Question

(1) All items of PPE except office buildings are bought on 1 January 2021. Depreciation charges for the year should be calculated at 10% on

(1) All items of PPE except office buildings are bought on 1 January 2021. Depreciation charges for the year should be calculated at 10% on cost PPE excl. buildings and at 2% on book value for buildings.

(2) Office buildings are to be revaluated to $700,000

(3) The income tax for the year is evaluated as $3,900

(4) Research and development costs include 50% of pure research and 50% meet certain criteria that indicate that future economic benefits are probable

(5) Receivables totalling $3,100 are to be written off

(6) Allowance for receivables should be created as 1% of net trade receivables

(7) Alpha’s directors made the following decisions during the year ended 31 December 2021: It disposed of all of its outlets in country A. A decision was also made to close down a regional office, which was communicated to the employees before the year-end. 50 employees would be retrained and kept within Alpha at a cost of $7,000, the others took redundancy and will be paid $25,000.

(8) The debentures issue during the year took place on 1 July2021, and all interest for the year should be accrued

(9) During the inventory count on 31 December, some goods which had cost $8,000 were found to be damaged. In February 2022 the damaged goods were sold for $8,100 by an agent who received a 9% commission out of the sale proceeds

Required:

a) a statement of profit or loss and other comprehensive income for the year ended 31 December 2021,

b) a statement of changes in equity for the year ended 31 December 2021,

c) a statement of financial position at that date,

d) notes, in accordance with IAS 1 “Presentation of Financial Statements”.

Your answer should be as complete and informative as possible within the limits of the information given to you. An accounting policy note is also required

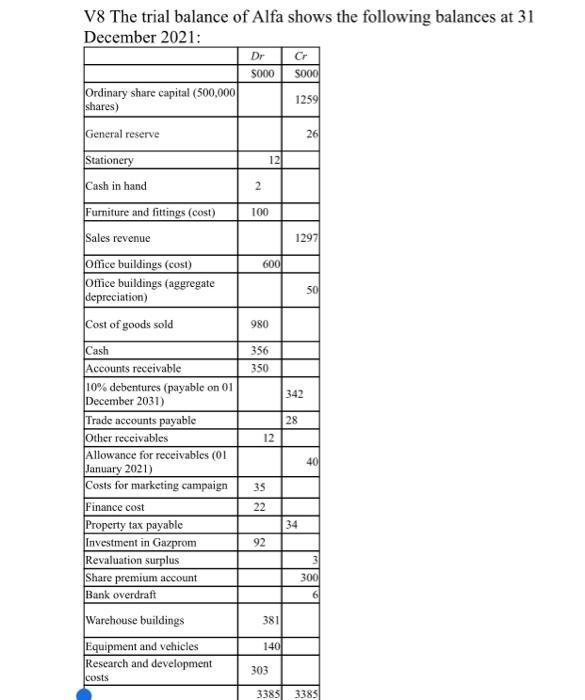

V8 The trial balance of Alfa shows the following balances at 31 December 2021: Ordinary share capital (500,000 shares) General reserve Stationery Cash in hand Furniture and fittings (cost) Sales revenue Office buildings (cost) Office buildings (aggregate depreciation) Cost of goods sold Cash Accounts receivable 10% debentures (payable on 01 December 2031) Trade accounts payable Other receivables Allowance for receivables (01 January 2021) Costs for marketing campaign Finance cost Property tax payable Investment in Gazprom Revaluation surplus Share premium account Bank overdraft Warehouse buildings Equipment and vehicles Research and development costs Dr $000 2 100 12 600 980 356 350 12 35 22 92 381 140 303 3385 Cr 5000 1259 1297 342 28 26 34 50 40 3 300 6 3385

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

A a Statement of Profit or Loss and Other Comprehensive Income For the year ended 31 December 2021 Revenue Sales revenue 1297 Expenses Cost of goods sold 980 Costs for marketing campaign 40 Finance co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started