Answered step by step

Verified Expert Solution

Question

1 Approved Answer

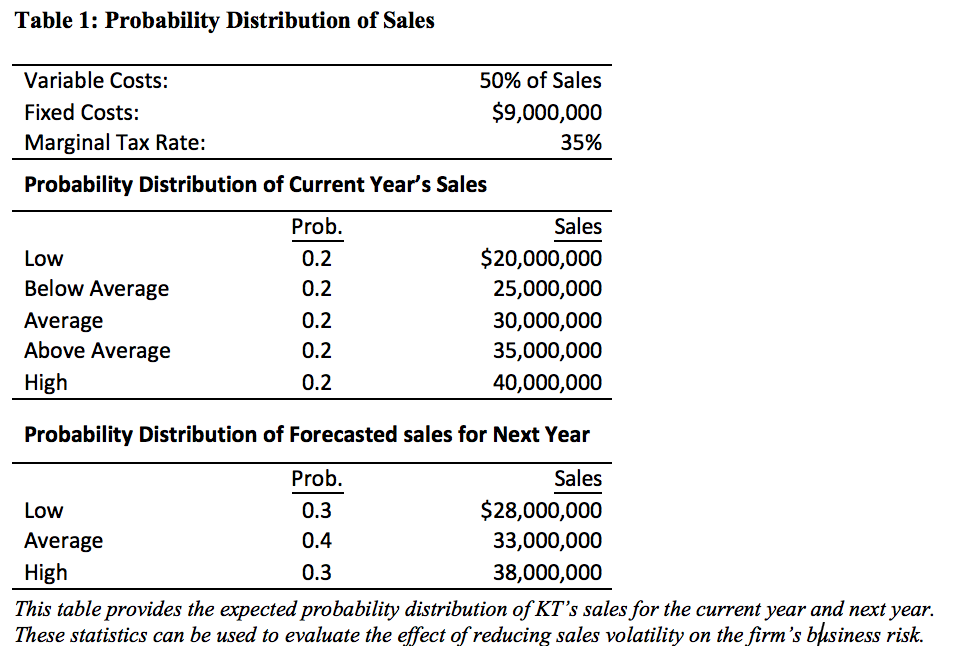

. 1.Calculate the expected value, standard deviation, and the coefficient of variation of KTs sales for the current year. 2. Calculate the expected value, standard

.

1.Calculate the expected value, standard deviation, and the coefficient of variation of KTs sales for the current year.

2. Calculate the expected value, standard deviation, and the coefficient of variation of KTs ROE with the sales figures for the current year.

3. Evaluate the effect of the current sales volatility on the companys business risk.

4. Calculate the expected value, standard deviation, and the coefficients of variation of KTs sales and ROE with the sales forecast for next year.

Table 1: Probability Distribution of Sales 50% of Sales Variable Costs: $9,000,000 Fixed Costs Marginal Tax Rate: 35% Probability Distribution of Current Year's Sales Prob. Sales $20,000,000 Low 0.2 25,000,000 Below Average 0.2 30,000,000 0.2 Average 35,000,000 Above Average 0.2 40,000,000 High 0.2 Probability Distribution of Forecasted sales for Next Year Sales Prob. $28,000,000 Low 0.3 33,000,000 0.4 Average High 0.3 38,000,000 This table provides the expected probability distribution of KT's sales for the current year and next year. These statistics can be used to evaluate the effect of reducing sales volatility on the firm's business riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started