Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Calculate the growth rate for Lionmead limited that you will use in the Gordon's growth model 2. Calculate the cost of debt 3. What is

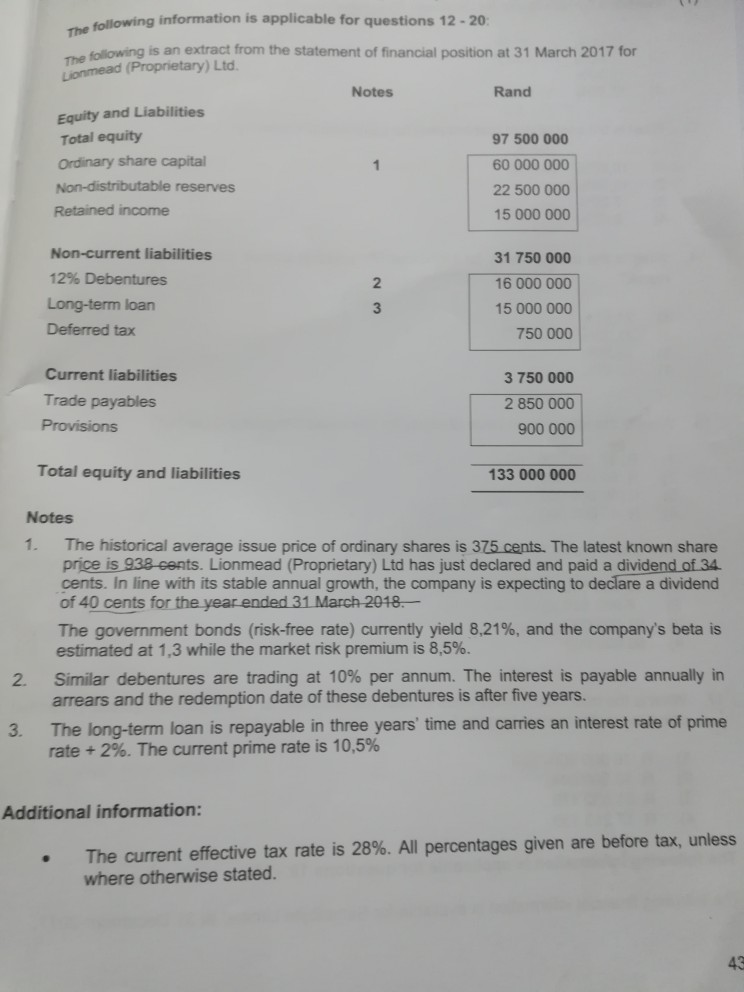

1.Calculate the growth rate for Lionmead limited that you will use in the Gordon's growth model 2. Calculate the cost of debt 3. What is the cost of equity using Gordon's growth 4 What is the market value of equity for Lionmead 5.How many shares do Lionmead Ltd have 6.What is the total market value of debt for Lionmead limited using mathematical formula

is applicable for questions 12-20 The following following is an extract from the statement of financial position at 31 March 2017 for The Notes Rand Equity and Liabilities Total equity 97 500 000 60 000 000 22 500 000 15 000 000 Ordinary share capital Non-distributable reserves Retained income Non-current liabilities 12% Debentures Long-term loan Deferred tax 31 750 000 16 000 000 2 3 15 000 000 750 000 Current liabilities 3 750 000 2 850 000 900 000 Trade payables Total equity and liabilities Notes 1. The historical average issue price of ordinary shares is 375 cents. The latest known share 133 000 000 price is 938-cents. Lionmead (Proprietary) Ltd has just declared and paid a dividend of 34. cents. In line with its stable annual growth, the company is expecting to declare a dividend of 40 cents for the year ended 31 March 2018- The government bonds (risk-free rate) currently yield 821%, and the company's beta is estimated at 1,3 while the market risk premium is 85%. Similar debentures are trading at 10% per annum. The interest is payable annually in arrears and the redemption date of these debentures is after five years. 2. 3. The long-term loan is repayable in three years' time and carries an interest rate of prime rate + 2%. The current prime rate is 10.5% Additional information: The current effective tax rate is 28%. All percentages given are before tax, unless where otherwise stated . 43Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started