19/8

Please fix. Req. B

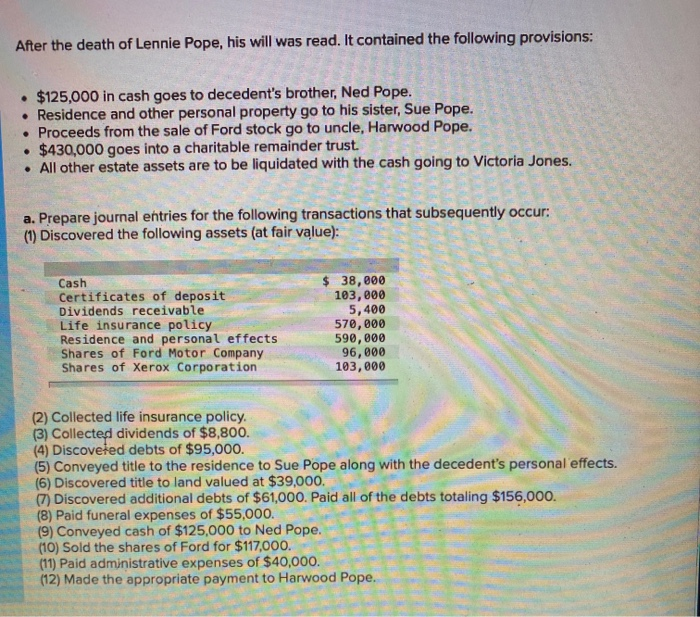

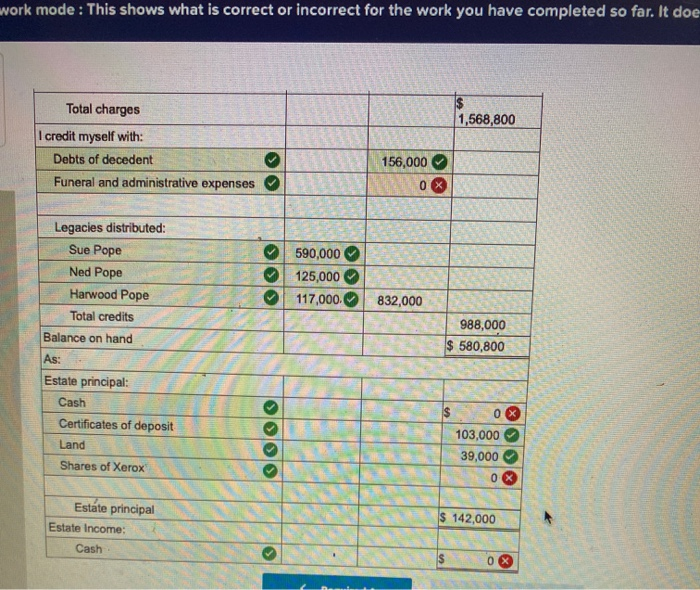

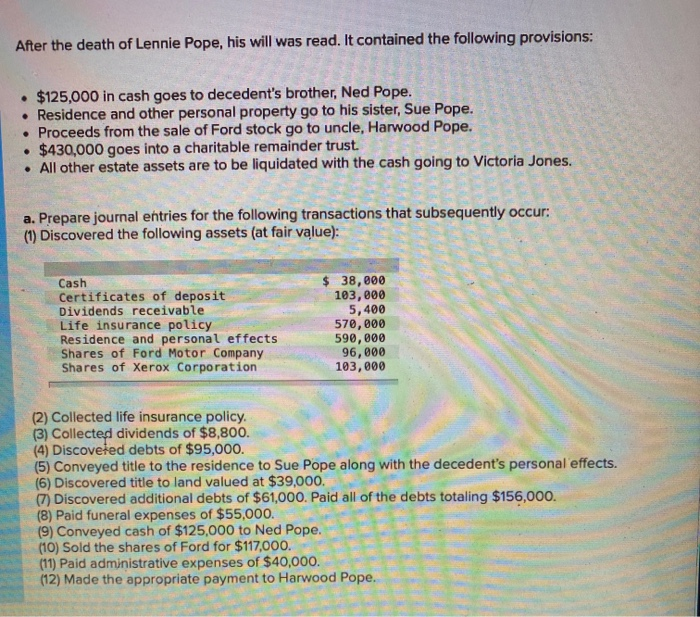

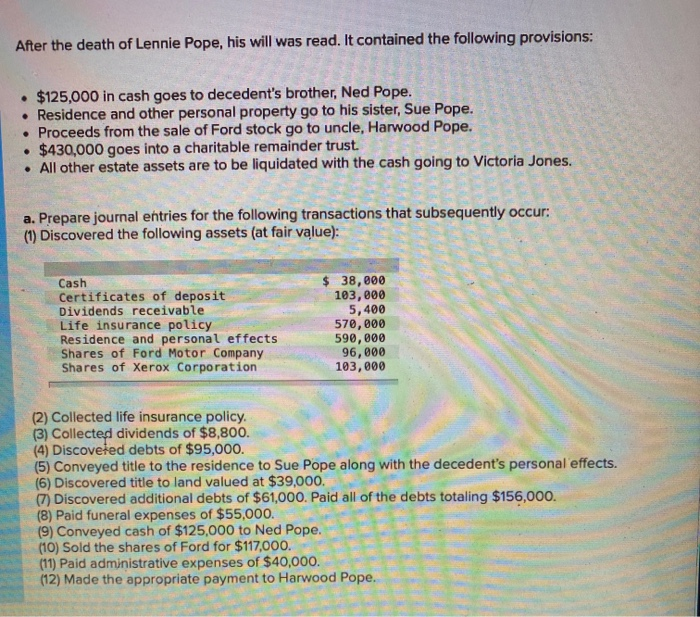

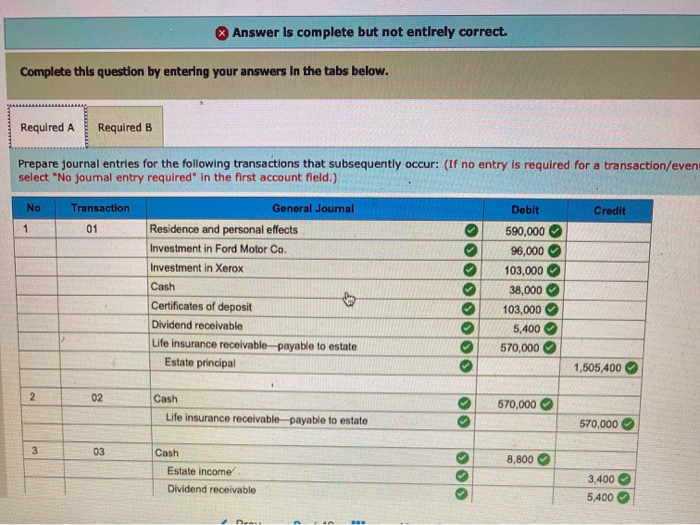

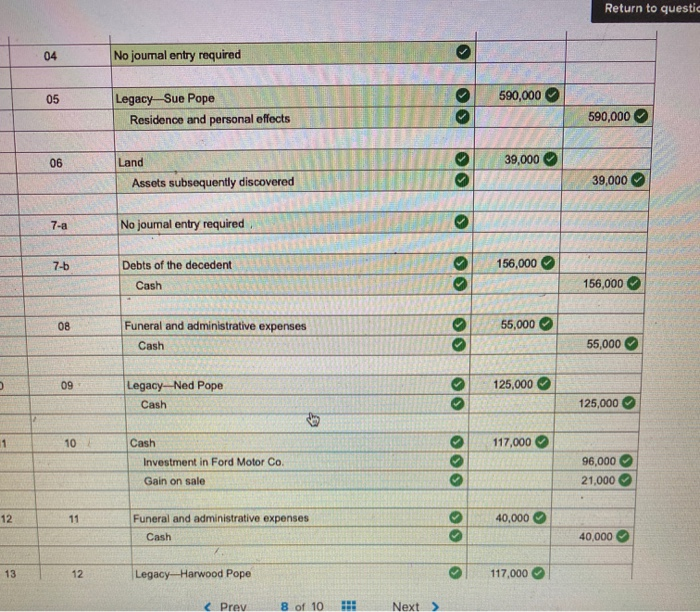

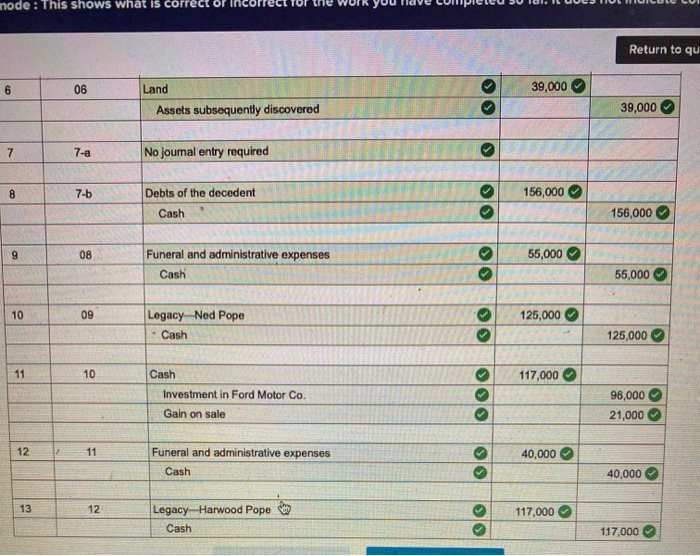

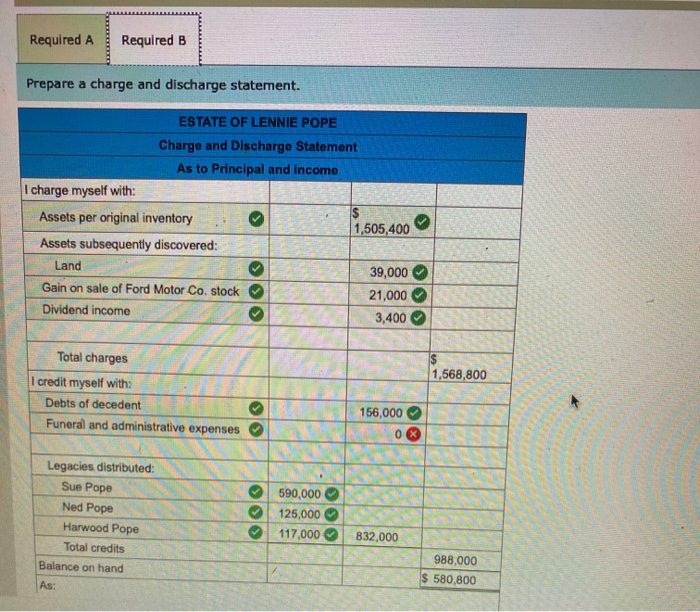

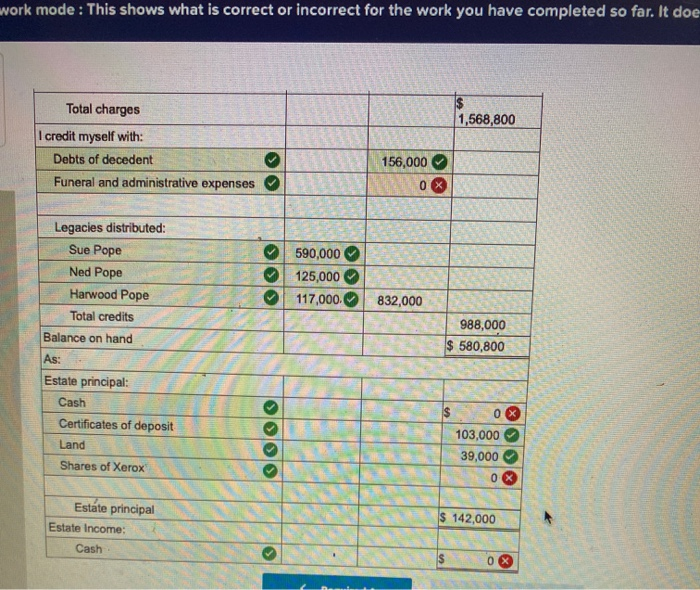

After the death of Lennie Pope, his will was read. It contained the following provisions: $125,000 in cash goes to decedent's brother, Ned Pope. Residence and other personal property go to his sister, Sue Pope. Proceeds from the sale of Ford stock go to uncle, Harwood Pope. $430,000 goes into a charitable remainder trust. All other estate assets are to be liquidated with the cash going to Victoria Jones. . a. Prepare journal entries for the following transactions that subsequently occur (1) Discovered the following assets (at fair value): Cash Certificates of deposit Dividends receivable Life insurance policy Residence and personal effects Shares of Ford Motor Company Shares of Xerox Corporation $ 38,000 103,000 5,400 570,000 590,000 96,000 103,000 (2) Collected life insurance policy. (3) Collected dividends of $8,800. (4) Discoveted debts of $95,000. (5) Conveyed title to the residence to Sue Pope along with the decedent's personal effects. (6) Discovered title to land valued at $39,000. (7) Discovered additional debts of $61,000. Paid all of the debts totaling $156,000. (8) Paid funeral expenses of $55,000. (9) Conveyed cash of $125,000 to Ned Pope. (10) Sold the shares of Ford for $117,000. (11) Paid administrative expenses of $40,000. (12) Made the appropriate payment to Harwood Pope. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for the following transactions that subsequently occur: (If no entry is required for a transaction/even select "No joumal entry required in the first account field.) No Debit Credit Transaction 01 1 General Journal Residence and personal effects Investment in Ford Motor Co. Investment in Xerox Cash Certificates of deposit Dividend receivable Life insurance receivable payable to estate Estate principal 590,000 96,000 103,000 38,000 103,000 5,400 570,000 1,505,400 2 02 Cash Life insurance receivable-payable to estate 570,000 O 570,000 3 03 8,800 Cash Estate income Dividend receivable 3,400 5,400 NO Return to questi > 04 No joumal entry required 05 590,000 Legacy Sue Pope Residence and personal effects 590,000 >> >> 06 Land 39,000 Assets subsequently discovered 39,000 7-a No joumal entry required 7-b 156,000 Debts of the decedent Cash >> 156,000 08 Funeral and administrative expenses 55,000 Cash 55,000 09 125,000 U Legacy-Ned Pope Cash 125,000 10 117,000 Cash Investment in Ford Motor Co. 96,000 21,000 Gain on sale 12 11 40,000 Funeral and administrative expenses Cash 40,000 13 12 Legacy-Harwood Pope 117,000 node: This shows what is correct or Return to qu 6 06 39,000 Land Assets subsequently discovered 39,000 7 7-a No joumal entry required 8 7-b 156,000 Debts of the decedent Cash 156,000 9 08 55,000 Funeral and administrative expenses Cash 55,000 10 09 125,000 Legacy Ned Pope Cash 125,000 11 10 117,000 Cash Investment in Ford Motor Co. Gain on sale 96,000 21,000 12 11 40,000 Funeral and administrative expenses Cash 40,000 13 12 117,000 Legacy Harwood Pope Cash 117,000 Required A Required B Prepare a charge and discharge statement. ESTATE OF LENNIE POPE Charge and Discharge Statement As to Principal and income I charge myself with: Assets per original inventory 1,505,400 Assets subsequently discovered: Land 39,000 Gain on sale of Ford Motor Co. stock 21,000 Dividend income 3,400 1,568,800 Total charges I credit myself with: Debts of decedent Funeral and administrative expenses 156,000 0 Legacies distributed: Sue Pope Ned Pope Harwood Pope Total credits Balance on hand As: 590,000 125,000 117,000 832,000 988,000 $ 580,800 wwork mode : This shows what is correct or incorrect for the work you have completed so far. It doe 1,568,800 Total charges I credit myself with: Debts of decedent Funeral and administrative expenses 156,000 0 590,000 125,000 117,000. 832,000 Legacies distributed: Sue Pope Ned Pope Harwood Pope Total credits Balance on hand As: Estate principal: Cash Certificates of deposit Land Shares of Xerox 988,000 $ 580,800 0 OOO 103,000 39,000 0 $ 142,000 Estate principal Estate Income: Cash IS

Please fix. Req. B

Please fix. Req. B