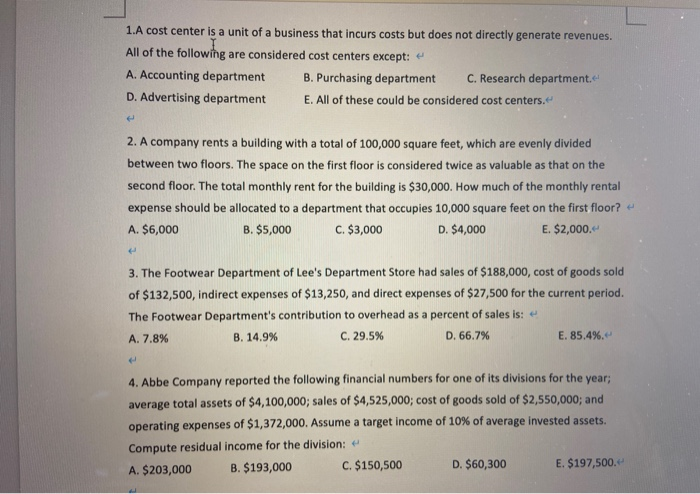

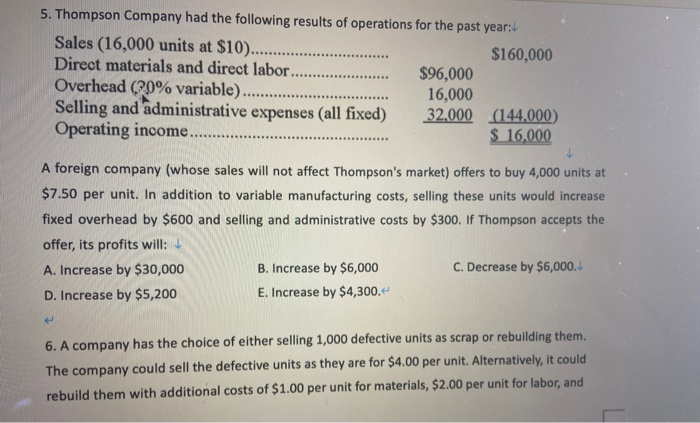

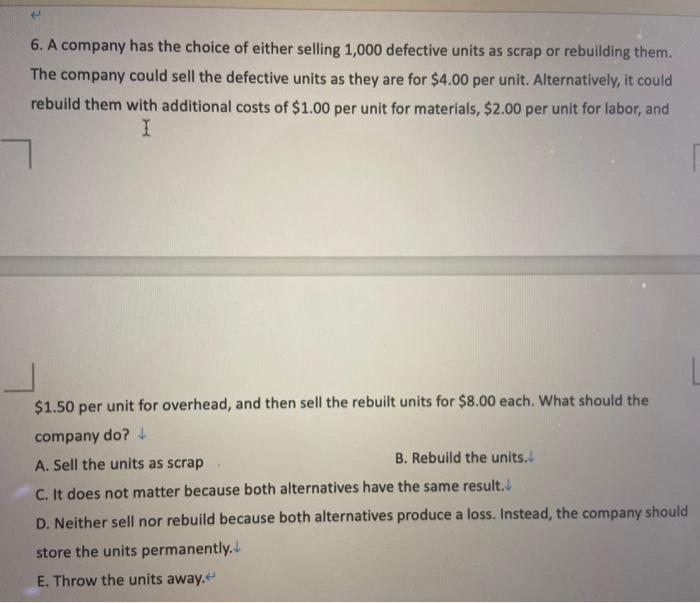

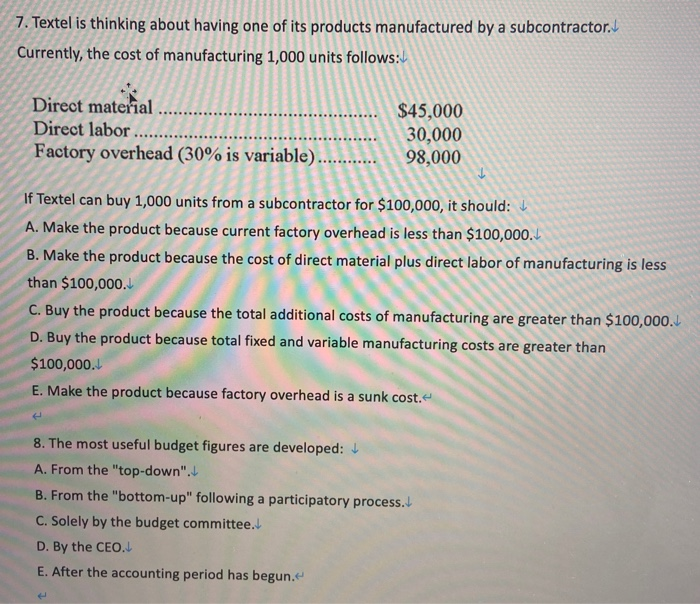

1.A cost center is a unit of a business that incurs costs but does not directly generate revenues. All of the following are considered cost centers except: A. Accounting department B. Purchasing department C. Research department. D. Advertising department E. All of these could be considered cost centers. 2. A company rents a building with a total of 100,000 square feet, which are evenly divided between two floors. The space on the first floor is considered twice as valuable as that on the second floor. The total monthly rent for the building is $30,000. How much of the monthly rental expense should be allocated to a department that occupies 10,000 square feet on the first floor? A. $6,000 B. $5,000 C. $3,000 D. $4,000 E. $2,000. 3. The Footwear Department of Lee's Department Store had sales of $188,000, cost of goods sold of $132,500, indirect expenses of $13,250, and direct expenses of $27,500 for the current period. The Footwear Department's contribution to overhead as a percent of sales is: A. 7.8% B. 14.9% C. 29.5% D. 66.7% E. 85.4%. 4. Abbe Company reported the following financial numbers for one of its divisions for the year; average total assets of $4,100,000; sales of $4,525,000; cost of goods sold of $2,550,000; and operating expenses of $1,372,000. Assume a target income of 10% of average invested assets. Compute residual income for the division: A. $203,000 B. $193,000 C. $150,500 D. $60,300 E. $197,500.- 5. Thompson Company had the following results of operations for the past year: Sales (16,000 units at $10)............ $160,000 Direct materials and direct labor... $96,000 Overhead (20% variable).... 16,000 Selling and administrative expenses (all fixed) 32,000 (144.000) Operating income $ 16,000 ERROR A foreign company (whose sales will not affect Thompson's market) offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. If Thompson accepts the offer, its profits will: A. Increase by $30,000 B. Increase by $6,000 C. Decrease by $6,000. D. Increase by $5,200 E. Increase by $4,300. 6. A company has the choice of either selling 1,000 defective units as scrap or rebuilding them. The company could sell the defective units as they are for $4.00 per unit. Alternatively, it could rebuild them with additional costs of $1.00 per unit for materials, $2.00 per unit for labor, and 6. A company has the choice of either selling 1,000 defective units as scrap or rebuilding them. The company could sell the defective units as they are for $4.00 per unit. Alternatively, it could rebuild them with additional costs of $1.00 per unit for materials, $2.00 per unit for labor, and I $1.50 per unit for overhead, and then sell the rebuilt units for $8.00 each. What should the company do? A. Sell the units as scrap B. Rebuild the units. C. It does not matter because both alternatives have the same result. D. Neither sell nor rebuild because both alternatives produce a loss. Instead, the company should store the units permanently. E. Throw the units away. 7. Textel is thinking about having one of its products manufactured by a subcontractor. Currently, the cost of manufacturing 1,000 units follows: Direct material Direct labor ...... Factory overhead (30% is variable)........... $45,000 30,000 98,000 If Textel can buy 1,000 units from a subcontractor for $100,000, it should: A. Make the product because current factory overhead is less than $100,000. B. Make the product because the cost of direct material plus direct labor of manufacturing is less than $100,000. C. Buy the product because the total additional costs of manufacturing are greater than $100,000. D. Buy the product because total fixed and variable manufacturing costs are greater than $100,000. E. Make the product because factory overhead is a sunk cost. 8. The most useful budget figures are developed: A. From the "top-down". B. From the "bottom-up" following a participatory process. C. Solely by the budget committee. D. By the CEO. E. After the accounting period has begun