Question

1b. What is your EBC on the loan described in question #10 if, in addition to the two discount points, you paid $10,000 in closing

1b. What is your EBC on the loan described in question #10 if, in addition to the two discount points, you paid $10,000 in closing costs to close the loan, and you then sell the office building after 7 years and pay off the loan at the sale (rounded to 2 decimal places)?

1b. What is your EBC on the loan described in question #10 if, in addition to the two discount points, you paid $10,000 in closing costs to close the loan, and you then sell the office building after 7 years and pay off the loan at the sale (rounded to 2 decimal places)?

1c. What is your EBC on the loan described in question #10 if you pay the loan off in 12 years (rounded to 2 decimal places)? (Note, you are still paying the $10,000 in closing costs to close the loan)

1d. What is your EBC on the loan described in question #10 if you sell the office building after 36 months and pay off the loan at the sale (rounded to 2 decimal places)? (Note, you'll still incur the $10,000 in closing costs to close the loan.)

1e. Suppose the bank gives you another option for a 30-year loan at a 3.3% interest rate. Will monthly payments for this option (Option 2) be higher or lower than the monthly payments for the original loan (Option 1)?

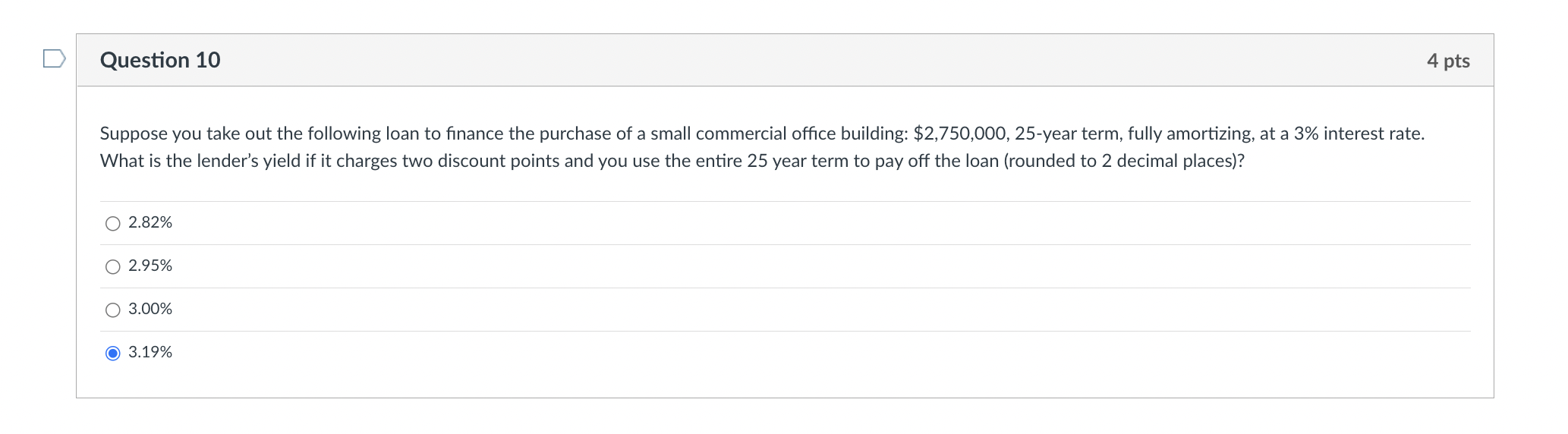

Suppose you take out the following loan to finance the purchase of a small commercial office building: $2,750,000,25-year term, fully amortizing, at a 3% interest rate. What is the lender's yield if it charges two discount points and you use the entire 25 year term to pay off the loan (rounded to 2 decimal places)? 2.82% 2.95% 3.00% 3.19% Suppose you take out the following loan to finance the purchase of a small commercial office building: $2,750,000,25-year term, fully amortizing, at a 3% interest rate. What is the lender's yield if it charges two discount points and you use the entire 25 year term to pay off the loan (rounded to 2 decimal places)? 2.82% 2.95% 3.00% 3.19%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started