Question

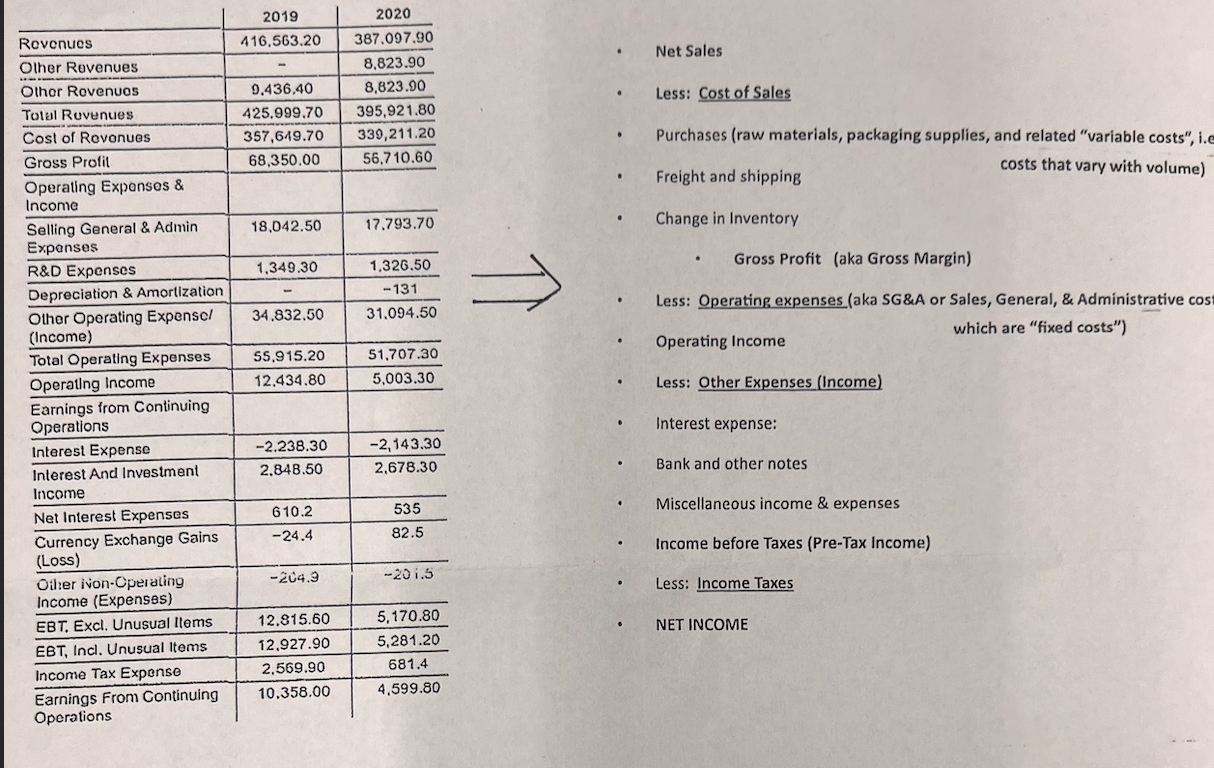

1.Convert the Income Statement at left to the format to the right. 2.The Company would like to continue increasing its sales in 2020 and beyond,

1.Convert the Income Statement at left to the format to the right.

2.The Company would like to continue increasing its sales in 2020 and beyond, as market demand is strong. They are evaluating a $150,000 investment to debottleneck their plant. After the expansion, no additional production personnel will be required. Assume 10-year straight-line depreciation. Assuming that annual sales increase to $600,000 in 2020:

a. Generate a new 2020 Income Statement, showing your assumptions for all of the costs of the expanded plant.

b. What is the incremental ROI in the year 2020 for the $150,000 investment?

c. What is the Payback Period for the incremental investment?

d. Should the Company make this investment? Why or why not?

\begin{tabular}{|c|c|c|} \hline & 2019 & 2020 \\ \hline Rovenues & 416.563 .20 & 387.097 .90 \\ \hline Olher Rovenues & - & 8.823 .90 \\ \hline Othor Rovenuos & 0.436 .40 & 8,823.90 \\ \hline Total Ruvenues & 425.999 .70 & 395,921.80 \\ \hline Cost of Rovonues & 357,649.70 & 330,211.20 \\ \hline Gross Profil & 68,350.00 & 56.710 .60 \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Operating Exponsos \& \\ Income \end{tabular}} \\ \hline \begin{tabular}{l} Selling General \& Admin \\ Expanses \end{tabular} & 18,042.50 & 17.793 .70 \\ \hline R\&D Expenses & 1.349 .30 & 1.326 .50 \\ \hline Depreciation \& Amortization & - & -131 \\ \hline \begin{tabular}{l} Other Operating Expenscl \\ (Income) \end{tabular} & 34.832 .50 & 31.094 .50 \\ \hline Total Operating Expenses & 55.915 .20 & 51.707 .30 \\ \hline Operallng Income & 12.434 .80 & 5.003 .30 \\ \hline \multicolumn{3}{|l|}{\begin{tabular}{l} Earnings from Continuing \\ Operations \end{tabular}} \\ \hline Interest Expense & -2.238 .30 & 2,143.30 \\ \hline \begin{tabular}{l} Interest And Investment \\ Income \end{tabular} & 2.848 .50 & 2,678.30 \\ \hline Net Interest Expenses & 610.2 & 535 \\ \hline \begin{tabular}{l} Currency Exchange Gains \\ (Loss) \end{tabular} & -24.4 & 82.5 \\ \hline \begin{tabular}{l} Other ivon-Cperating \\ Income (Expenses) \end{tabular} & 2C4.9 & 20i.5 \\ \hline EBT. Excl. Unusual llems & 12.815 .60 & 5,170.80 \\ \hline EBT, Incl. Unusual ltems & 12.927 .90 & 5,281.20 \\ \hline Income Tax Expense & 2.569 .90 & 681.4 \\ \hline \begin{tabular}{l} Earnings From Continuing \\ Operations \end{tabular} & 10.358 .00 & 4.599 .80 \\ \hline \end{tabular} - Operating Income - Less: Other Expenses (Income) - Interest expense: - Bank and other notes - Miscellaneous income \& expenses - Income before Taxes (Pre-Tax Income) - Less: Income Taxes - NET INCOMEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started