Answered step by step

Verified Expert Solution

Question

1 Approved Answer

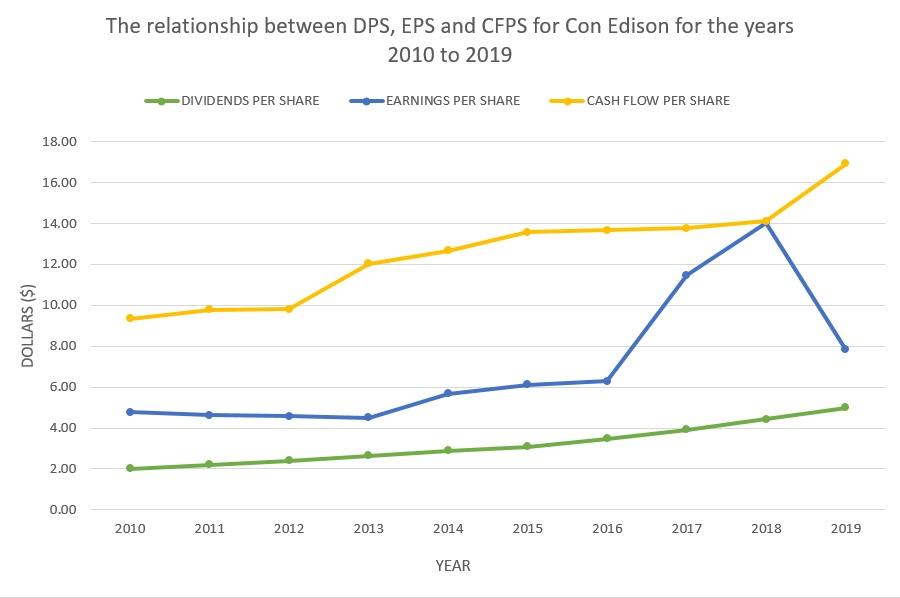

1.Describe the output of the graph. Is there are any relation between the CFPS, EPS, and DPS. 2. Describe how volatile the payout ratios are

1.Describe the output of the graph. Is there are any relation between the CFPS, EPS, and DPS.

2. Describe how volatile the payout ratios are based on earnings and cash flows.

3. Is there any correlation between (a) dividends and cash flows AND (b) dividends and earnings. From your analysis, can you say which of the two that dividend is more dependent on?

The relationship between DPS, EPS and CFPS for Con Edison for the years 2010 to 2019 DIVIDENDS PER SHARE EARNINGS PER SHARE CASH FLOW PER SHARE 18.00 16.00 14.00 12.00 10.00 DOLLARS ($) 8.00 6.00 4.00 2.00 0.00 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 YEARStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started