Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1)(a)Tomorrow, ABC firm based in NYC expects to receive 20 million Yen for its consultancy services to a Japanese firm. Today, the Yen depreciated

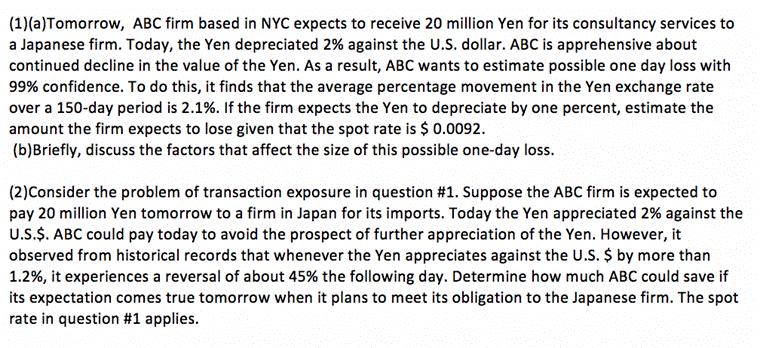

(1)(a)Tomorrow, ABC firm based in NYC expects to receive 20 million Yen for its consultancy services to a Japanese firm. Today, the Yen depreciated 2% against the U.S. dollar. ABC is apprehensive about continued decline in the value of the Yen. As a result, ABC wants to estimate possible one day loss with 99% confidence. To do this, it finds that the average percentage movement in the Yen exchange rate over a 150-day period is 2.1%. If the firm expects the Yen to depreciate by one percent, estimate the amount the firm expects to lose given that the spot rate is $ 0.0092. (b)Briefly, discuss the factors that affect the size of this possible one-day loss. (2)Consider the problem of transaction exposure in question #1. Suppose the ABC firm is expected to pay 20 million Yen tomorrow to a firm in Japan for its imports. Today the Yen appreciated 2% against the U.S.$. ABC could pay today to avoid the prospect of further appreciation of the Yen. However, it observed from historical records that whenever the Yen appreciates against the U.S. $ by more than 1.2%, it experiences a reversal of about 45% the following day. Determine how much ABC could save if its expectation comes true tomorrow when it plans to meet its obligation to the Japanese firm. The spot rate in question #1 applies.

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 a The amount the firm expects to lose with 99 confidence i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started