Question

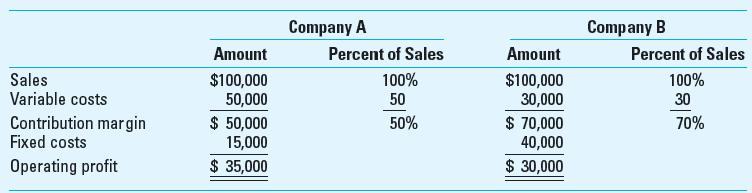

The following sales and cost data (000s) are for two companies in the transportation industry: Required: 1. Calculate the degree of operating leverage (DOL) for

The following sales and cost data (000s) are for two companies in the transportation industry:

Required:

1. Calculate the degree of operating leverage (DOL) for each company. If sales increase from the present level, which company benefits more? How do you know?

2. Assume that sales rise 20% in the next year but that everything else remains constant. Calculate the percentage increase in profit for each company. Are the results what you expected? Explain.

Company A Company B Amount Percent of Sales Amount Percent of Sales Sales $100,000 50,000 100% $100,000 30,000 100% Variable costs 50 30 Contribution margin Fixed costs $ 50,000 15,000 $ 70,000 40,000 50% 70% Operating profit $ 35,000 $ 30,000

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Degree of leverage is the ratio of Contribution ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Tools for business decision making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

5th edition

470506954, 471345881, 978-0470506950, 9780471345886, 978-0470477144

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App