Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1d. If they consolidate all their debt and refinance at 5.4% (same as the existing mortgage) by taking out a new 30-year mortgage (i.e. resetting

1d. If they consolidate all their debt and refinance at 5.4% (same as the existing mortgage) by taking out a new 30-year mortgage (i.e. resetting the 30-year clock), what would their new monthly payment become? 1e. How much interest will they end up paying by the time this new mortgage is paid off, and how does this compare to the interest they would have to pay without consolidating and refinancing? Does consolidating and refinancing appear to be a good choice here?

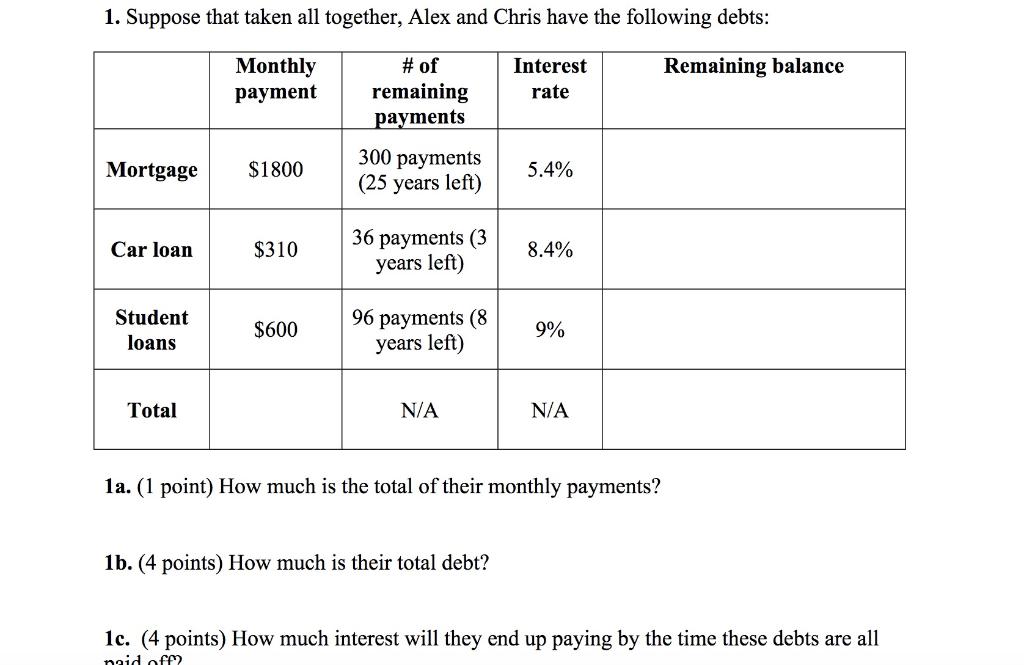

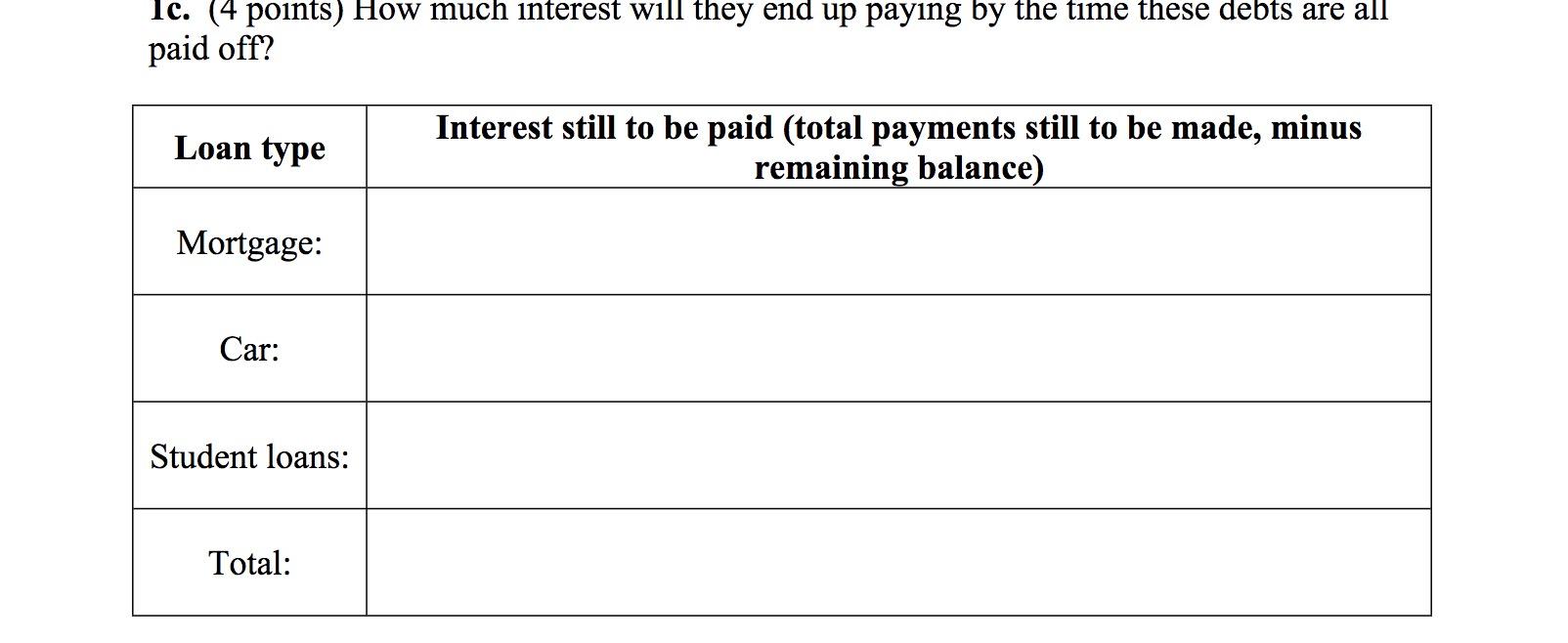

1. Suppose that taken all together, Alex and Chris have the following debts: Monthly payment # of remaining payments Interest rate Remaining balance Mortgage $1800 300 payments (25 years left) 5.4% Car loan 36 payments (3 $310 8.4% years left) Student loans $600 96 payments (8 years left) 9% Total N/A N/A 1a. (1 point) How much is the total of their monthly payments? 1b. (4 points) How much is their total debt? 1c. (4 points) How much interest will they end up paying by the time these debts are all paid of Ic. (4 points) How much interest will they end up paying by the time these debts are all paid off? Loan type Interest still to be paid (total payments still to be made, minus remaining balance) Mortgage: Car: Student loans: Total: 1. Suppose that taken all together, Alex and Chris have the following debts: Monthly payment # of remaining payments Interest rate Remaining balance Mortgage $1800 300 payments (25 years left) 5.4% Car loan 36 payments (3 $310 8.4% years left) Student loans $600 96 payments (8 years left) 9% Total N/A N/A 1a. (1 point) How much is the total of their monthly payments? 1b. (4 points) How much is their total debt? 1c. (4 points) How much interest will they end up paying by the time these debts are all paid of Ic. (4 points) How much interest will they end up paying by the time these debts are all paid off? Loan type Interest still to be paid (total payments still to be made, minus remaining balance) Mortgage: Car: Student loans: TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started