Question

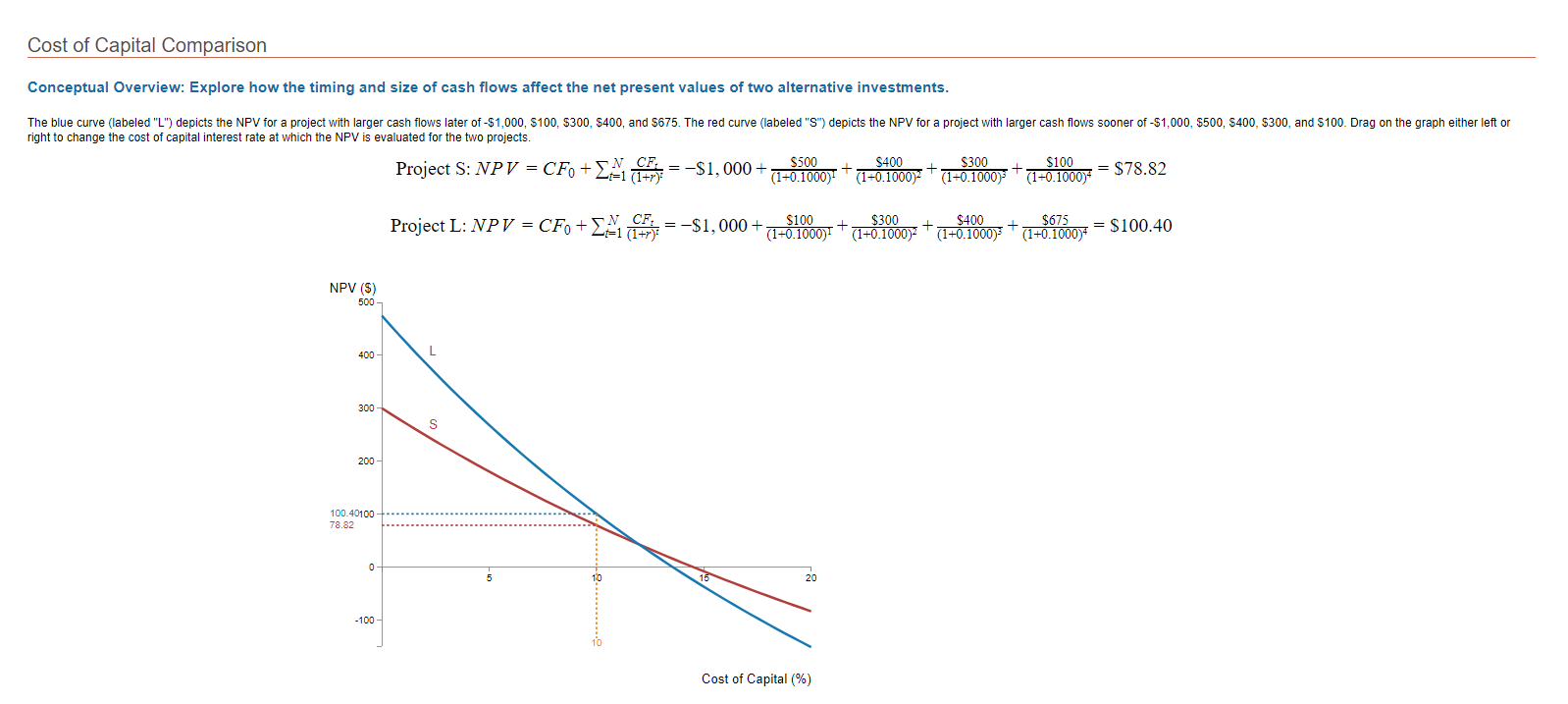

1a. What is the approximate cost of capital for which the two cash flows are about equal? 10% 12% 13.5% 14.5% 1b. What is the

1a. What is the approximate cost of capital for which the two cash flows are about equal?

- 10%

- 12%

- 13.5%

- 14.5%

1b. What is the approximate internal rate of return (IRR) for the Project L cash flow?

- 10%

- 12%

- 13.5%

- 14.5%

1c. What is the approximate internal rate of return (IRR) for the Project S cash flow?

- 10%

- 12%

- 13.5%

- 14.5%

1d. What is the name for the point at which the two projects' NPVs are equal?

- Inflection point

- Equal NPV rate

- Crossover rate

- There is no special name for this point

1e. At a cost of capital less than the point at which they cross, which project will have the higher NPV?

- Project S

- Project L

- Project S and L will have the same NPV

- Cannot determine

1f. At a cost of capital greater than the point at which they cross, which project will have the higher NPV?

- Project S

- Project L

- Project S and L will have the same NPV

- Cannot determine

1g. The internal rate of return (IRR) is the point at which a project's NPV equals 0. If the cost of capital were 5% (move the slider so that is the case), then

- Project S is the better project because it has the higher IRR.

- Project L is the better project because it has the higher NPV.

- It depends because there is a conflict between IRR and NPV.

1h. If the cost of capital was greater than the point at which the two projected NPVs are equal, then

- It depends because there is a conflict between IRR and NPV.

- There is no conflict because Project S has both a higher NPV and a higher IRR than Project L.

- There is no conflict because Project L has both a higher NPV and a higher IRR than Project S.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started