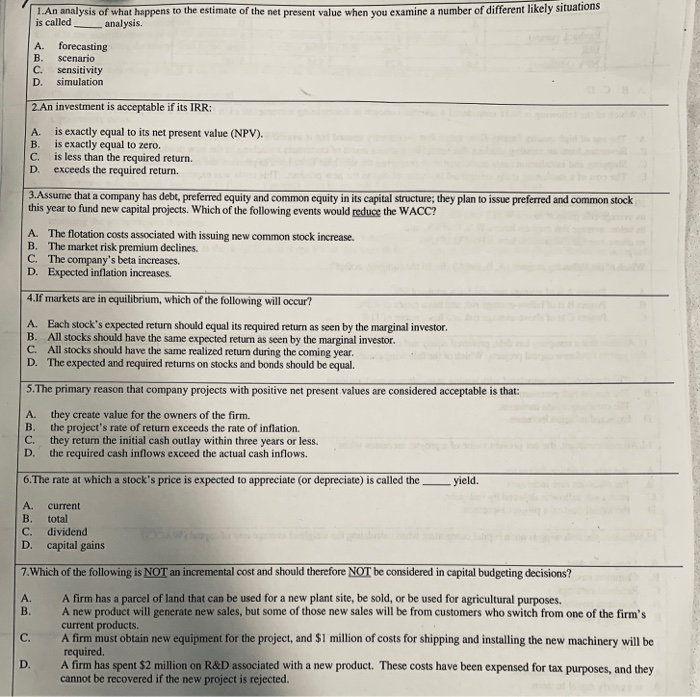

1.An analysis of what happens to the estimate of the net present value when you examine a number of different likely ti is calledanalysis. A. forecasting B. scenario C. sensitivity D. simulation 2.An investment is acceptable if its IRR is exactly equal to its net present value (NPV). B. is exactly equal to zero. C. is less than the required return. D. exceeds the required return. A. 3.Assume that a company has debt, preferred equity and common equity in its capital structure; they plan to issue preferred and common stock this year to fund new capital projects. Which of the following events would reduce the WACC? A. The flotation costs associated with issuing new common stock increase. B. The market risk premium declines. C. The company's beta increases D. Expected inflation increases 4.If markets are in equilibrium, which of the following will occur? A. Each stock's expected return should equal its required return as seen by the marginal investor. B. All stocks should have the same expected return as seen by the marginal investor. C. All stocks should have the same realized return during the coming year. D. The expected and required returns on stocks and bonds should be equal. 5.The primary reason that company projects with positive net present values are considered acceptable is that: A. they create value for the owners of the firm. B. the project's rate of return exceeds the rate of inflation. C. they return the initial cash outlay within three years or less. D. the required cash inflows exceed the actual cash inflows. 6.The rate at which a stock's price is expected to appreciate (or depreciate) is called theyield A. current B. total C. dividend D. capital gains 7.Which of the following is NOT an incremental cost and should therefore NOT be considered in capital budgeting decisions? A. A firm has a parcel of land that can be used for a new plant site, be sold, or be used for agricultural purposes B. A new product will generate new sales, but some of those new sales will be from customers who switch from one of the firm's current products. C. A firm must obtain new equipment for the project, and $1 million of costs for shipping and installing the new machinery will be required D. A firm has spent $2 million on R&D associated with a new product. These costs have been expensed for tax purposes, and they cannot be recovered if the new project is rejected