Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1b The following are transactions and events of the general fund of Sycamore Hospital, a not-for-profit entity, for the 206 fiscal year ending December 31,206

1b

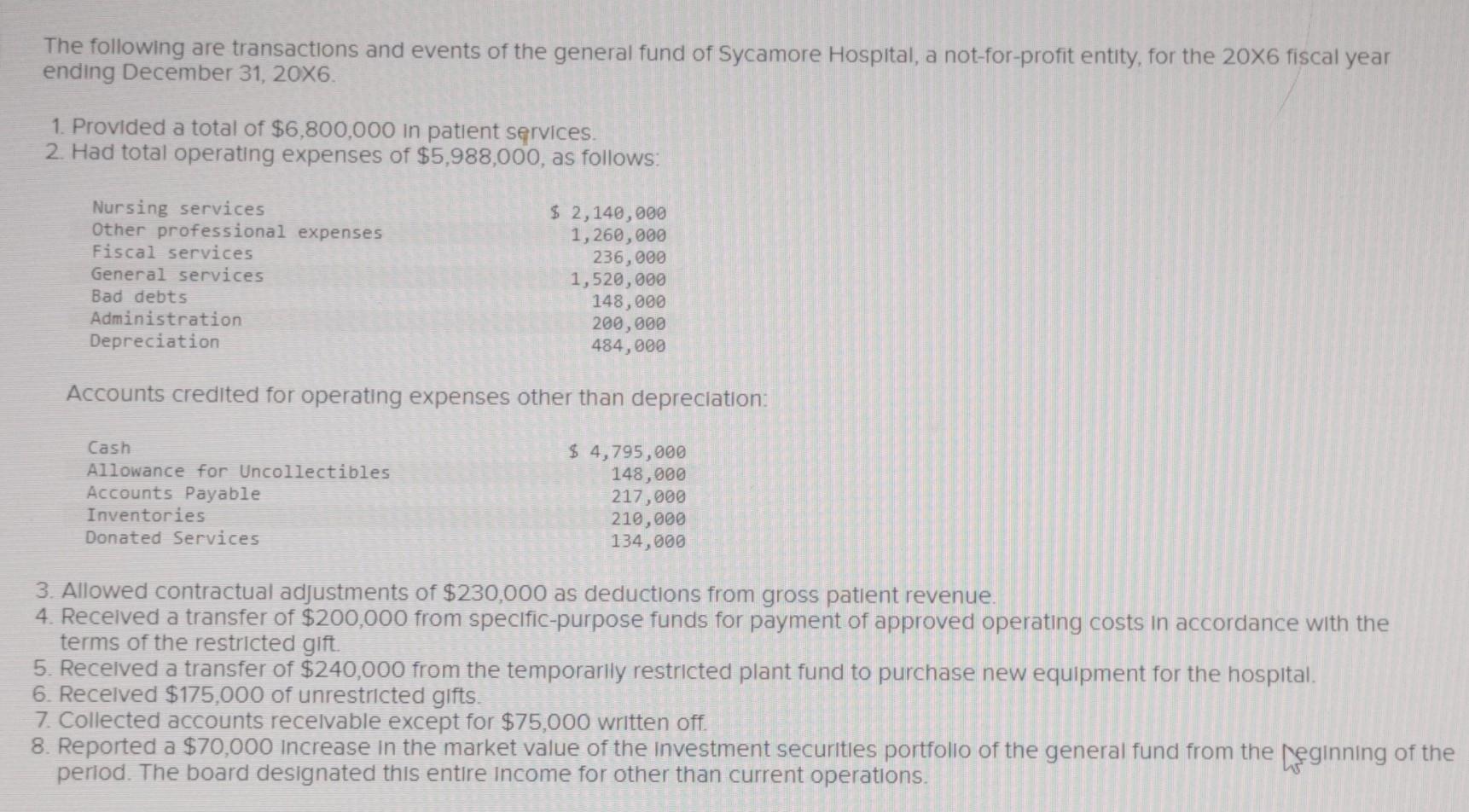

The following are transactions and events of the general fund of Sycamore Hospital, a not-for-profit entity, for the 206 fiscal year ending December 31,206 1. Provided a total of $6,800,000 in patient services. 2. Had total operating expenses of $5,988,000, as follows: Accounts credited for operating expenses other than depreciation: 3. Allowed contractual adjustments of $230,000 as deductions from gross patient revenue. 4. Received a transfer of $200,000 from specific-purpose funds for payment of approved operating costs in accordance with the terms of the restricted gift. 5. Recelved a transfer of $240,000 from the temporarily restricted plant fund to purchase new equipment for the hospital. 6. Recelved $175,000 of unrestricted gifts. 7. Collected accounts recelvable except for $75,000 written off. 8. Reported a $70,000 increase In the market value of the investment securitles portfolio of the general fund from the [eginning of the period. The board designated this entire income for other than current operations. b. Prepare the statement of operations for the general fund without donor restrictions of Sycamore Hospital. SYCAMORE HOSPITAL Statement of Operations For the Year Ended December 31, 20X6 Unrestricted Revenue, Gains, and Other Support Total revenues, gains, and other support Expenses and lossesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started