Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Calculate 2019 and 2020 residual income assuming Intel had a 25% required rate of return. ***DO NOT USE ANSWERS FROM OTHER CHEGG POST*** Chapter 10

1.Calculate 2019 and 2020 residual income assuming Intel had a 25% required rate of return.

1.Calculate 2019 and 2020 residual income assuming Intel had a 25% required rate of return.

***DO NOT USE ANSWERS FROM OTHER CHEGG POST***

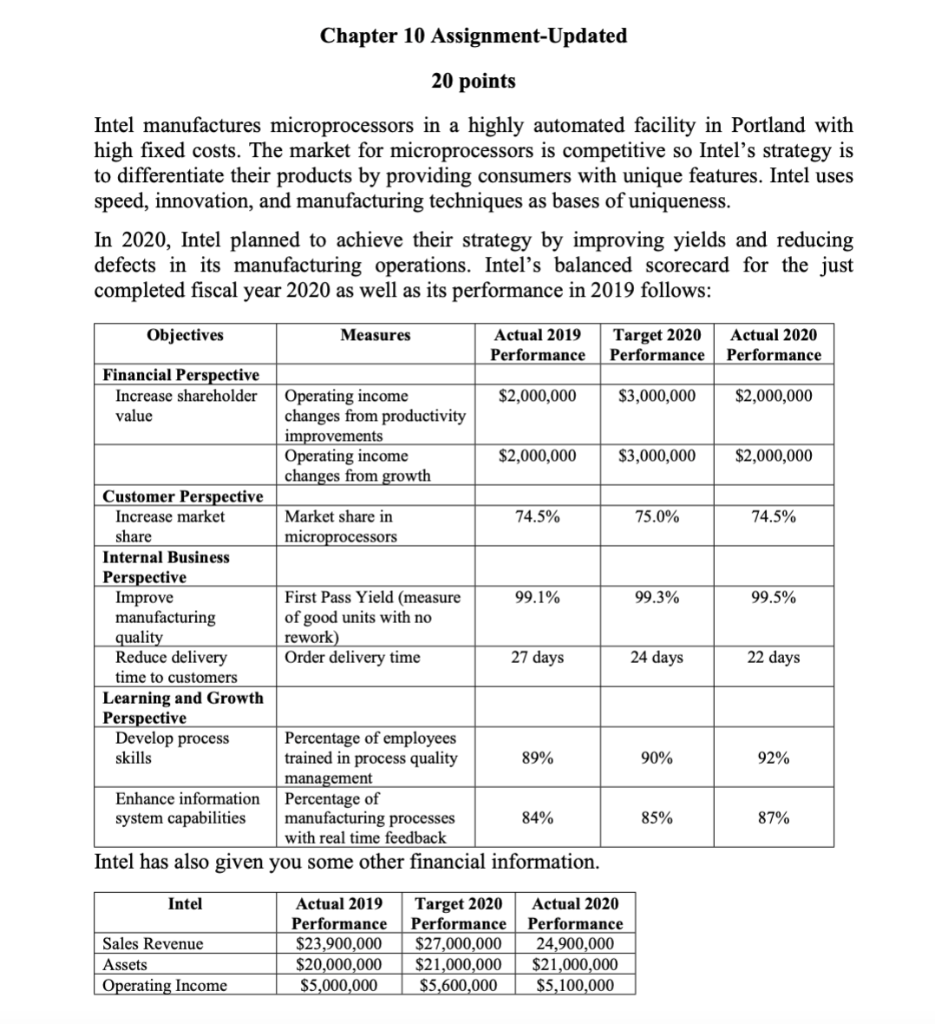

Chapter 10 Assignment-Updated 20 points Intel manufactures microprocessors in a highly automated facility in Portland with high fixed costs. The market for microprocessors is competitive so Intel's strategy is to differentiate their products by providing consumers with unique features. Intel uses speed, innovation, and manufacturing techniques as bases of uniqueness. In 2020, Intel planned to achieve their strategy by improving yields and reducing defects in its manufacturing operations. Intel's balanced scorecard for the just completed fiscal year 2020 as well as its performance in 2019 follows: Target 2020 Performance Actual 2020 Performance $3,000,000 $2,000,000 $3,000,000 $2,000,000 75.0% 74.5% Objectives Measures Actual 2019 Performance Financial Perspective Increase shareholder Operating income $2,000,000 value changes from productivity improvements Operating income $2,000,000 changes from growth Customer Perspective Increase market Market share in 74.5% share microprocessors Internal Business Perspective Improve First Pass Yield (measure 99.1% manufacturing of good units with no quality rework) Reduce delivery Order delivery time 27 days time to customers Learning and Growth Perspective Develop process Percentage of employees skills trained in process quality 89% management Enhance information Percentage of system capabilities manufacturing processes 84% with real time feedback Intel has also given you some other financial information. 99.3% 99.5% 24 days 22 days 90% 92% 85% 87% Intel Sales Revenue Assets Operating Income Actual 2019 Performance $23,900,000 $20,000,000 $5,000,000 Target 2020 Performance $27,000,000 $21,000,000 $5,600,000 Actual 2020 Performance 24,900,000 $21,000,000 $5,100,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started