Westcock Shipbuilding Ltd. has a December 31 year end. On January 1, 2017, the company had the following shareholder's equity accounts Preferred shares, $4 non-cumulative, unlimited number authorized, 7,000 issued Common shares, unlimited number authorized, 150,000 issued $850,000 2250,000 1,750,000 22,000 Retained earnings Other LAccumulated Comprehensive Income Westcock Shipbuilding Ltd. had the following transactions during 2017: Jan 31 Issued 700 preferred shares at $95 per share. Reacquired 5,000 common shares at $16 a share. Announced a 3-for-1 stock split of the common shares. Immediately before the split, the share price was $13 a share. Declared the annual dividend on preferred shares for the shareholders of record on Sep 30, payable on Oct 15 Declared a common share dividend of $0.50 a share for all shareholders of record Nov 30. The dividend is payable on Dec 15 Mar 2 Jun 28 Sep 15 Oct 31 The company reported a profit of $450,000 and other comprehensive income of $15,000 for 2017 Required: a) Prepare journal entries to record all of the transactions b) Prepare the Statement of Changes in Sharehoider's Equity (HINTS: (a) Use format similar to that shown in Illustration 14-10 on age 747 in the textbook: (b) you will need a column for Preferred shares instead of Contributed Surplus) 196-1/courses ALG-ACC2202-842 17/ALG.ACC2202-800-S 1 7/ACC2 '876.dt-content, na-1262 Question 3: (24 marks) Westcock Shipbuilding Ltd. has a December 31 year end. On January 1, 2017, the company had the following shareholder's equity accounts Preferred shares, $4 non-cumulative, unlimited number authorized, 7,000 issued Common shares, unlimited number authorized, 150,000 issued $850,000 2250,000 1,750,000 22,000 Retained earnings Other LAccumulated Comprehensive Income Westcock Shipbuilding Ltd. had the following transactions during 2017: Jan 31 Issued 700 preferred shares at $95 per share. Reacquired 5,000 common shares at $16 a share. Announced a 3-for-1 stock split of the common shares. Immediately before the split, the share price was $13 a share. Declared the annual dividend on preferred shares for the shareholders of record on Sep 30, payable on Oct 15 Declared a common share dividend of $0.50 a share for all shareholders of record Nov 30. The dividend is payable on Dec 15 Mar 2 Jun 28 Sep 15 Oct 31 The company reported a profit of $450,000 and other comprehensive income of $15,000 for 2017 Required: a) Prepare journal entries to record all of the transactions b) Prepare the Statement of Changes in Sharehoider's Equity (HINTS: (a) Use format similar to that shown in Illustration 14-10 on age 747 in the textbook: (b) you will need a column for Preferred shares instead of Contributed Surplus)