Question

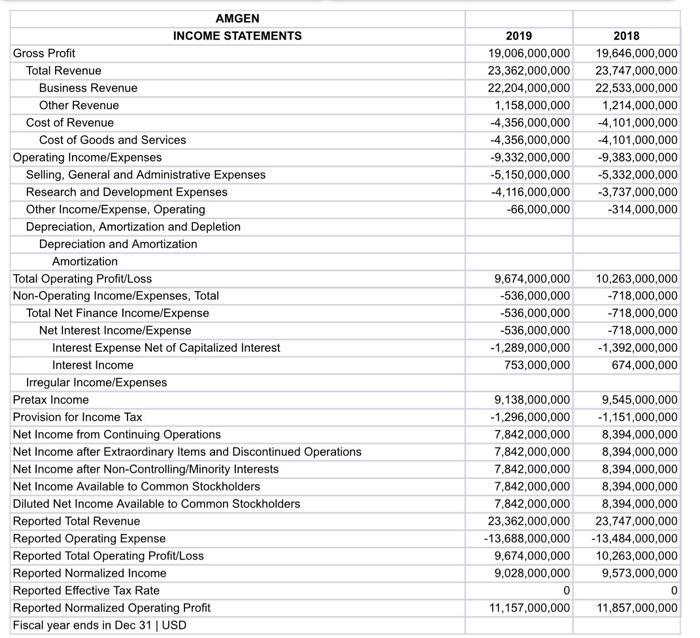

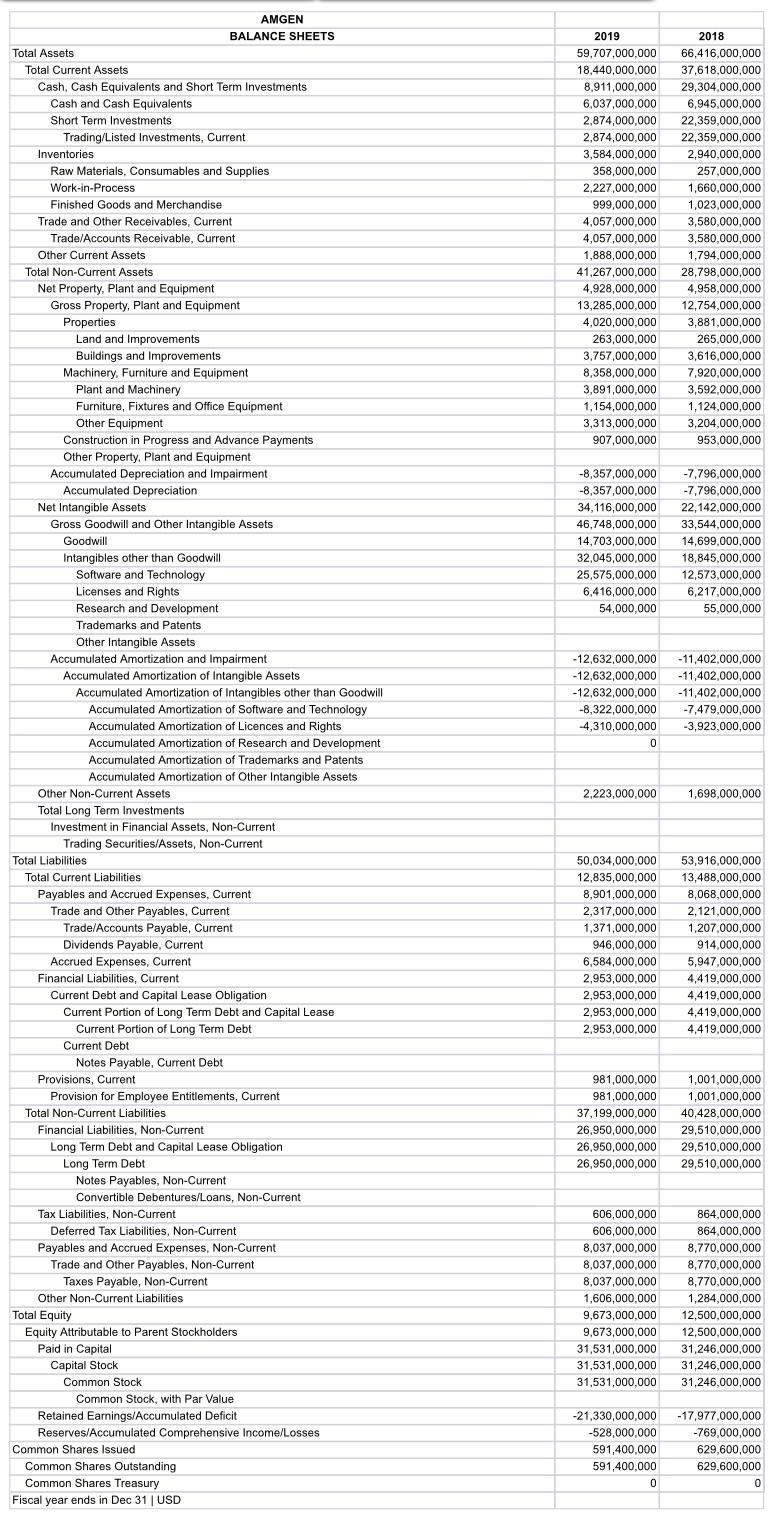

Refer to Amgens 2019 and 2018 balance sheets and income statements from Morningstar. They are included with the Final Exam. Use Amgens financial statement information

Refer to Amgen’s 2019 and 2018 balance sheets and income statements from Morningstar. They are included with the Final Exam. Use Amgen’s financial statement information provided to calculate the company’s Operating Cycle and Cash (Conversion) Cycle. Show all your work for each equation. (Equations as shown below.)

Equation : (Eq. 1) Average Inventory = (Beginning Inventory +Ending Inventory)/2

(Eq. 2) Inventory Turnover Ratio = Cost of Goods Sold/Average Inventory

(Eq. 3) Inventory Period = 365 days/Inventory Turnover Ratio

(Eq.4) Average Accounts Receivables = (Beginning Accounts Receivables + Ending Accounts Receivables)/2

(Eq. 5) Accounts Receivable Turnover = Net (credit) sales/Average Accounts Receivables

(Eq. 6) Accounts Receivable Period = 365 days/Accounts Receivable Turnover

(Eq. 7) Average Accounts Payables= (Beginning Accounts Payables + Ending Accounts Payables)/2

(Eq. 8) Accounts Payables Ratio = Cost of Goods Sold/Average Accounts Payables

(Eq. 9) Accounts Payable Period = 365 days/Accounts Payables Ratio

(Eq 10) Operating Cycle = Inventory Period +Accounts Receivable Period

(Eq 11) Cash Cycle = Operating Cycle –Accounts Payable Period

1B. If Amgen wished to improve its Cash (Conversion) Cycle, should its managers decrease or increase its cash conversion cycle? _______________Explain your answer in 3-4 sentences.

1C. List at least two ways that Amgen could achieve this improvement.

1D. Explain the possible risks Amgen may face if it follows your suggestions.

AMGEN INCOME STATEMENTS 2019 2018 Gross Profit 19,006,000,000 19,646,000,000 Total Revenue 23,362,000,000 23,747,000,000 Business Revenue 22,204,000,000 22,533,000,000 Other Revenue 1,158,000,000 1,214,000,000 Cost of Revenue -4,356,000,000 -4,101,000,000 Cost of Goods and Services -4,356,000,000 -4,101,000,000 Operating Income/Expenses -9,332,000,000 -9,383,000,000 Selling, General and Administrative Expenses -5,150,000,000 -5,332,000,000 Research and Development Expenses -4,116,000,000 -3,737,000,000 Other Income/Expense, Operating -66,000,000 -314,000,000 Depreciation, Amortization and Depletion Depreciation and Amortization Amortization Total Operating Profit/Loss 9,674,000,000 10,263,000,000 Non-Operating Income/Expenses, Total -536,000,000 -718,000,000 Total Net Finance Income/Expense -536,000,000 -718,000,000 Net Interest Income/Expense -536,000,000 -718,000,000 Interest Expense Net of Capitalized Interest -1,289,000,000 -1,392,000,000 Interest Income 753,000,000 674,000,000 Irregular Income/Expenses Pretax Income 9,138,000,000 9,545,000,000 Provision for Income Tax -1,296,000,000 -1,151,000,000 Net Income from Continuing Operations 7,842,000,000 8,394,000,000 Net Income after Extraordinary Items and Discontinued Operations Net Income after Non-Controlling/Minority Interests 7,842,000,000 8,394,000,000 7,842,000,000 8,394,000,000 Net Income Available to Common Stockholders 7,842,000,000 ,394,000,000 Diluted Net Income Available to Common Stockholders 7,842,000,000 8,394,000,000 Reported Total Revenue 23,362,000,000 23,747,000,000 Reported Operating Expense -13,688,000,000 -13,484,000,000 Reported Total Operating Profit/Loss 9,674,000,000 10,263,000,000 Reported Normalized Income 9,028,000,000 9,573,000,000 Reported Effective Tax Rate Reported Normalized Operating Profit 11,157,000,000 11,857,000,000 Fiscal year ends in Dec 31 | USD

Step by Step Solution

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Average Inventory Beginning Inventory 2018 2940000000 Ending Inventory 2019 3584000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started