Question

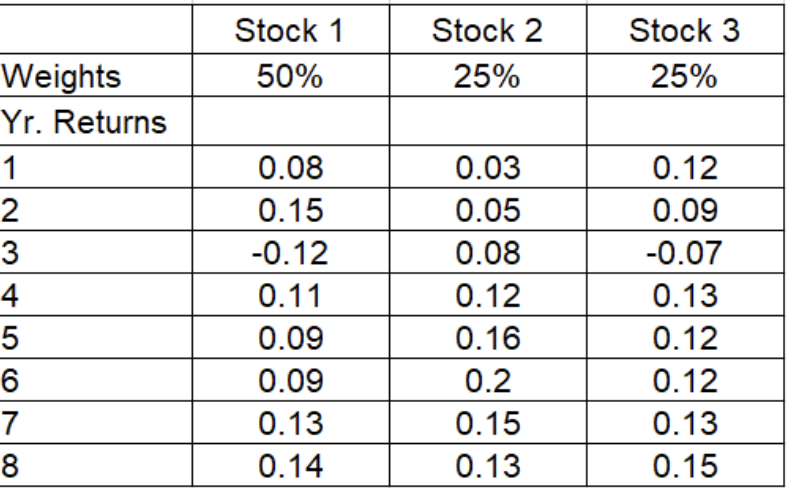

1)After working for several months in portfolio analysis for Berkshire Hathaway, you are rotated into the team that creates portfolios to proxy the Sharpe risk-return

1)After working for several months in portfolio analysis for Berkshire Hathaway, you are rotated into the team that creates portfolios to proxy the Sharpe risk-return profile of the Market Portfolio of the current CML. The current Rf is 3%.To start, you are provided with the following portfolio information:

The portfolio expected return is :

a. 3.59% b. 5.93% c. 9.53%

The portfolio expected return is :

a. 0.004174 b. 0.007414 c. 0.001474

it's Sharpe Ratio is : a. 1.01% return per 1 unit of std dev. b. 2.01% return per 1 unit of std dev. c. 3.01% return per 1 unit of std dev.

2) the Market Portfolio has a Sharpe Ratio fo 1.50% per unit of standard deviation.

Find the weight combination among the portoflio assets that provides a Sharpe Ratio closest to that of the Market Portfolio. The only possible weight combinations are 65%, 20% and 15%.

The combination of portoflio weights that enables the portfolio to proxy the Market Portfolio Sharpe is :

a. Stock 1 15%, Stock 2 20%, Stock 3 65% b. Stock 1 20%, Stock 2 65%, Stock 3 15% c. Stock 1 65%, Stock 2 20%, Stock 3 15% d. Stock 1 65%, Stock 2 15%, Stock 3 20% e. Stock 1 15%, Stock 2 65%, Stock 3 20% f. Stock 1 20%, Stock 2 15%, Stock 3 65%

The portfolio return of this weight combination is :

a. 9.71% b. 10.20% c. 10.71% with a variance of : a. 0.006452 b. 0.004526 c. 0.002645

3) Now that you have a proxy for the Market Portfolio (MP), you can begin to construct CML portfolio combinations that consist of the Rf and the Market Portfolio.

For the Grandmother fund investor, construct a CML portfolio with a 66.8% weight in the risk-free asset and the remaining weight in the MP proxy. The correlation between the risk-free asset and the MP proxy is 0. The variance of the risk-free asset is 0. The expected return of this CML portfolio is :

a. 2.57% b. 1.72% c. 5.56%

the standard deviation is :

a. 0.01617 b. 0.01708 c. 0.01967

the Sharpe Ratio is :

a. 1.22% per unit of std dev. b. 1.50% per unit of std dev. c. 1.82% per unit of std dev.

\begin{tabular}{|l|c|c|c|} \hline & Stock 1 & Stock 2 & Stock 3 \\ \hline Weights & 50% & 25% & 25% \\ \hline Yr. Returns & & & \\ \hline 1 & 0.08 & 0.03 & 0.12 \\ \hline 2 & 0.15 & 0.05 & 0.09 \\ \hline 3 & -0.12 & 0.08 & -0.07 \\ \hline 4 & 0.11 & 0.12 & 0.13 \\ \hline 5 & 0.09 & 0.16 & 0.12 \\ \hline 6 & 0.09 & 0.2 & 0.12 \\ \hline 7 & 0.13 & 0.15 & 0.13 \\ \hline 8 & 0.14 & 0.13 & 0.15 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline & Stock 1 & Stock 2 & Stock 3 \\ \hline Weights & 50% & 25% & 25% \\ \hline Yr. Returns & & & \\ \hline 1 & 0.08 & 0.03 & 0.12 \\ \hline 2 & 0.15 & 0.05 & 0.09 \\ \hline 3 & -0.12 & 0.08 & -0.07 \\ \hline 4 & 0.11 & 0.12 & 0.13 \\ \hline 5 & 0.09 & 0.16 & 0.12 \\ \hline 6 & 0.09 & 0.2 & 0.12 \\ \hline 7 & 0.13 & 0.15 & 0.13 \\ \hline 8 & 0.14 & 0.13 & 0.15 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started