Question

Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct

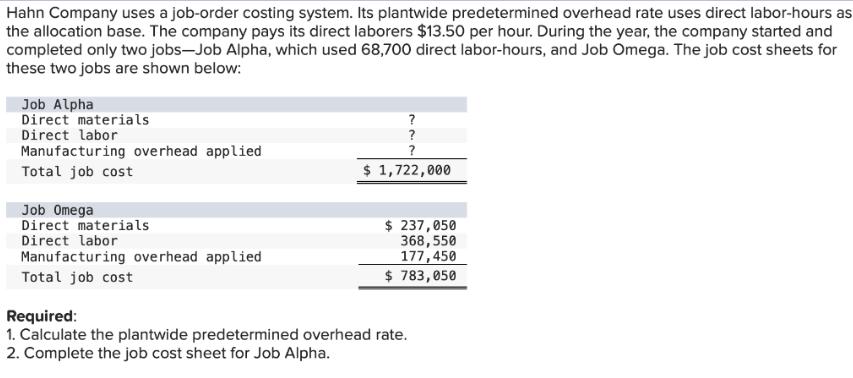

Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $13.50 per hour. During the year, the company started and completed only two jobs-Job Alpha, which used 68,700 direct labor-hours, and Job Omega. The job cost sheets for these two jobs are shown below: Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost Job Omega Direct materials Direct labor Manufacturing overhead applied Total job cost ? ? ? $ 1,722,000 $ 237,050 368,550 177,450 $ 783,050 Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha.

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Thermodynamics

Authors: Richard E. Sonntag, Claus Borgnakke, Gordon J. Van Wylen

6th edition

471152323, 978-0471152323

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App