Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Dorothy Taylor expects to need $68,000 for a down payment on a house in six years. How much would she have to invest today in

1.Dorothy Taylor expects to need $68,000 for a down payment on a house in six years. How much would she have to invest today in an account paying 9.25 percent in order to have $68,000 in six years?

2. Robert Williams is considering an investment that pays 8.2 percent, compounded annually. How much will he have to invest today so that the investment will be worth $29,000 in six years?

3.

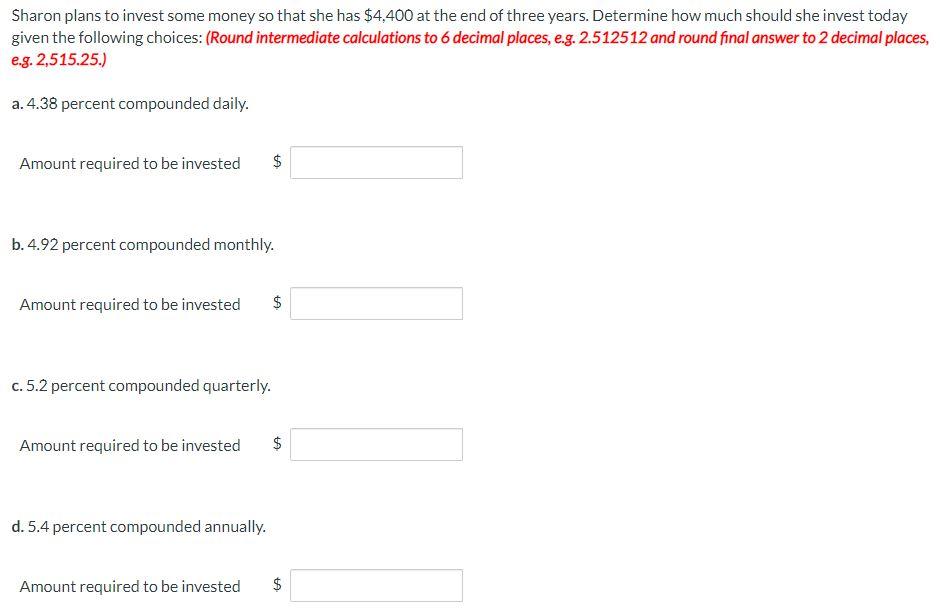

Sharon plans to invest some money so that she has $4,400 at the end of three years. Determine how much should she invest today given the following choices: (Round intermediate calculations to 6 decimal places, e.g. 2.512512 and round final answer to 2 decimal places, e.g. 2,515.25. a. 4.38 percent compounded daily. Amount required to be invested $ b. 4.92 percent compounded monthly. Amount required to be invested \$ c. 5.2 percent compounded quarterly. Amount required to be invested \$ d. 5.4 percent compounded annually. Amount required to be invested $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started