Answered step by step

Verified Expert Solution

Question

1 Approved Answer

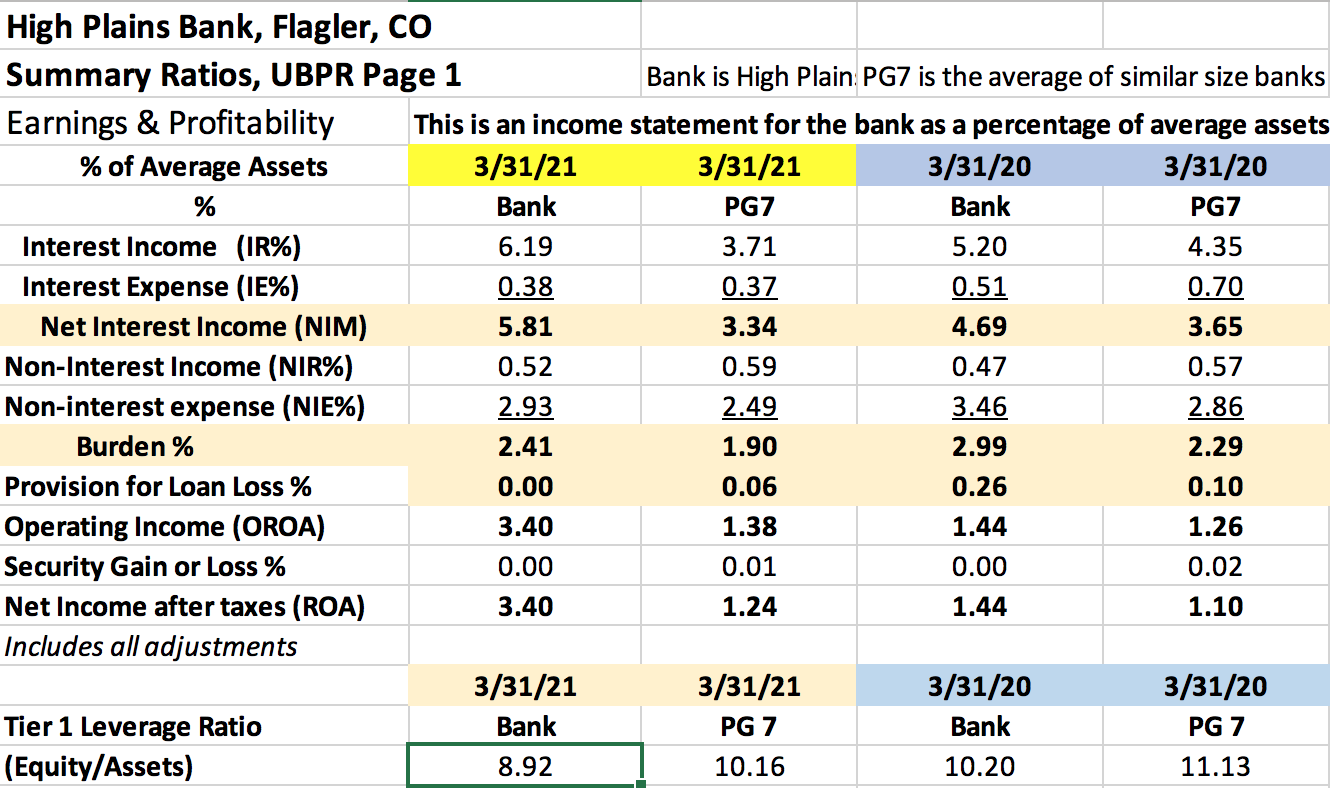

1.Do a OROA Peer Analysis comparing High Plains Bank to its PG7 peers For 3/31/21. Be sure to examine differences in the Bank versus the

1.Do a OROA Peer Analysis comparing High Plains Bank to its PG7 peers For 3/31/21. Be sure to examine differences in the Bank versus the PG7 For NIM, Burden%, and PLL% and explain why the NIM is different based on differences in IR% and IE% and the Burden% is different based on NIR% and NIE%.

Explain in detail what strengths and weaknesses are revealed for High Plains Bank compared to the PG7.

3/31/21 Bank High Plains Bank, Flagler, CO Summary Ratios, UBPR Page 1 Earnings & Profitability % of Average Assets % Bank is High Plain PG7 is the average of similar size banks This is an income statement for the bank as a percentage of average assets 3/31/21 3/31/20 3/31/20 PG7 Bank PG7 Interest Income (IR%) 6.19 3.71 5.20 4.35 Interest Expense (IE%) 0.38 0.37 0.51 0.70 Net Interest Income (NIM) 5.81 3.34 4.69 3.65 Non-Interest Income (NIR%) 0.52 0.59 0.47 0.57 Non-interest expense (NIE%) 2.93 2.49 3.46 2.86 Burden % 2.41 1.90 2.99 2.29 Provision for Loan Loss % 0.00 0.06 0.26 0.10 Operating Income (OROA) 3.40 1.38 1.44 1.26 Security Gain or Loss % 0.00 0.01 0.00 0.02 Net Income after taxes (ROA) 3.40 1.24 1.44 1.10 Includes all adjustments 3/31/21 3/31/21 3/31/20 3/31/20 Tier 1 Leverage Ratio Bank PG 7 Bank PG 7 (Equity/Assets) 8.92 10.16 10.20 11.13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started